Summary

Markets remain in a sustained de-risking phase driven by macro headwinds, a holding Fed, policy uncertainty, and AI-related capital rotation, pushing BTC to a ~52% drawdown from its October 2025 ATH. The key question is shifting from “how far” to “when” demand returns.

Structural participation is deeper than prior cycles suggest: spot BTC ETF AUM has held broadly resilient despite the price decline, stablecoin supply remains near ATHs, and RWAs continue to attract capital as a cycle-agnostic theme.

The week's defining signal is BlackRock settling its tokenized Treasury fund BUIDL on Uniswap; a landmark for institutional DeFi adoption, validating the convergence thesis and demonstrating that liquidity is present and ready to move on credible catalysts.

Market View

Markets are in a sustained de-risking phase, and the key question is starting to shift from 'how far does this go' to 'when does demand return.' The honest answer is that it depends heavily on a reversal in sentiment, which for now, continues to be pulled in several directions at once.

Two forces are doing most of the work. The first is a rotation of attention and capital away from crypto and toward AI and other defensive narratives. The second is policy: expectations of hawkish Fed policy, the possibility of another partial government shutdown and continued geopolitical and trade tensions have left the environment unreceptive to risk-taking.

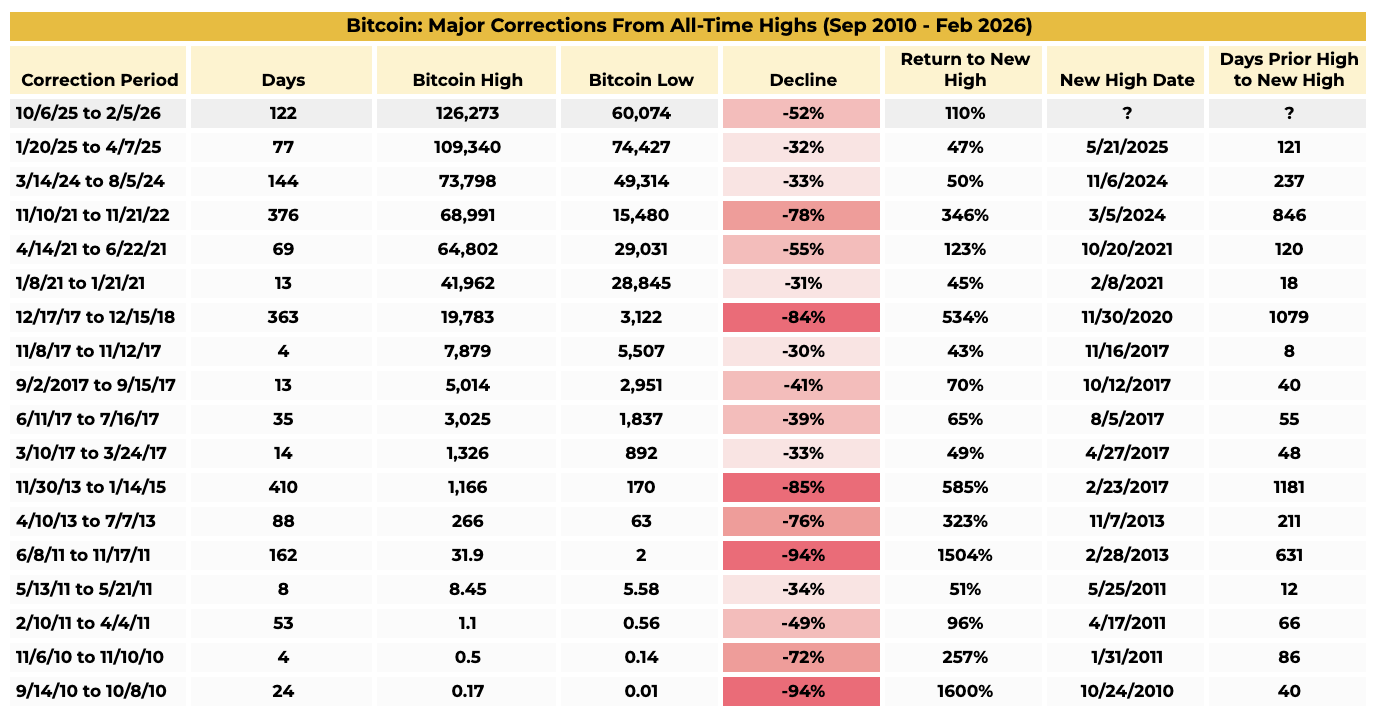

With BTC touching lows of US$60K on February 5 before recovering, it becomes useful to look at where this cycle's drawdown sits relative to prior cycles. From the October 2025 all-time high (ATH), the decline is now roughly 50%. Historically, corrections of this magnitude have occurred multiple times within broader cycles, although today’s market structure is more institutional and liquidity channels are deeper.

Figure 1: BTC has experienced nine 50% drawdowns from all-time highs

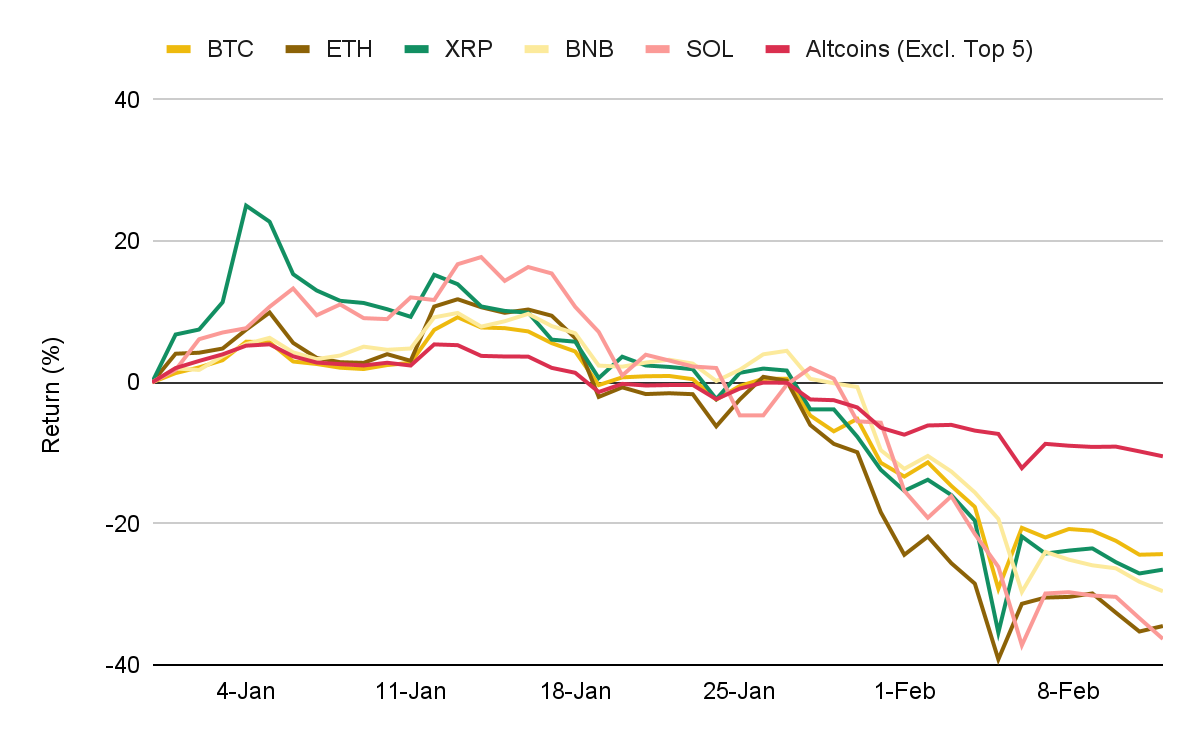

Moreover, as BTC consolidates, altcoins continue to lag. Their underperformance has been disproportionately severe compared to prior cycles. Capital is concentrating in the largest assets, reflecting a rotation toward durability and away from speculative beta. While painful for smaller tokens, this transition typically precedes stronger long-term foundations.

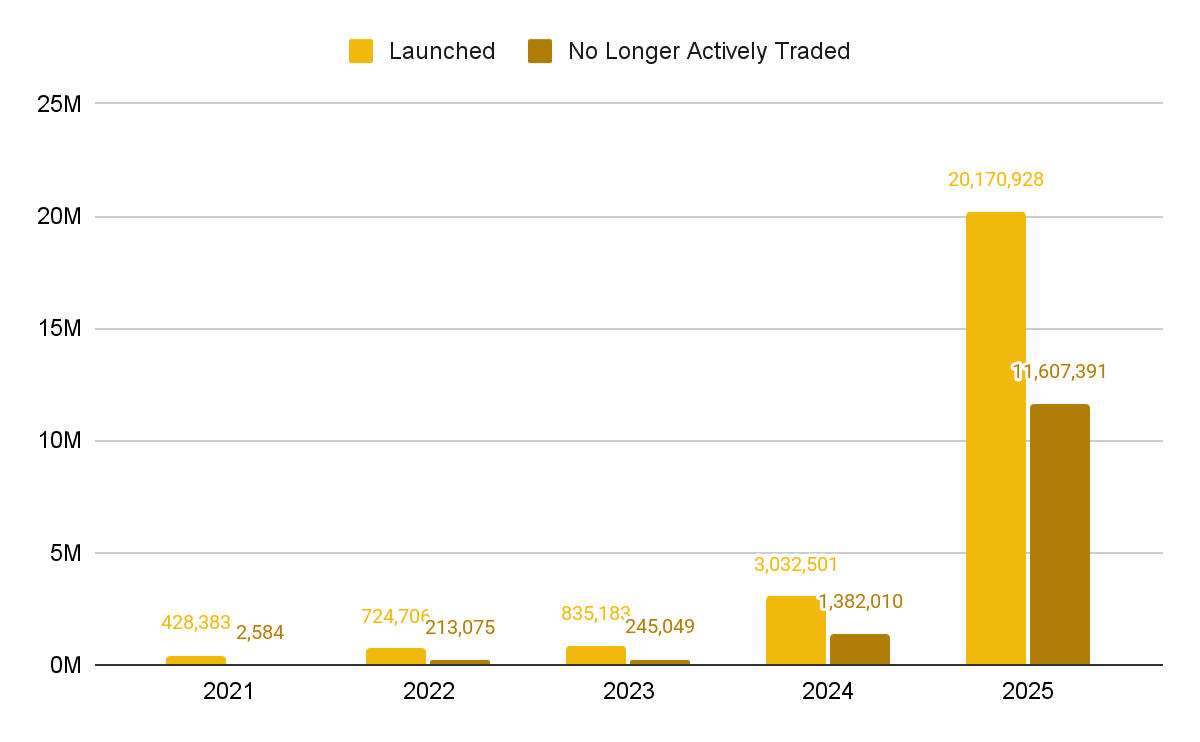

Supply expansion has intensified the effect. Roughly 11.6M out of the 20.2M tokens launched in 2025, many without users, revenue, or defensible differentiation, leading to price discovery to happen entirely on hype, are no longer actively traded. Attention fragmented across an increasingly crowded market, user fatigue set in faster, and projects with fundamentals have had to compete with a constant pipeline of short-lived issuance. Unsurprisingly, most of these tokens are no longer actively traded and remain well below their initial valuations.

Figure 2: More than half of tokens launched in 2025 have seen severe drawdowns

Interestingly, parts of the long tail have recently exhibited smaller percentage moves than major assets. This likely reflects the fact that much of the deleveraging and repricing occurred earlier in the cycle, leaving reduced marginal supply in the current phase. Rather than signaling renewed risk appetite, it may indicate that selling pressure is becoming progressively exhausted.

Figure 3: YTD indexed performance – major digital assets

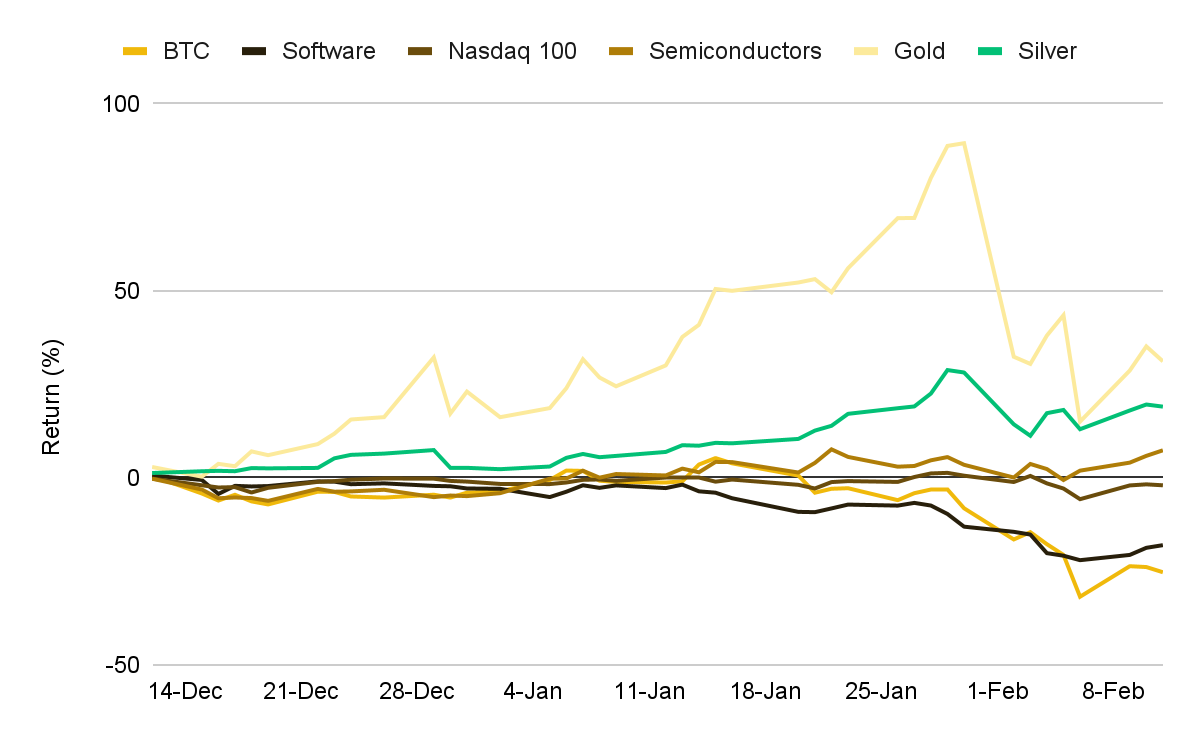

Moreover, recent market performance is not just a crypto-only phenomenon. Equity markets have also repriced risk, particularly within the software sector, following rapid advances in the AI disruption narrative.

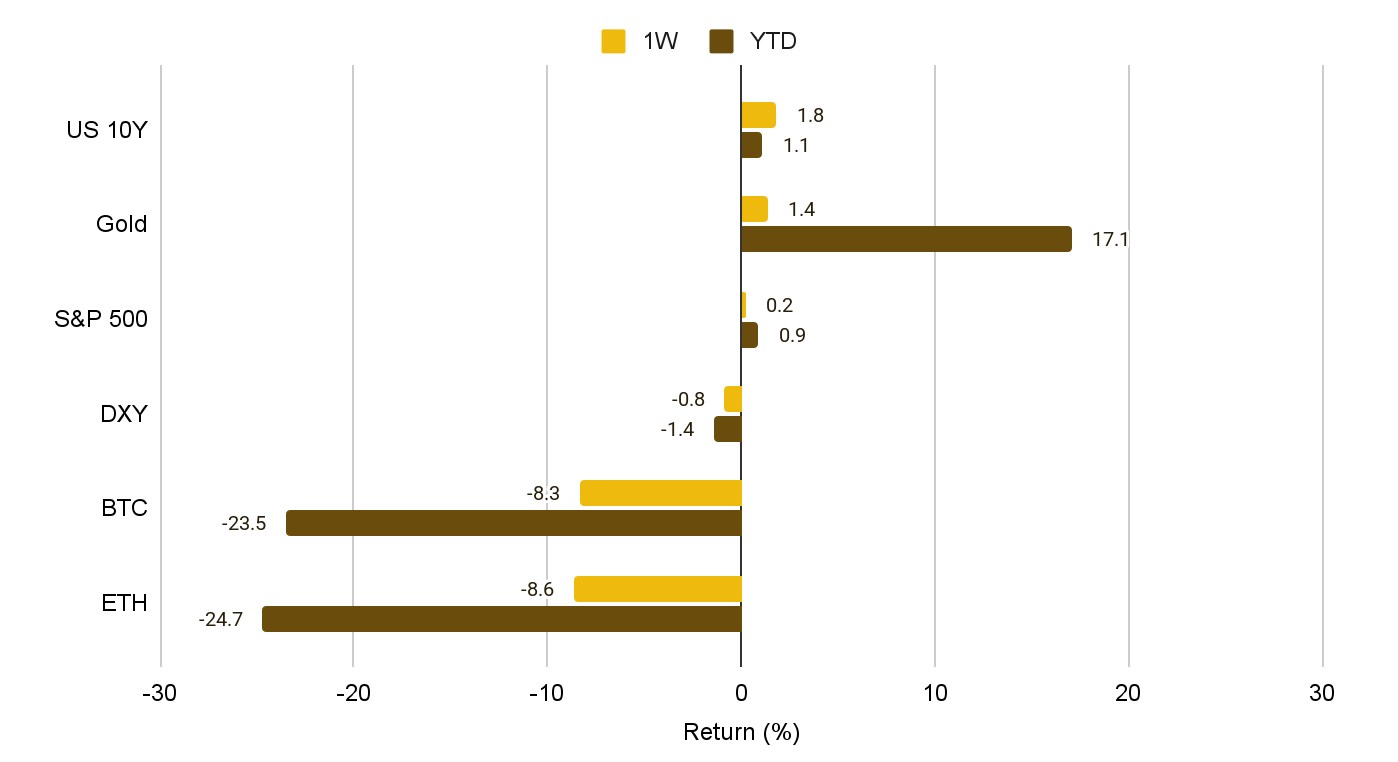

Figure 4: De-risking is broad-based across asset classes

The distinction for crypto markets is important. Unlike equities that were sold on disruption to specific workflows, the primary impact on crypto is less structural than it is one of attention and sentiment. In prior cycles, crypto investors were accustomed to altcoin cycles delivering outsized returns while equities and commodities lagged. This cycle has presented something new: AI-themed stocks, alongside emerging markets, precious metals and to some extent traditional commodities, have outperformed BTC from a relative standpoint, creating an attention and liquidity divide as capital weighs competing narratives.

That said, the AI disruption narrative cuts both ways. The same agentic AI systems driving technology stock divergence are among the most compelling emerging use cases for on-chain payment rails and stablecoin infrastructure (AI agents transacting at machine speed, settling across borders, requiring programmable, permissionless money). The medium-term opportunity is real, even as the short-term allocation dynamic is negative.

Macro Is Still Calling the Shots

Macro continues to be the primary driver of crypto markets, arguably more so than at any point in recent years. This week's key inputs were the January jobs report and its implications for the Federal Reserve.

January's nonfarm payrolls came in ahead of expectations at 130,000, and unemployment fell to 4.3%. On the surface, this looks positive, though the fuller picture is more nuanced. Annual benchmark revisions simultaneously revealed that only 181,000 total jobs were created in all of 2025 (roughly 15,000 per month), versus the 584,000 initially reported, making last year the worst for net job creation since 2020, or since 2003 outside of a recession. January's number therefore represents stabilization within a weak environment, not the start of a meaningful recovery.

That distinction matters for markets. A strong jobs number in a truly robust economy would give the Fed licence to ease policy. A strong number in a fragile, already-cooling labour market instead gives the Fed reason to stay put, which is precisely the signal markets received. Rate cuts are not imminent. And with the nomination of Kevin Warsh as the incoming Fed Chair, the uncertainty around the medium-term liquidity outlook has only grown.

BTC has historically been the single most sensitive major asset to changes in global liquidity conditions in the short term, more so than equities, gold, or any other benchmark risk asset. In an environment where liquidity is being constrained, that sensitivity is a headwind. The same sensitivity will become a tailwind the moment expectations shift.

Where the Structural Case Holds

Despite the drawdown and the noise, the structural tailwinds for crypto have not disappeared. In fact, this period bears a resemblance to every prior correction: the product and fundamentals layer continues to compound quietly while speculative attention retreats. That is typically where the foundation for the next phase gets built.

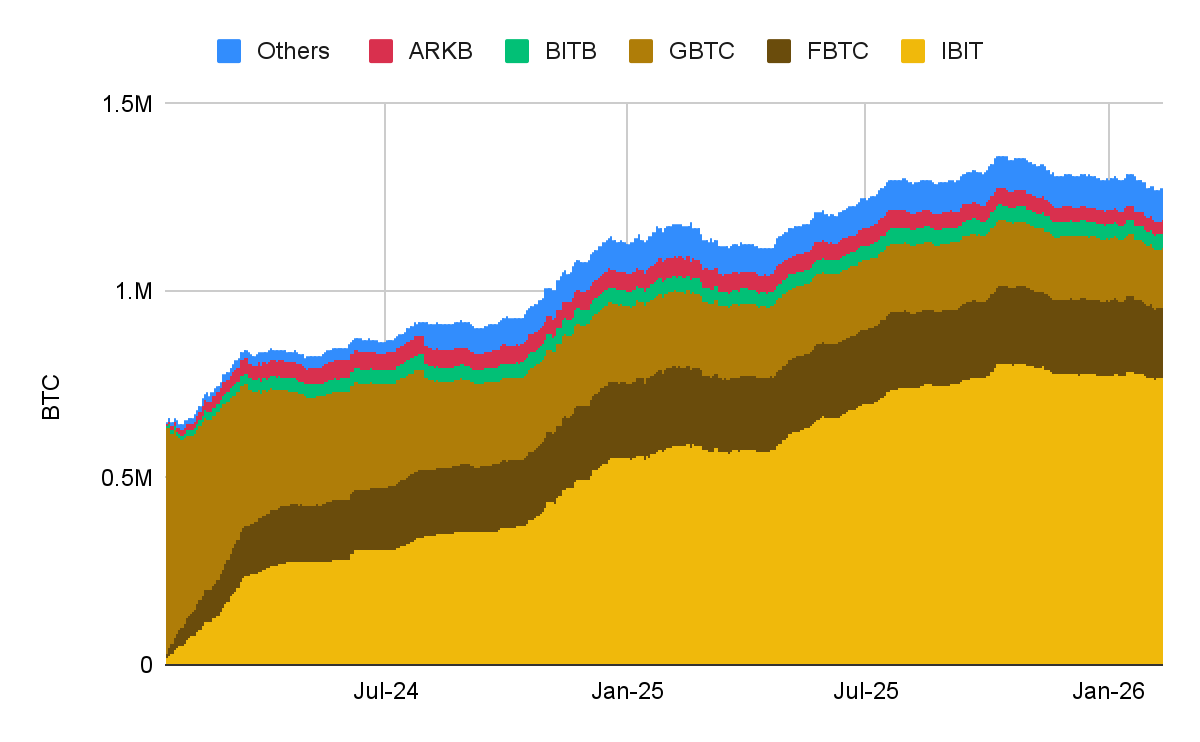

Spot ETFs

Despite a roughly 50% fall from the ATH, spot BTC ETF AUM has declined only modestly. That divergence is significant. Positioning appears closer to strategic allocation than momentum capital, suggesting the investor base is comparatively sticky. There have even been periods of net inflows across several days, indicating genuine opportunistic accumulation. This is a constructive medium-term signal that the ETF channel is functioning as a durable demand source, not just a bull-market vehicle.

Figure 5: Spot BTC ETF AUM remains resilient despite the correction

This resilience is particularly important given that another major flow channel this cycle, digital asset treasuries (DATs), has softened. DAT buyers, by contrast, are contributing less incremental demand. With prices below many acquisition levels and equity premiums compressed, balance-sheet expansion is harder to justify. These entities are behaving more like holders than marginal accumulators.

Stablecoins

Stablecoin supply has remained near cycle highs. Unlike prior downturns, capital has not aggressively exited the on-chain dollar system. Liquidity is present, but appears to be waiting.

Figure 6: Stablecoin supply remains above US$305B

Real-World Assets and Tokenization

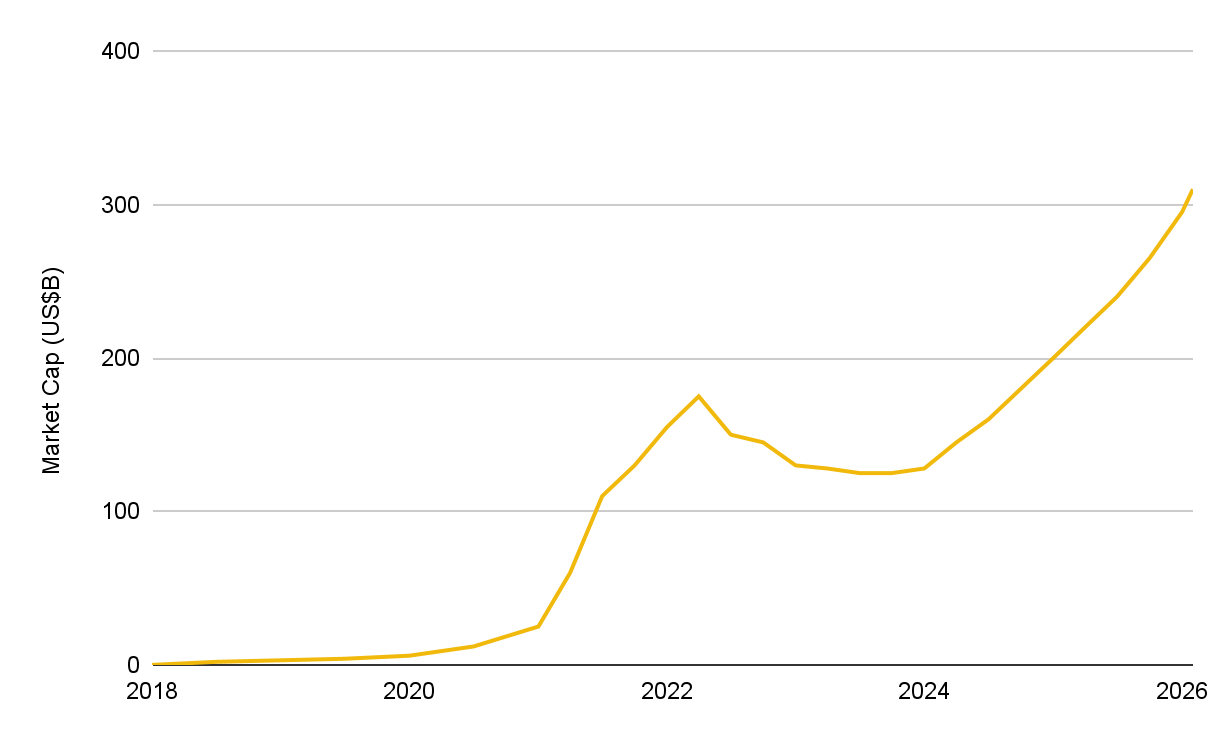

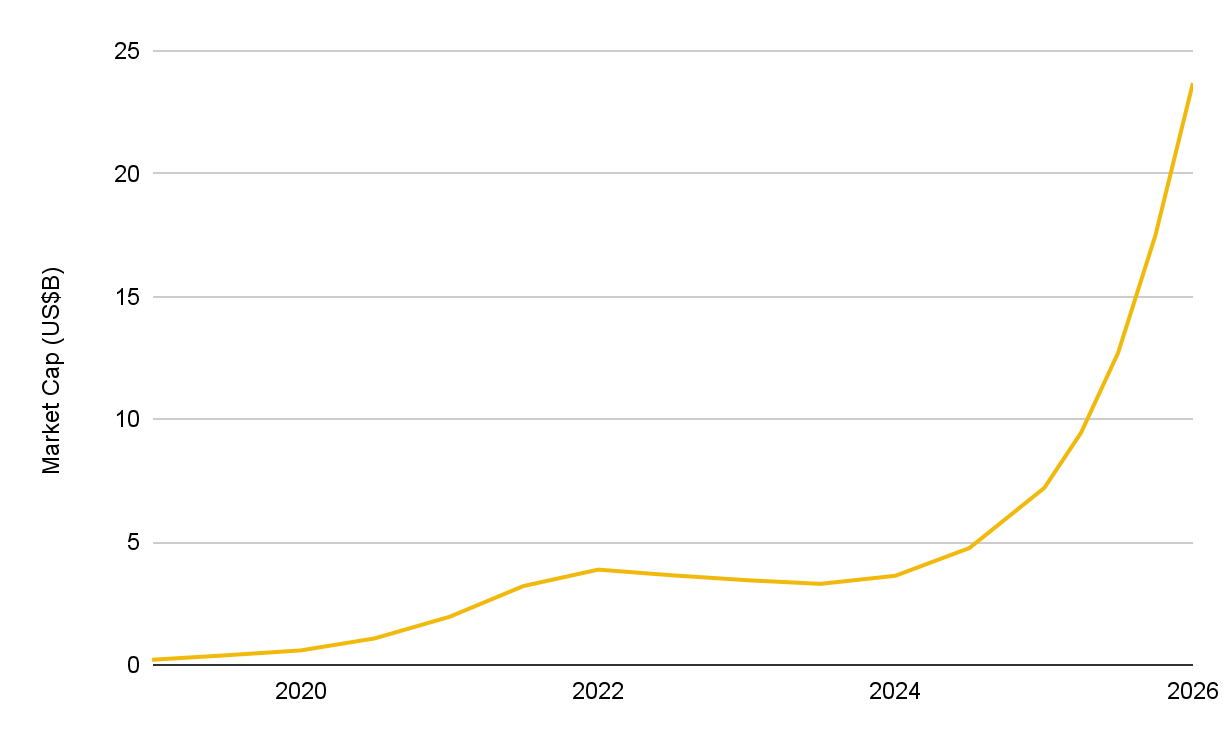

Real-world assets (RWAs) continue to stand out in a risk-off environment, and this period is no exception. Capital preservation is the dominant theme, and RWAs are a natural vehicle. The on-chain RWA market is approaching US$25B, with tokenized treasuries, commodities, and yield-oriented structures attracting capital seeking stability and transparency. Adoption is accelerating across institutions exploring tokenization pathways, reinforcing the durability of this trend.

Figure 7: On-chain RWA value continues to break new highs

Tokenized commodities in particular have expanded notably, up more than 50% since the start of 2026. Tokenized gold has become a key on-chain defensive primitive. With spot gold pushing above US$5K per ounce, demand has created a fresh source of inflows. Tether Gold (XAUT) has seen market capitalization climb above US$2.6B, with supply exceeding 712K ounces. If elevated volumes extend beyond purely risk-off periods, a structural flywheel can take shape: deeper liquidity enables tighter spreads, improving routing efficiency and expanding gold’s viability as DeFi collateral, with spillovers into other assets.

More broadly, the RWA thesis is unfolding largely as anticipated. Tokenized U.S. Treasuries now account for roughly US$10.7B on-chain. Private credit, tokenized equities, and yield vaults continue to attract allocations. Emerging markets are also seeing proportionally higher inflows and performance, reflecting the genuinely global nature of the opportunity.

DeFi convergence

Against the recent price backdrop, the single most significant development of the week, and the most important forward-looking signal for DeFi: BlackRock, working with tokenisation firm Securitize, will make shares of its tokenised U.S. Treasury fund BUIDL tradable via UniswapX, Uniswap's institutional order routing and settlement layer.

The significance of this cannot be overstated. BlackRock has been deliberate and methodical in every step of its digital asset engagement, from the launch of the spot BTC ETFs to BUIDL's initial on-chain issuance. Selecting a DeFi protocol for settlement signals growing confidence in the maturity and reliability of decentralized infrastructure. More importantly, it outlines a repeatable blueprint: regulated entry, compliant access controls, atomic settlement, and continuous market availability. This is the structure required for equities, credit, commodities, and ETFs to scale on-chain.

The subsequent purchase of Uniswap’s governance tokens adds another layer of significance. The world’s largest asset manager has taken exposure within a DeFi protocol. The UNI price reaction is instructive not because of the 20–30% move itself, but because of what it reveals: liquidity is available and can mobilize quickly when credible catalysts appear. The market is not impaired; it is just patient. This reinforces the view that tokens supported by real utility and protocol revenue are waiting for demand catalysts to drive re-pricing in the current environment. More broadly, the episode marks tangible progress in the convergence between DeFi infrastructure and TradFi and provides a template for what may follow.

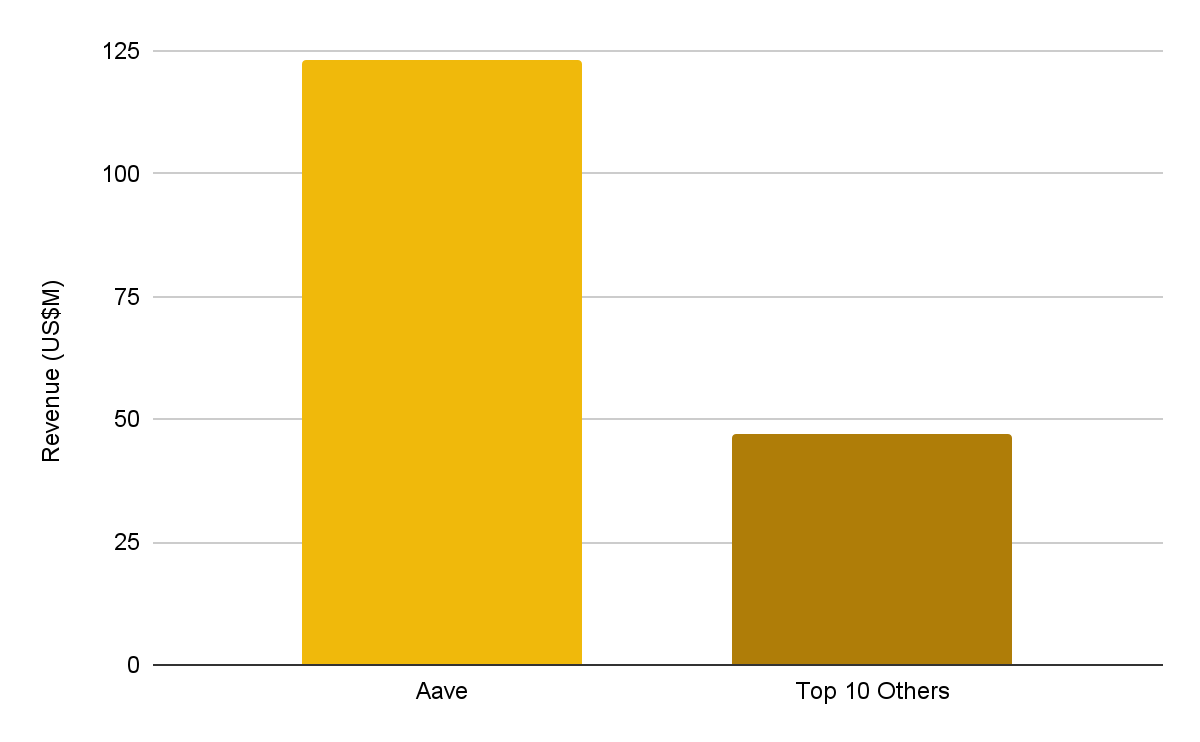

Institutional participation is emerging in a market that already produces measurable cash flows. Uniswap is one illustration, but it is not an outlier. Across DeFi, several sectors from borrowing, trading and liquidity provision are already supporting meaningful levels of usage and revenue generation.

Figure 8: Leading DeFi protocols already operate at meaningful revenue scale

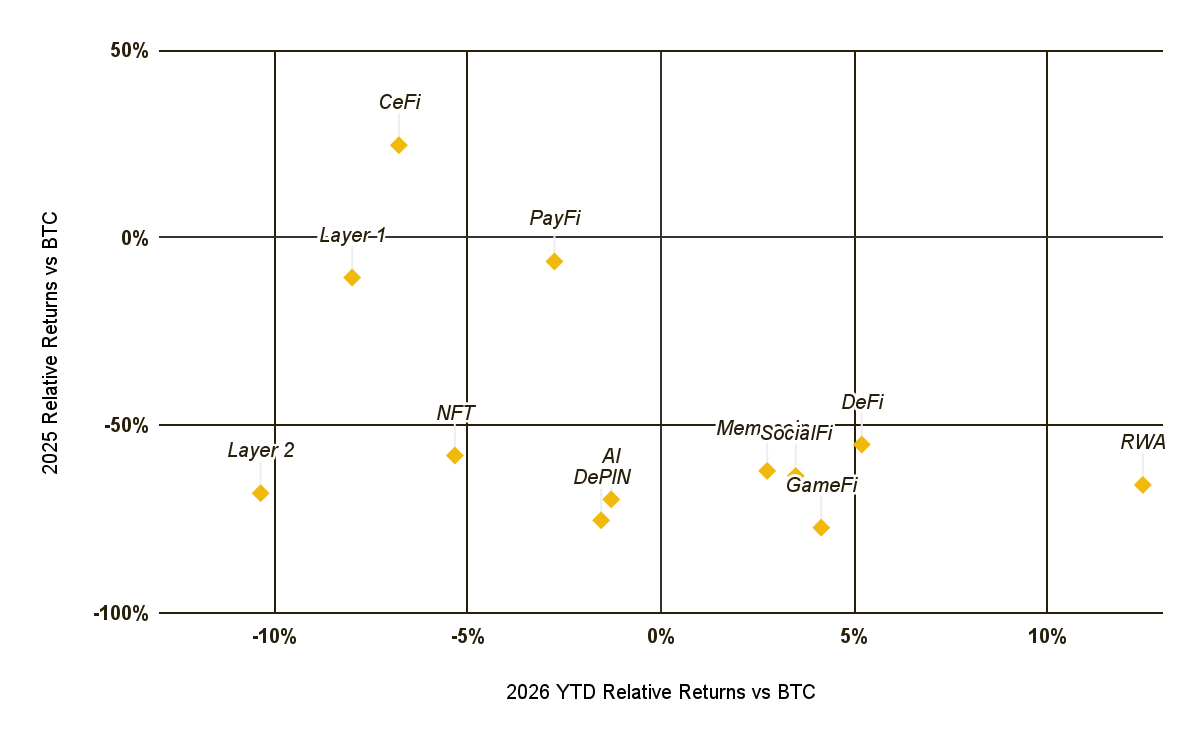

Even so, relative performance dispersion across sectors remains visible beneath the surface. Areas linked to utility and institutional engagement (RWAs, DeFi) have held up somewhat better, although price action continues to be driven primarily by broader macro and sentiment forces.

Figure 9: Relative performance of crypto sectors vs BTC

Looking Ahead

We are likely entering a phase of elevated volatility while markets search for clearer signals. Bitcoin's realized price, the average cost basis across holders, a proxy for where the aggregate market is 'in' at, sits at approximately ~US$55,000. When spot price approaches this level, it reflects a market where a large portion of holders are close to, or below, breakeven. This tends to amplify both the psychological pressure and the eventual significance of holding that level.

Stepping back, the broader backdrop is materially different from prior cycles. Markets are navigating a roughly 50% drawdown and a multi-trillion reduction in market value, yet structural participation is deeper than ever. Stablecoin rails are established, RWAs and tokenization are scaling, prediction markets are advancing and global institutions are actively disclosing digital asset holdings or settling products on blockchain infrastructure. The macro and structural environment is not the same as 2018 or 2022. The drawdown is real; but the context surrounding it is genuinely different.

History across crypto and traditional markets shows a consistent pattern. When prices compress despite continued fundamental progress, conviction builds beneath the surface and the product layer strengthens. Once risk reprices, assets that advanced during the reset typically lead. For now, liquidity remains present but selective, waiting for clearer catalysts.

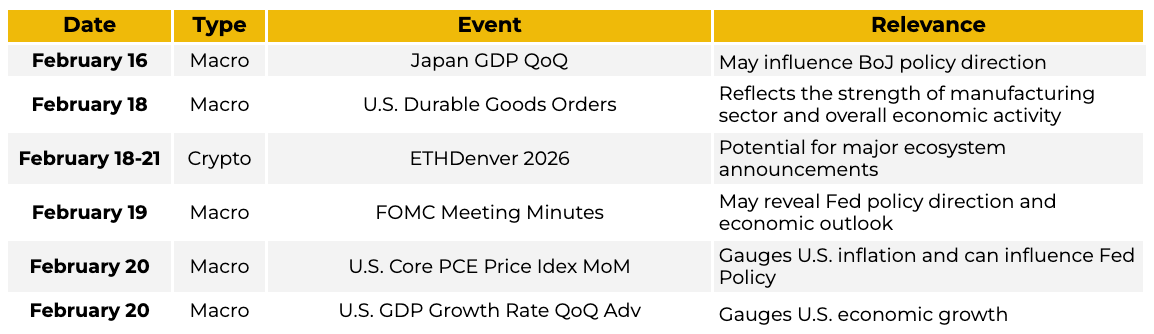

In the week ahead, focus turns to the release of the FOMC minutes and U.S. core PCE. The minutes will provide greater visibility into how policymakers assessed recent conditions at the last meeting, while the inflation print will update the near-term macro backdrop investors are navigating. At the same time, ETHDenver provides a live pulse on builder activity, capital formation, and ecosystem momentum at a moment when public market pricing has turned cautious.

Figure 10: Key macro and crypto events for the week ahead

Performance Snapshot

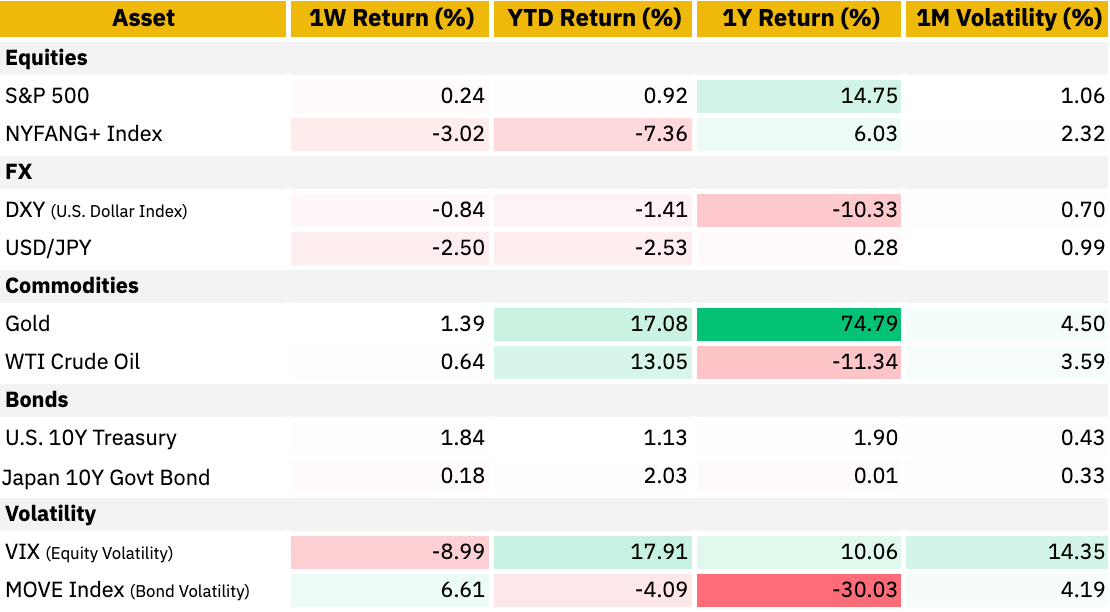

Weekly and yearly performance – crypto and global market assets

Multi-asset Performance – Equities, FX, Commodities, Bonds, Volatility