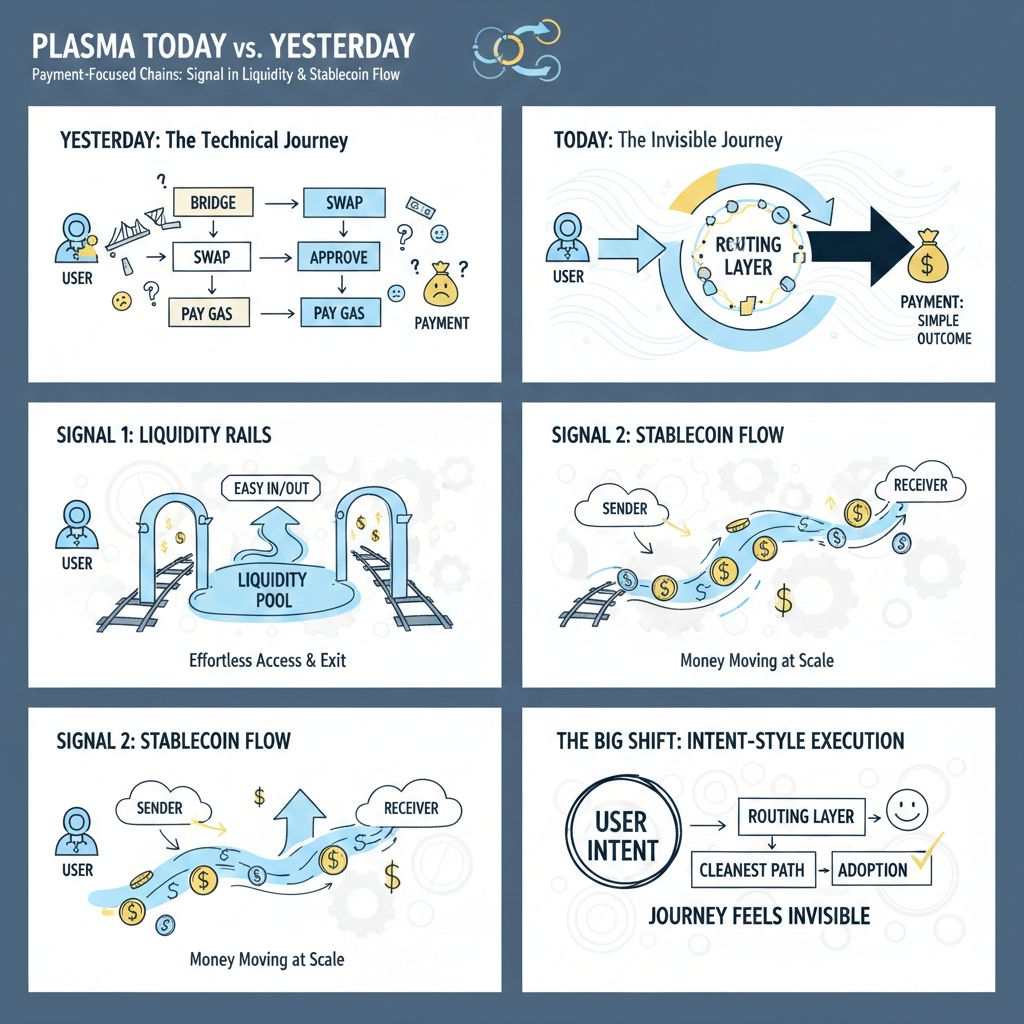

When I look at Plasma today versus yesterday, I’m not trying to force a story out of small noise. With payment-focused chains, the real signal usually shows up in two places: the rails around liquidity (how easy it is to get in and out), and the stablecoin flow itself (whether money is actually moving at scale).

The biggest “today” shift isn’t some loud announcement. It’s that Plasma is leaning harder into the kind of routing that makes stablecoin movement feel less like crypto steps and more like a simple outcome. Instead of users thinking, “bridge here, swap there, approve this, pay gas,” the direction is clearly moving toward intent-style execution where the user asks for a result and the routing layer figures out the cleanest path. That’s not just convenience — it’s adoption. Payments don’t grow when the user journey feels technical. They grow when the journey feels invisible.

And that’s why this matters in the next 30–90 days. If routing and liquidity access keep improving, Plasma doesn’t have to “sell” the idea of stablecoin settlement. The product becomes the experience: fast movement, low friction, predictable costs, and fewer steps. That’s how you go from a chain that works to a chain that people repeatedly use without thinking.

The second thing I’m watching is the stablecoin activity on-chain, because that’s the scoreboard you can’t fake for long. Holder count, daily transfers, daily volume — these tell you whether usage is expanding, consolidating, or cooling. Even a drop in 24h transfers isn’t automatically a negative. Sometimes it just means flows are consolidating into fewer, larger settlement movements, which can actually happen when routing becomes cleaner or when bigger players start using the rail more efficiently. Either way, it’s real signal because it’s measured in movement, not in marketing.

What also stands out is how “payments-like” the chain behavior looks in practice. For payments, the most underrated feature is boring consistency: steady block production, reliable finality, throughput that doesn’t fall apart when traffic changes. People love to argue about peak performance numbers, but payment rails are judged on whether they behave the same on a quiet day and a busy day. That kind of stability is what makes integrators comfortable, and it’s what turns early usage into recurring usage.

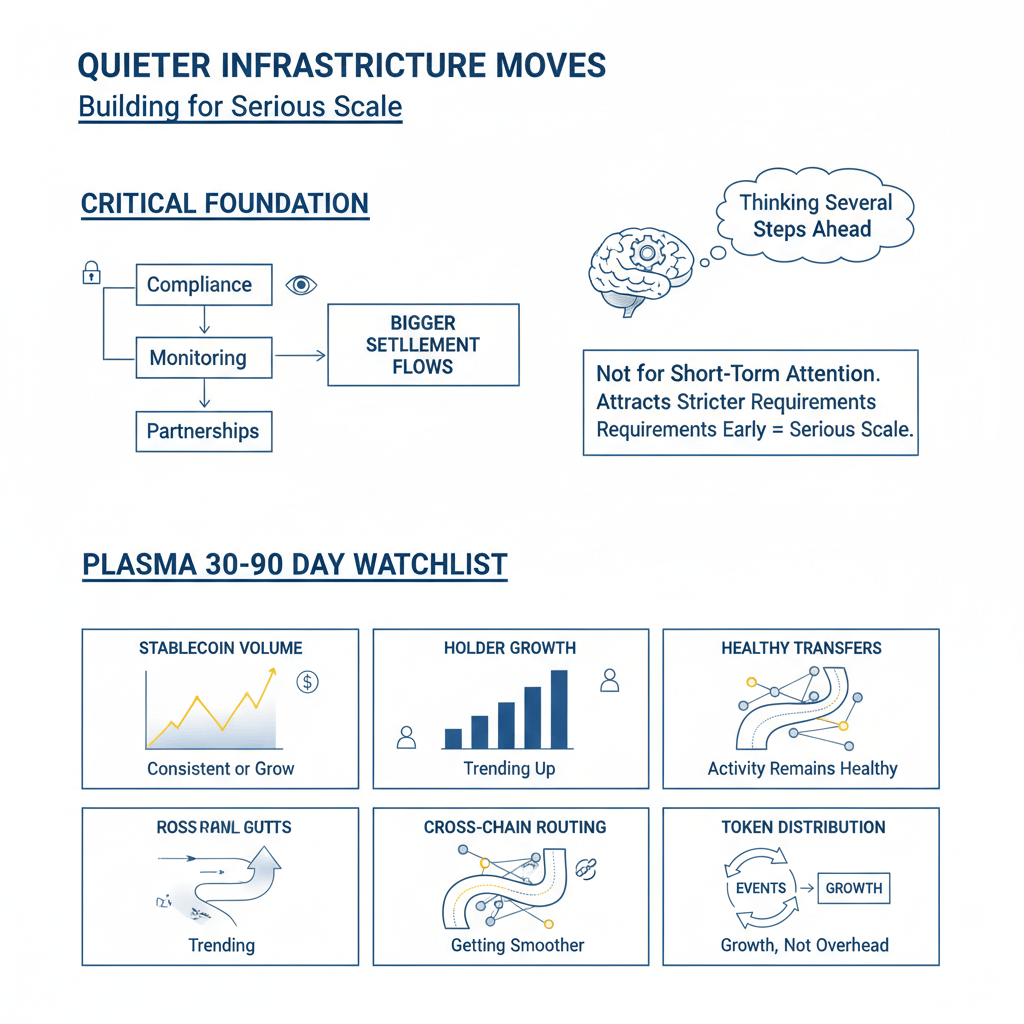

Now the part that’s easy to ignore but matters a lot: supply and distribution timing. Plasma is moving deeper into the phase where unlock schedules and allocation flows start becoming a real market factor. That isn’t fear or hype — it’s just reality. Over the next 30–90 days, the question won’t be “is there an unlock?” The real question will be: where does that distribution go? If it goes into ecosystem growth, liquidity programs, developer activity, and incentives that pull in real payment flows, it can be constructive. If it leaks into passive selling without matching demand, price can lag even while the network quietly improves. Both outcomes are possible, and this is exactly why tracking “what changed today” matters more than repeating big-picture narratives.

And finally, I pay attention to the quieter infrastructure moves — the kind that never trends, but decides whether bigger settlement flows can arrive later. Compliance and monitoring partnerships aren’t exciting to talk about, but they’re often a sign the project is building toward serious scale rather than just short-term attention. Stablecoin settlement at size attracts stricter requirements automatically. If those pieces are being placed early, it usually means the team is thinking several steps ahead.

So if I had to reduce today’s Plasma signal into a simple 30–90 day watchlist, it would be this: does stablecoin volume stay consistent or grow, does holder growth keep trending up, do transfers remain healthy (even if the shape of activity changes), does cross-chain routing keep getting smoother, and do token distribution events translate into growth rather than overhead.

That’s the real “what changed today?” lens for Plasma. Not drama. Not noise. Just the practical signs that the rail is getting easier to use, harder to break, and more ready for real settlement demand.