Introduction to deterministic money: why AI agents can’t use ordinary stablecoins

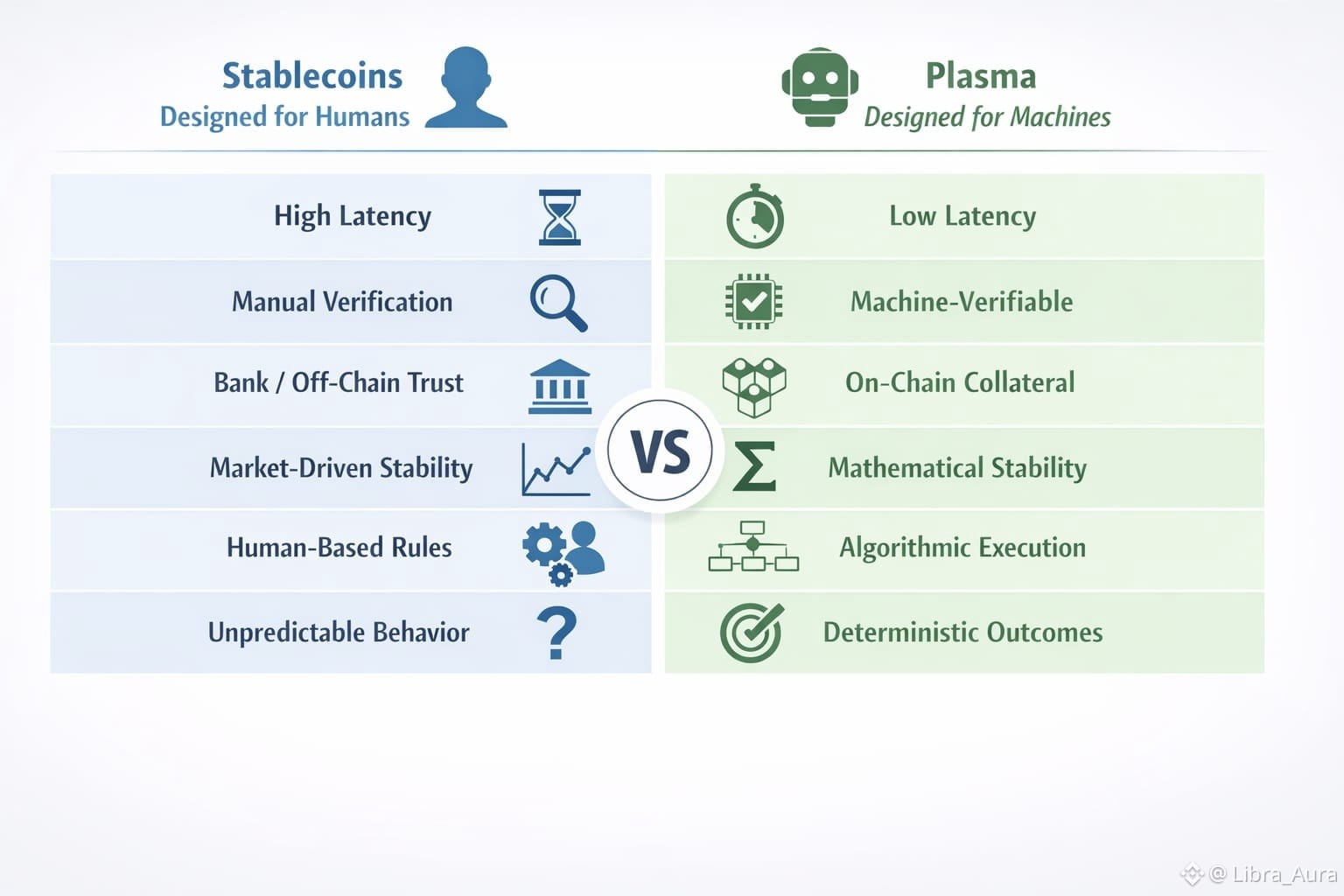

Stablecoins were designed for humans.

We use them for payments, savings, yield, trading, cross-border transfers — all activities that assume human reasoning, predictable latency, and economic context. But AI agents do not operate like humans. They request data, automate actions, perform micro-transactions, and optimize real-time outcomes with no emotion or delay.

When I began studying the economics of autonomous agents, a key friction became obvious:

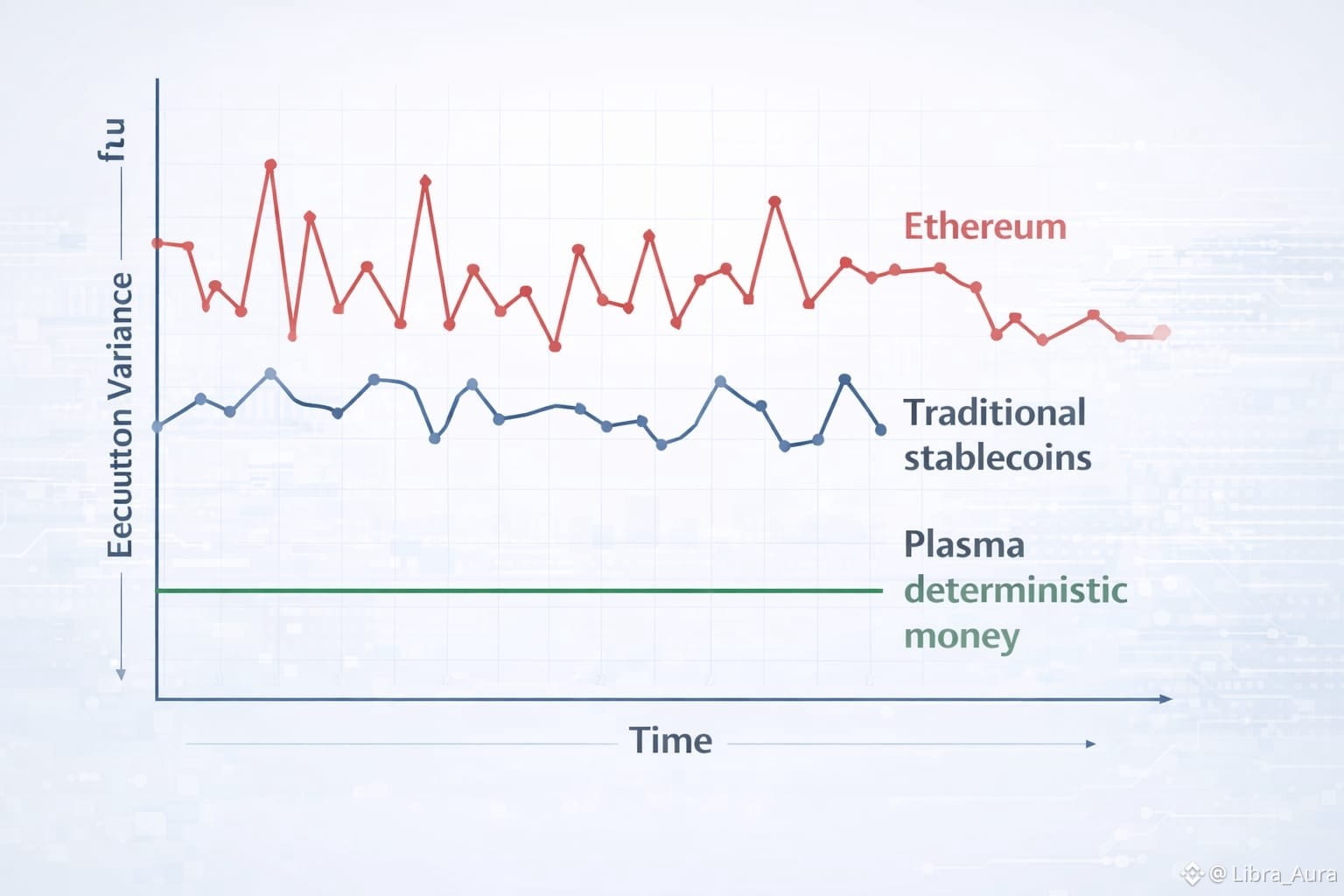

AI systems cannot rely on stablecoins that fluctuate under stress, depeg during volatility, or depend on discretionary liquidity injection.

AI liquidity must be:

•deterministic

•latency-predictable

•cost-predictable

•collateral-guaranteed

•data-verifiable

•designed for machine-driven micro-actions

That is the exact design space Plasma entered — not to compete with stablecoins, but to provide the first stablecoin infrastructure built for machines, not humans.

Why conventional stablecoins break for AI systems

Stablecoins today depend on three fragile mechanics:

1. Human-driven liquidity and incentives

Liquidity mining, arbitrage, peg arbitrage — all depend on traders, market makers, and human behavior.

AI needs predictable liquidity, not liquidity based on market moods.

2. External collateral systems

USDC, USDT → off-chain banking

DAI → mixed collateral

Algorithmic coins → endogenous, often unstable

AI systems can’t trust systems that fail when markets panic.

3. Non-verifiable backing data

AI cannot audit opaque reserves.

AI cannot interpret PDFs, bank statements, or legal disclosures.

AI needs machine-verifiable collateralization, not marketing tweets.

4. Network latency unpredictability

Ethereum congestion, chain forks, gas spikes — all break AI automation.

AI requires deterministic execution windows.

When you look at these factors objectively, it becomes clear:

•Stablecoins were built for humans.

•Plasma is building money for machines.

What Plasma actually is: the autonomous liquidity layer

Plasma is not a stablecoin.

It is the infrastructure on which stablecoins — especially AI-native stablecoins — can be built.

Its core innovation is simple but powerful:

Plasma turns collateral, stability, minting logic, and redemption rules into programmable economic primitives — deterministic, verifiable, and machine-readable.

Every stablecoin built on Plasma inherits:

•deterministic peg maintenance

•automated collateral checks

•verifiable reserves

•on-chain redemption guarantees

•zero external trust

•no incentive-based stability

This makes it the first stablecoin substrate engineered for global AI-native monetary flows.

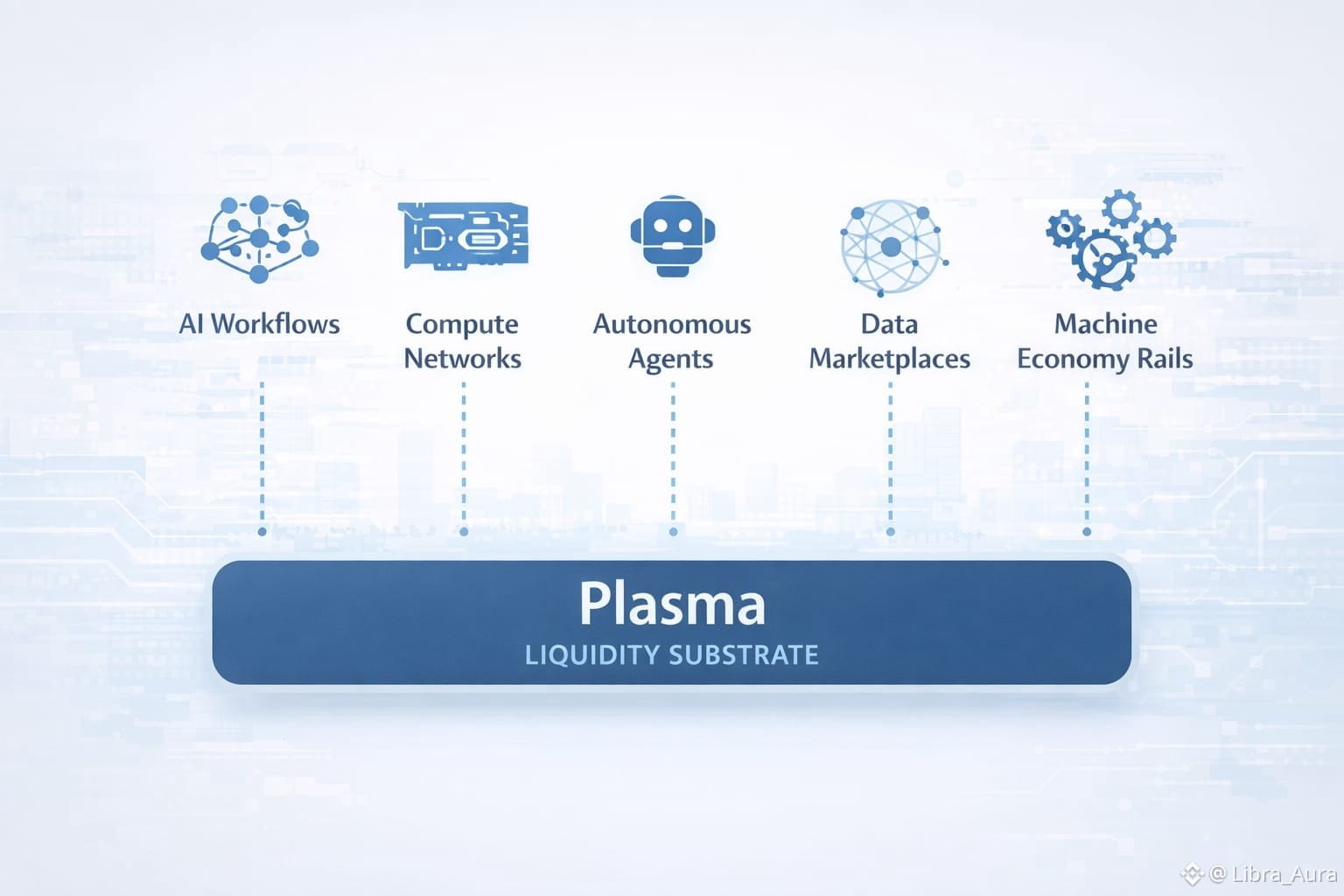

Why Plasma matters in the coming AI economy

AI agents will need to:

•buy data

•pay for GPU cycles

•execute micro-transactions

•access APIs

•pay storage nodes

•interact with on-chain contracts

•settle between each other

This requires currency with machine-level stability.

Plasma solves this by combining:

1. Deterministic collateralization

Not “market-based.”

Not “hope-based.”

Not “incentive-based.”

Collateral conditions are enforced by mathematical constraints, not market psychology.

2. Verifiable state transition logic

AI systems can independently verify that the currency is stable.

3. 100% transparent monetary rules

No black-box protocol behavior.

4. Execution optimized for automation

Stablecoins can be minted, redeemed, or rebalanced by AI workflows with sub-second predictability.

This transforms stablecoins from human money into machine money.

How Plasma works: simple explanation of the deterministic model

Plasma introduces a mathematical stability model that avoids the failures of:

•Terra-style reflexivity

•DAI-style mixed collateral

•USDC-style off-chain risk

•FRAX-style shifting models

The Plasma model includes:

1. Hard collateralization

Collateral is always greater than circulating supply.

No partial backing.

No dynamic guessing.

2. Deterministic minting rules

Minting cannot occur unless collateral constraints are proven.

3. Deterministic burning and redemption

Redemptions trigger automatic system-level rebalancing.

4. Economic invariants

Plasma enforces invariants like:

•solvency

•over-collateralization

•redemption priority

•peg anchoring rules

All using deterministic math, not incentives.

5. Fully machine-readable

AI agents can inspect every variable in real time.

The XPL token: stability engine + collateral backbone

XPL serves as the:

•collateral backbone

•stability guarantor

•minting governor

•redemption buffer

•liquidity provisioning instrument

•machine-verifiable economic resource

Unlike governance tokens that vote on “parameters,” XPL’s role is structural:

It defines the economic floor and ceiling within which the stablecoin must operate.

This gives AI agents certainty about price behavior.

Real-world use cases: where Plasma’s deterministic stability becomes critical

1. AI agent-to-agent payments

Machine intelligence cannot tolerate depegs.

2. Autonomous trading systems

Deterministic latency + deterministic stability = zero slippage.

3. On-chain compute & storage payments

GPU cycles, indexing, data retrieval — paid in stable, guaranteed units.

4. Micro-billing at scale

Humans can tolerate irregular billing.

Machines cannot.

5. Cross-AI coordination

Imagine AI agents negotiating, paying, buying data — Plasma enables this.

6. Global autonomous DAOs

Stability is required for AI-managed treasuries.

Ecosystem: building a machine-native monetary network

Plasma’s partners focus on:

•AI workflows

•data marketplaces

•compute networks

•autonomous agents

•Indexing protocols

•machine economy rails

This ecosystem alignment is why Plasma is becoming the liquidity substrate for AI systems, not just another stablecoin narrative.

Plasma vs existing stablecoin systems: a structural comparison

•Mechanism

•Traditional Stablecoins

•Algorithmic Coins

•Plasma

•Backing

•Off-chain / opaque

•Endogenous / unstable

•Deterministic hard-backed

•Stability

•Market-dependent

•Reflexive

•Mathematically enforced

•Verification

•Manual

•None

•Machine verifiable

•Latency

•Variable

•Often high

•Predictable

•Risk Model

•Human trust

•Reflexive loops

•Invariant-based safety

•For AI Agents

•Not suitable

•Dangerous

•Machine-native

Plasma isn’t competing with stablecoins — it is competing with the physics of money for AI systems.

Risks & execution challenges

AI adoption curve is early

deterministic models require strict parameter tuning

XPL economic structure must scale with demand

competition from emerging AI-focused chains

But the macro trend is undeniable:

AI will need currency — and that currency must be deterministic.

No legacy stablecoin satisfies this requirement.

Plasma does.

Conclusion

Plasma isn’t just a stablecoin infrastructure.

It is the first deterministic monetary substrate engineered for autonomous AI economies. Its mathematical invariants, machine-readable constraints, verifiable collateral logic, and predictable execution make it fundamentally different from any stablecoin model to date.

If Web3 is the financial internet for humans,

Plasma is becoming the monetary engine for AI.