$BITCOIN recently retraced nearly 50% from its late-2025 highs near $126K.

That kind of move feels dramatic — but historically, Bitcoin has survived far worse.

Multiple 70–80% drawdowns. Multiple resets. Every time, new highs followed.

What’s different now isn’t Bitcoin’s resilience.

It’s who owns it — and how capital moves through it.

Since 2024–2025, Bitcoin’s market structure quietly changed.

Not weaker.

More complex.

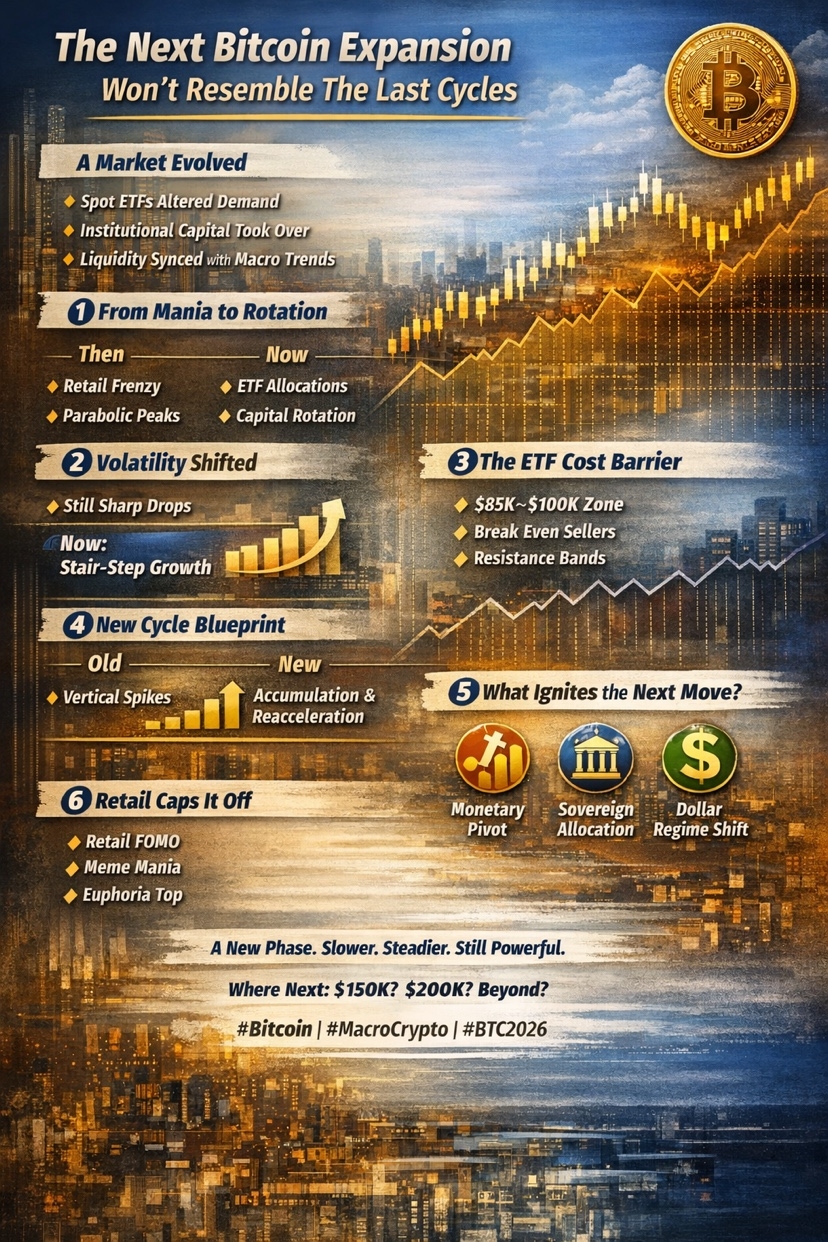

A Market That Grew Up

Three shifts altered Bitcoin’s cycle dynamics:

• Spot ETFs reshaped demand behavior

• Institutional capital overtook retail dominance

• Bitcoin synced with global liquidity regimes

Bitcoin is no longer a pure reflexive retail trade.

It’s evolving into a macro-sensitive allocation asset.

That single shift changes how rallies begin, how they extend, and how they cool.

1️⃣ Cycles Are Rotating — Not Exploding

Before:

• Retail-driven FOMO

• Vertical price runs

• Blow-off tops

• Brutal resets

Now forming:

• ETF-led allocation

• Gradual capital rotation

• Rebalancing flows

• Liquidity-based acceleration

Institutions don’t chase momentum emotionally.

They allocate when:

– Real yields compress

– Risk-adjusted returns improve

– Diversification benefits increase

That favors longer expansions, not instant parabolas.

2️⃣ Volatility Didn’t Disappear — It Changed Shape

Yes, Bitcoin still drops 25–35%.

No, ETFs didn’t “tame” volatility.

What may change is the path:

Instead of:

Peak → collapse → crypto winter

We may see:

Advance → consolidation → re-acceleration

Measured pullbacks over multiple quarters

Short-term swings remain violent.

Long-term volatility may slowly decay as ownership broadens.

That’s maturation — not stagnation.

3️⃣ A New Ceiling Exists: Institutional Cost Basis

This didn’t exist in early cycles.

Large ETF inflows in 2025 clustered roughly between $85K–$100K.

That creates:

• Defined cost-basis zones

• Mechanical selling pressure

• Structured resistance bands

When price revisits these areas:

– Breakeven flows emerge

– Risk desks rebalance

– Momentum pauses

Bitcoin now absorbs positioning, not just emotion.

4️⃣ The New Cycle Blueprint

Old cycle pattern:

Vertical surge → exhaustion → deep winter

Emerging pattern:

Liquidity shift → accumulation

Breakout → rotation → consolidation

Re-acceleration → controlled extension

Macro cooling — not total collapse

Think less fireworks.

More stair-steps.

Still powerful — just structurally layered.

5️⃣ What Actually Triggers the Next Expansion?

Cycles don’t begin with narratives.

They begin with capital movement.

Three realistic catalysts:

Monetary Pivot

If real yields fall, rate cuts accelerate, and liquidity expands — Bitcoin historically responds first and fastest.

Sovereign or Pension Allocation

One meaningful institutional allocation can change perception instantly.

Signal > size.

That reflexivity pulls sidelined capital forward.

Dollar Regime Shift

Sustained DXY weakness or global M2 expansion funnels capital into scarce assets.

Bitcoin thrives when liquidity grows — not when sentiment tweets do.

6️⃣ Retail Still Ends Every Cycle

Institutions build the foundation.

Retail creates the surge.

Signs retail is back:

• Search interest spikes

• Exchange app downloads

• Meme coin excess

• Mainstream euphoria

Without retail: orderly expansion.

With retail: reflexive acceleration.

Every cycle ends the same way — just at different heights.

So… Another Supercycle?

Probably.

But it may be:

• Liquidity-triggered

• Institutionally layered

• Mechanically absorbed

• Retail-finished

Bitcoin isn’t early-stage speculation anymore.

It’s a macro asset with built-in volatility.

Those waiting for a 2021-style vertical candle may miss a slower, structural repricing.

Final Thought

Bitcoin didn’t change overnight.

Its capital base did.

The next expansion won’t start with hype — it will start with liquidity.

The real question isn’t:

“Will Bitcoin run again?”

It’s:

“Will we recognize the cycle if it doesn’t look like the last one?”

Where do you see BTC next cycle — $150K, $200K, or higher?

#bitcoin #CryptoCycles #MacroCrypto #BTC2026