FUD never appears when markets are euphoric. It always arrives at the most fragile moments: right after key supports break, liquidity thins out, and confidence begins to crack. In these phases, bad news spreads faster than data, emotion overwhelms logic, and most investors react out of fear rather than understanding what they are actually facing. History repeatedly shows that during periods of Extreme Fear, the majority of selling pressure comes from retail participants - those least tolerant of volatility and least patient with time.

When fear escalates, one of the most powerful narratives always resurfaces: the collapse of exchanges. A spike in withdrawals, a wallet reshuffle, or an unverified rumor is often enough to trigger memories of past failures. Yet increased inflows and outflows during volatile periods are normal market behavior, not proof of insolvency. Today’s major exchanges operate with far greater transparency and scrutiny than in previous cycles. In this context, exchange-related FUD is rarely driven by real liquidity gaps - it is driven by collective trauma being reactivated at the worst possible moment.

Closely tied to this is a broader and more dramatic fear: the collapse of the entire crypto market. Every sharp correction, ETF outflow, or industry layoff is quickly framed as proof that “crypto is finished.” In reality, these events usually signal post-expansion rebalancing rather than systemic decay. Markets do not die because prices fall, and technology does not lose relevance simply because a cycle turns downward. Historically, narratives of total collapse peak precisely when long-term accumulation quietly resumes beneath the surface.

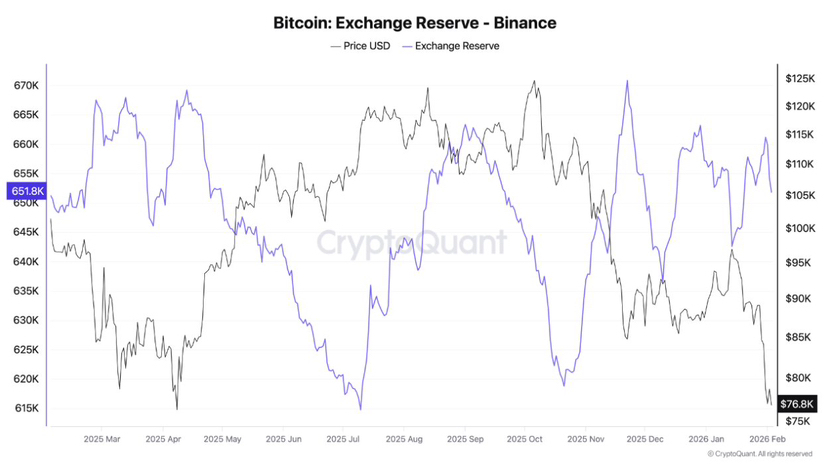

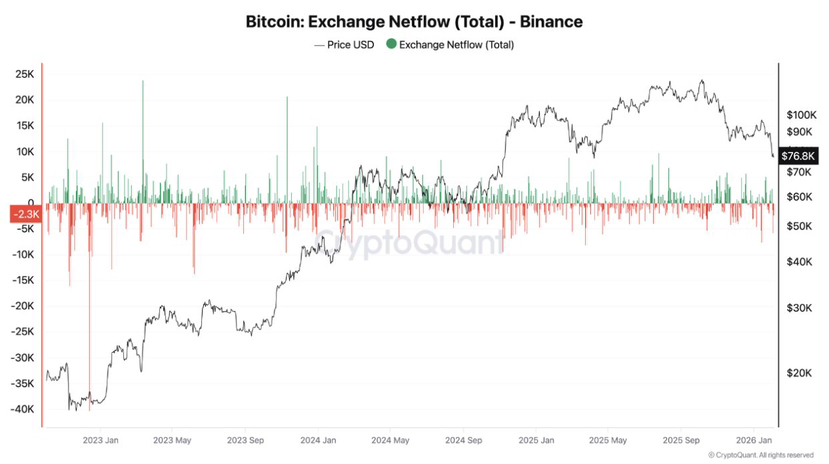

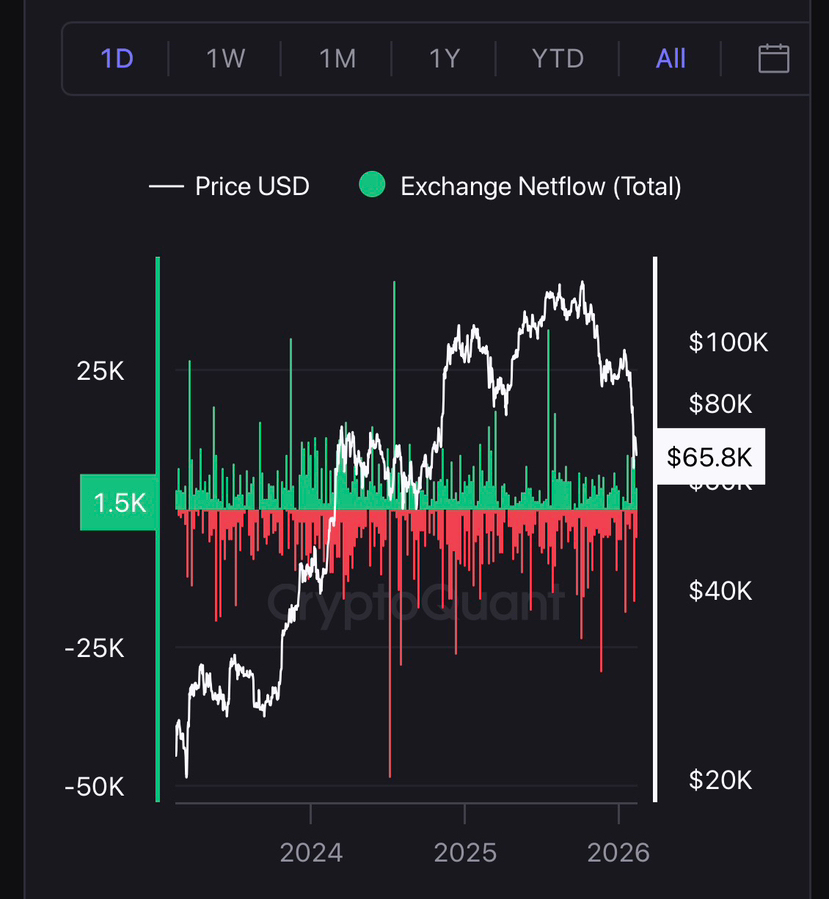

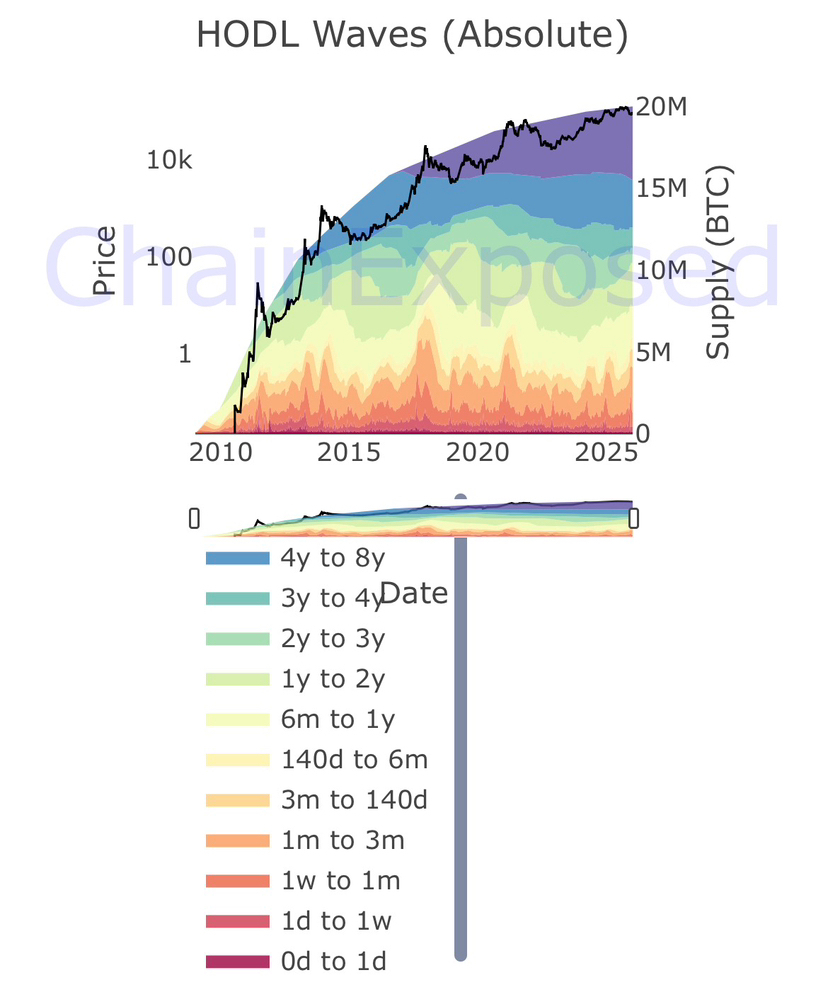

While headlines and social media amplify worst-case scenarios, on-chain data tells a very different story. At many major bottoms, coins steadily flow out of exchanges, signaling long-term holding rather than panic selling. Large wallets and long-term holders rarely distribute assets during periods of maximum fear. Instead, they absorb the liquidity created by emotional sellers. This is not luck - it is the result of understanding cycles, understanding capital flows, and accepting volatility as the cost of participation.

Every deep downturn includes a quiet but decisive process: assets transfer from weak hands to disciplined ones. Markets do not eliminate everyone at once. They apply pressure until those unable to endure voluntarily exit the game. Prices may fall sharply, but ownership becomes increasingly concentrated - and that concentration is precisely what lays the groundwork for the next expansionary phase.

No one becomes a strong investor in comfortable, rising markets. FUD is the real test. It forces difficult questions: Do you truly understand what you hold? Do you have a plan, or only hope? Can you maintain discipline when collective fear demands reaction? Those who survive these periods rarely win because they call the exact bottom - they win because they are not forced out of the market.

FUD is not what kills you - it is the fire that reveals whether you are steel or ash.

Markets do not reward those who avoid fear, nor do they punish patience. They do only one thing: they filter. Those who let emotion lead become ash. Those who understand cycles, read data, and maintain discipline are forged into steel - and they are the ones still standing when the fire fades.