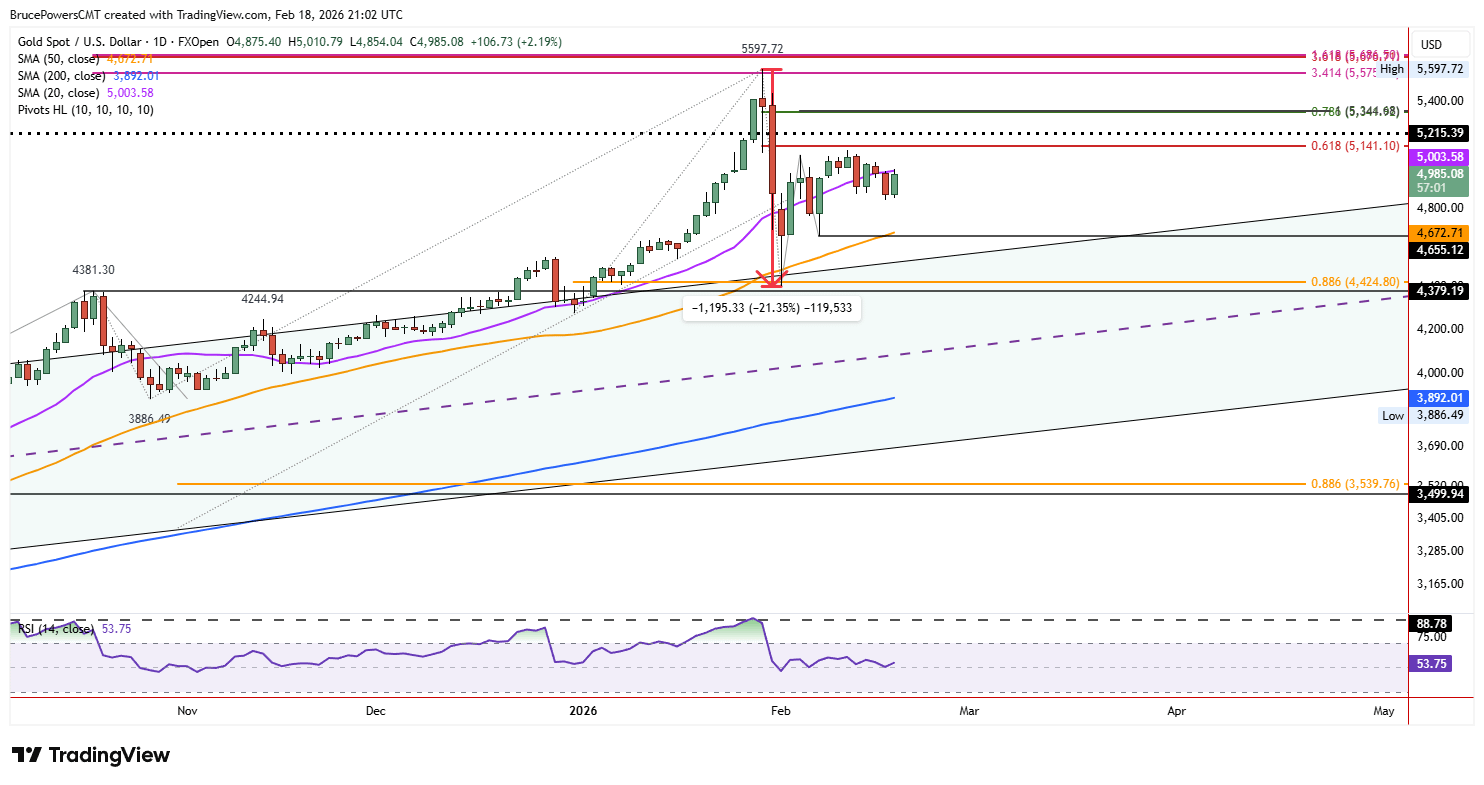

Gold is currently navigating a delicate balance, showing resilience at critical support levels despite facing near-term selling pressure. While the immediate outlook suggests sluggish movement, the structure of the uptrend remains intact, keeping the door open for a potential recovery toward $5,345.

📉 Short-Term Weakness & Immediate Hurdles

Current Stalemate: Gold tested resistance at the 20-day moving average ($5,003) this week, peaking at $5,011.

The Key Level to Watch: The metal must reclaim the 20-day average to shake off its current vulnerability. Until then, weakness may persist.

First Line of Defense: Immediate support rests at Tuesday’s low of $4,842. A break below this level could accelerate a deeper pullback from the recent swing high of $5,119.

🛡️ Critical Support Levels

The 50-Day MA Confluence: A crucial support zone lies near the 50-day moving average ($4,673) , aligning with the recent swing low of $4,655.

Trend Integrity: If this zone holds, it confirms the validity of the second leg up in the current bull phase. A violation here would signal a failure in the recent recovery attempt.

Fibonacci Context: The recent peak of $5,119 fell just short of the 61.8% Fibonacci retracement level ($5,141) , highlighting a lack of momentum in the bounce.

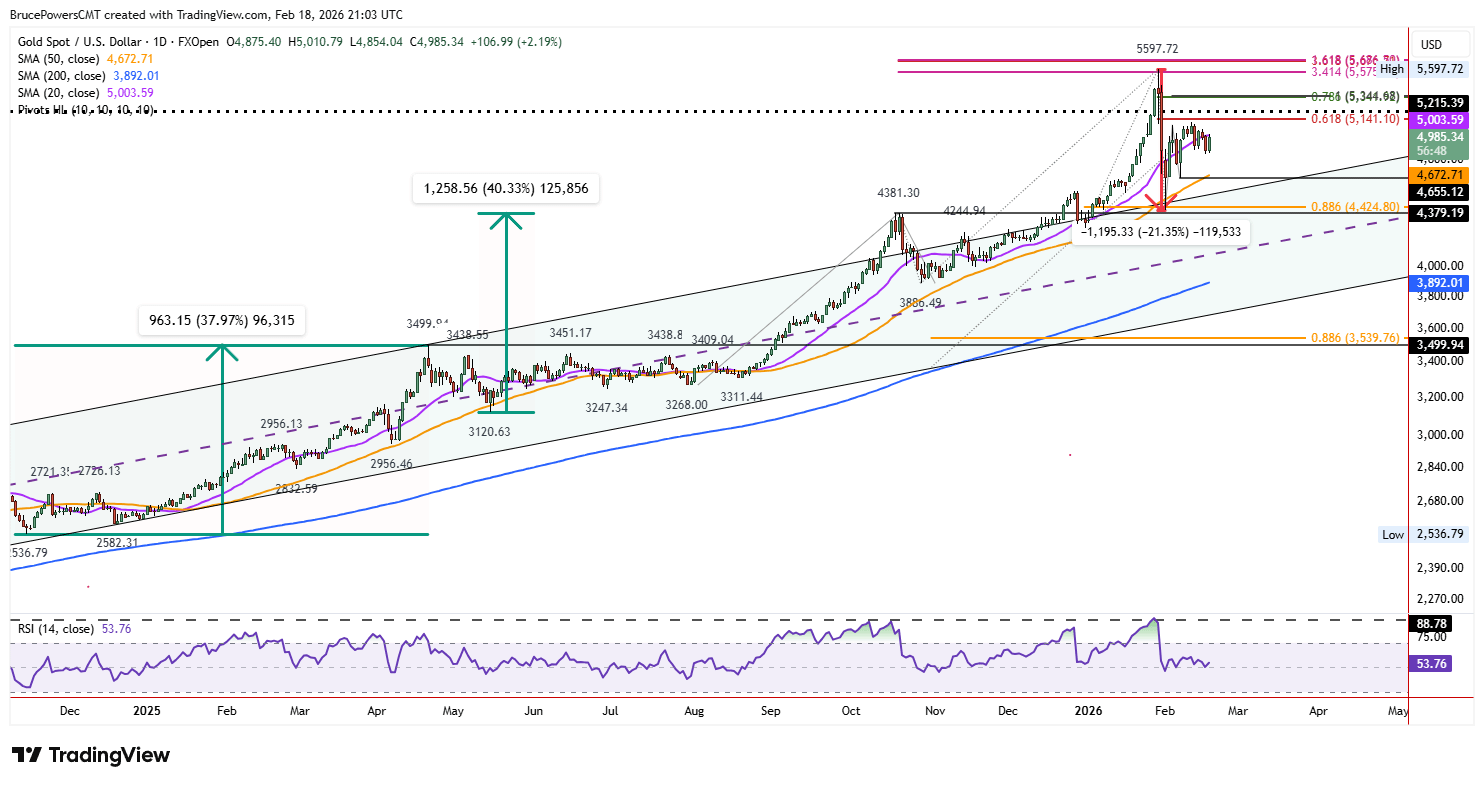

📈 Long-Term Context: The Bull Channel Remains Alive

Structural Bullishness: Despite a sharp 21.4% decline from the $5,598 peak, the pattern of higher swing lows and highs remains intact.

Successful Retest: The recent low successfully tested the top of the rising trend channel as support for the first time since the January breakout. This confluence with the 50-day average validates the strength of the current floor.

🔮 Outlook: Waiting for a Catalyst

Volatility Decline: With volatility cooling off, gold is likely to remain range-bound in the near term, consolidating between the 50-day average and the $5,598 peak.

Upside Scenario: A decisive move above $5,010 would target the 20-day average. Sustained strength above $5,119 could pave the way for a run at the 78.6% Fibonacci target of $5,345.

Downside Risk: A break below $4,655 would shift the bias firmly bearish in the short term.