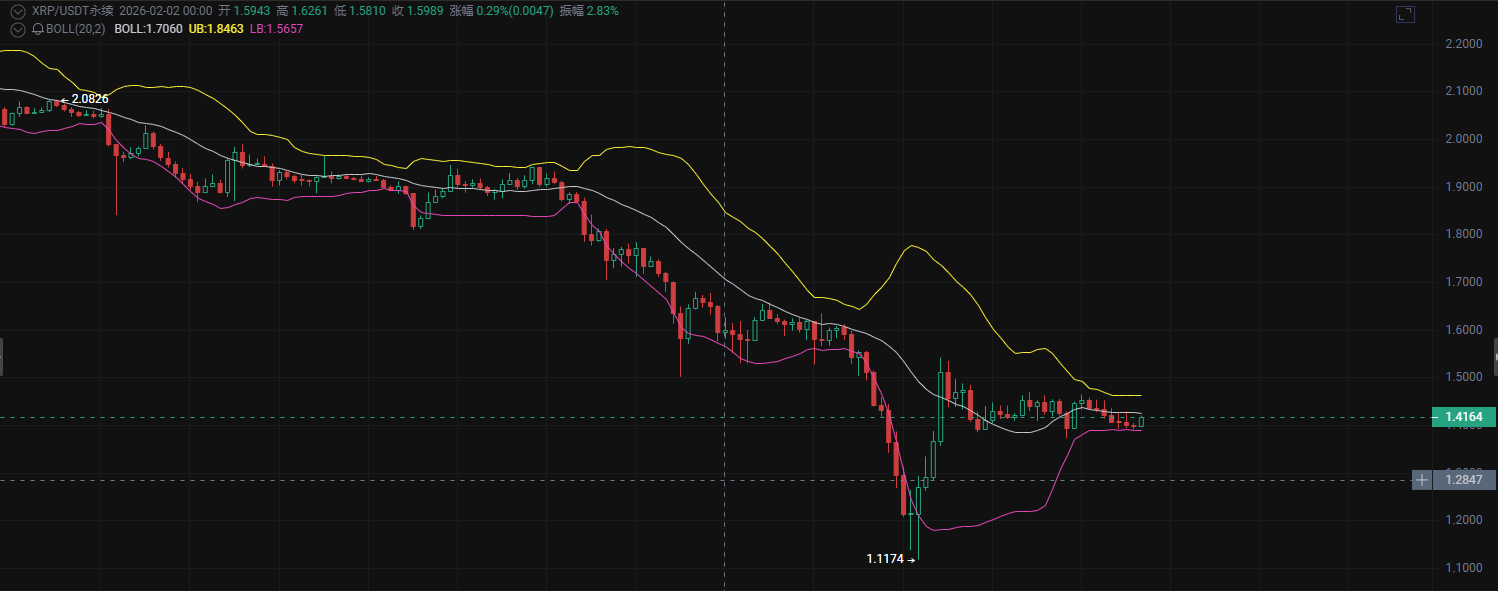

1.4 is not the bottom, it is the consumption zone

XRP is weakening simultaneously on the one-hour and four-hour charts, and the only direction left at the end of the sideways movement is one

The most dangerous consensus in the market right now is just one sentence:

"XRP has been so sideways, it should be about to pull up, right?"

But veterans understand -

A real decline often starts from a place where 'everyone is calm'.

Four-hour chart (trend direction) - rebound ends, structure has not reversed

The major structure clearly drops from 1.56 to 1.11

Then there is a rebound:

No recovery of previous highs

Repeatedly pressured by the BOLL middle line + upper line

Current price status:

Running below the midline for a long time

Upper track continues to decline → channel is bearish

K-line structure:

High points keep moving lower

Each round of rebound amplitude is shrinking

Four-hour summary:

This is a consolidation in a downtrend, not the starting point of a new uptrend.

One-hour chart (entry signal) — the longer it consolidates, the greater the risk

Prices oscillate narrowly around 1.38 – 1.44

But pay attention to three details:

The rebound lacks volume

The upward movement is immediately pushed back

Support below is gradually weakening

BOLL three lines converge and flatten out

Direction choice is approaching, following the larger cycle, it will only go down.

This is typical:

Use time to exchange for space, using consolidation to cover short positions.

XRP short strategy

Entry position: 1.41

First take profit: 1.39

Second take profit: 1.37

Stop loss position: 1.43