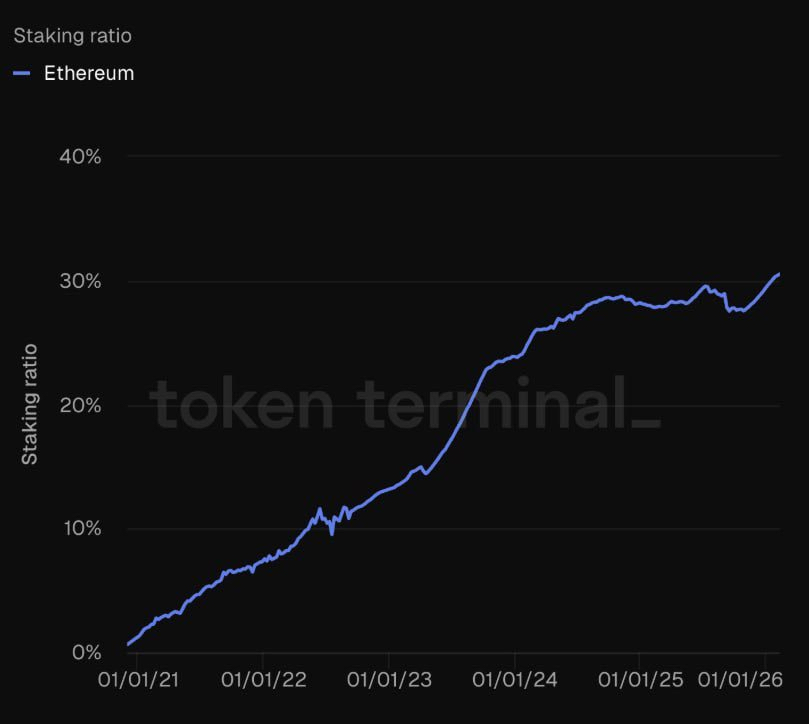

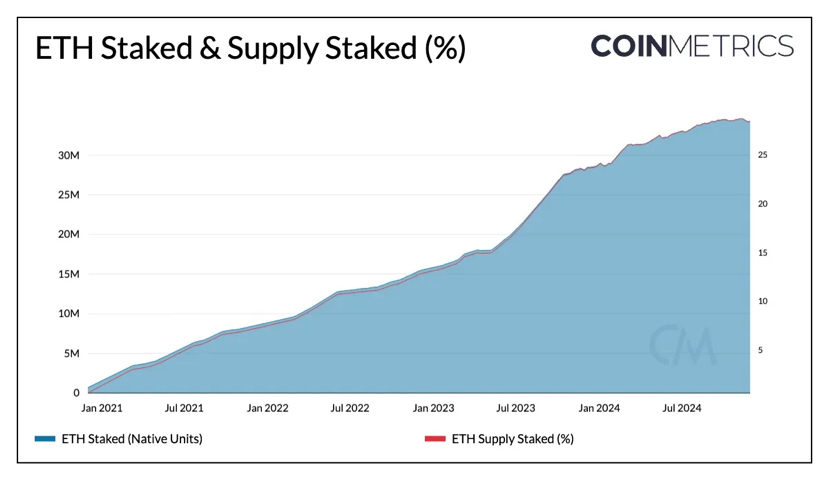

Most people are watching 1 hour candles. Some are waiting for quick pumps. Some are scared of small pullbacks. But in the background something much bigger is happening. For the first time in history, 30% of Ethereum supply is now staked. That is not just a number. That is a structural shift.

If you look at the staking growth chart, you can clearly see how slowly and consistently this number increased. In early days staking was under 5 percent. Then it crossed 10 percent. Then 20 percent. Now it has touched 30 percent. This means almost one third of total ETH supply is locked inside the network.

Locked means not actively available for selling. Locked means reduced liquid supply. And reduced liquid supply changes how price reacts when demand increases.

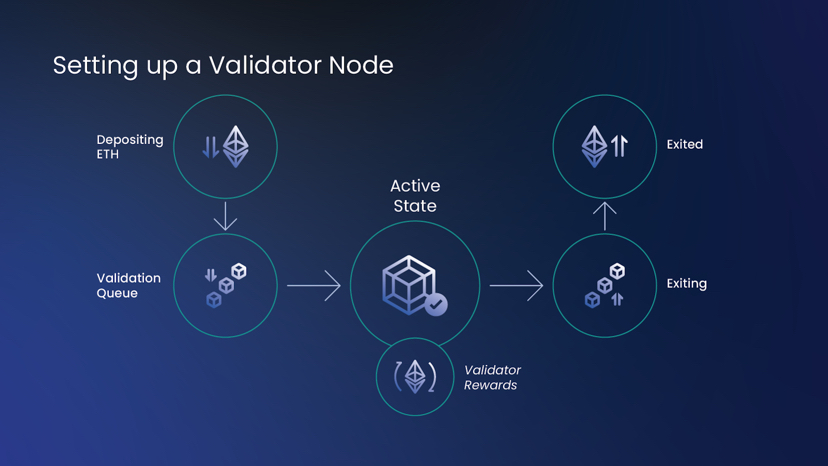

Now let’s understand this in simple words. Ethereum runs on Proof of Stake. Instead of miners, validators secure the network by staking ETH. When someone stakes ETH, they help confirm transactions. In return, they earn rewards. That means ETH is no longer just something you hold and hope goes up. It becomes something that can generate yield.

This is important because it changes holder behavior. If you can earn yield by staking, you are less likely to panic sell. Many long term holders prefer to stake and earn rather than trade every small move. That creates a strong base of committed supply.

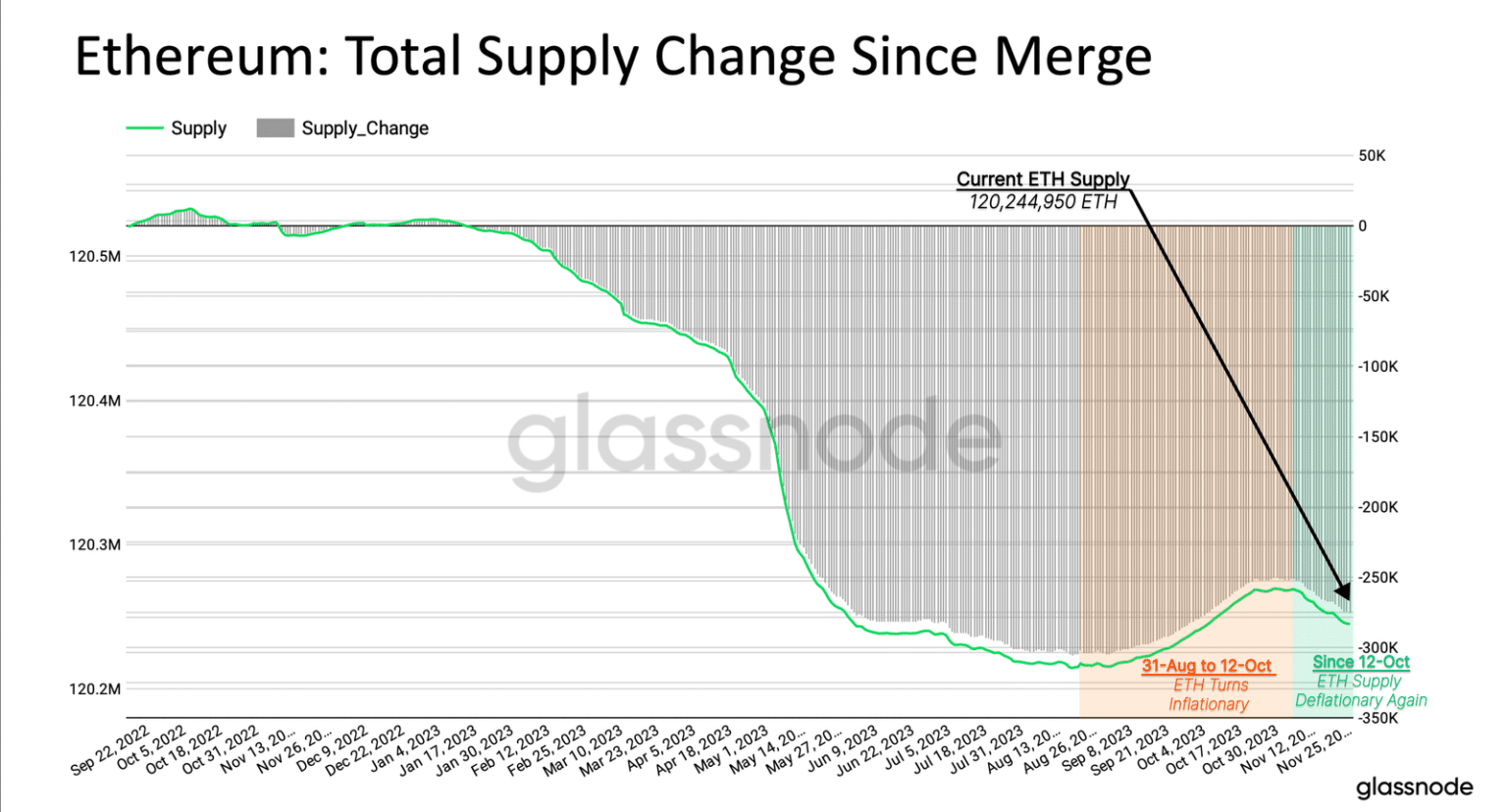

There is another layer people forget. Ethereum also burns a portion of transaction fees. That means some ETH is permanently removed from supply. So now two things are happening at the same time. A large percentage is locked in staking and some ETH is continuously burned. Both reduce effective circulating pressure.

When supply tightens and demand stays stable or increases, prices usually react stronger. It does not mean ETH will pump tomorrow. Markets still depend on macro news, Bitcoin movement, liquidity and global sentiment. But structure always matters more than noise.

Look at exchange balances over time. As staking increases, ETH on exchanges generally decreases. That means fewer coins are sitting ready to be sold instantly.

When exchange supply goes down, sudden demand can create sharper moves because there is less immediate selling pressure.

Now think bigger. Institutions prefer assets that generate yield. Staking gives ETH a financial use case beyond speculation. It starts to look more like a productive digital asset instead of just a volatile token. That changes how large capital views it.

Retail traders focus on short term fear and hype. But staking ratio tells you what long term holders are doing. And long term holders are not exiting. They are locking.

If staking ratio moves from 30 percent to 35 or even 40 percent in coming years, liquid supply becomes even tighter. That does not guarantee price direction short term. But it builds pressure under the surface.

Sometimes the strongest signals are not loud. They are slow and consistent. This 30 percent staking milestone is one of those signals. Price may move sideways for weeks. It may even drop during macro panic. But supply structure is quietly changing.

And when the next strong demand wave arrives, many will suddenly ask why ETH moved so fast.

#TradeCryptosOnX #MarketRebound #ethstaking #BTCMiningDifficultyDrop #WhaleDeRiskETH