This morning, the global market sold off, and the VIRTUAL surged against the trend by 5.84%, showing exceptionally strong performance. Is this a technical rebound or a trend reversal?

In-depth interpretation of technical indicators

MACD: Strong golden cross (0.0991 crossing above 0.0666), histogram expanding, bullish momentum accelerating.

RSI: Deeply overbought at 83.93, far exceeding the 70 threshold, soaring from 40 to 80 within two weeks, driven by momentum but with high short-term pullback risk.

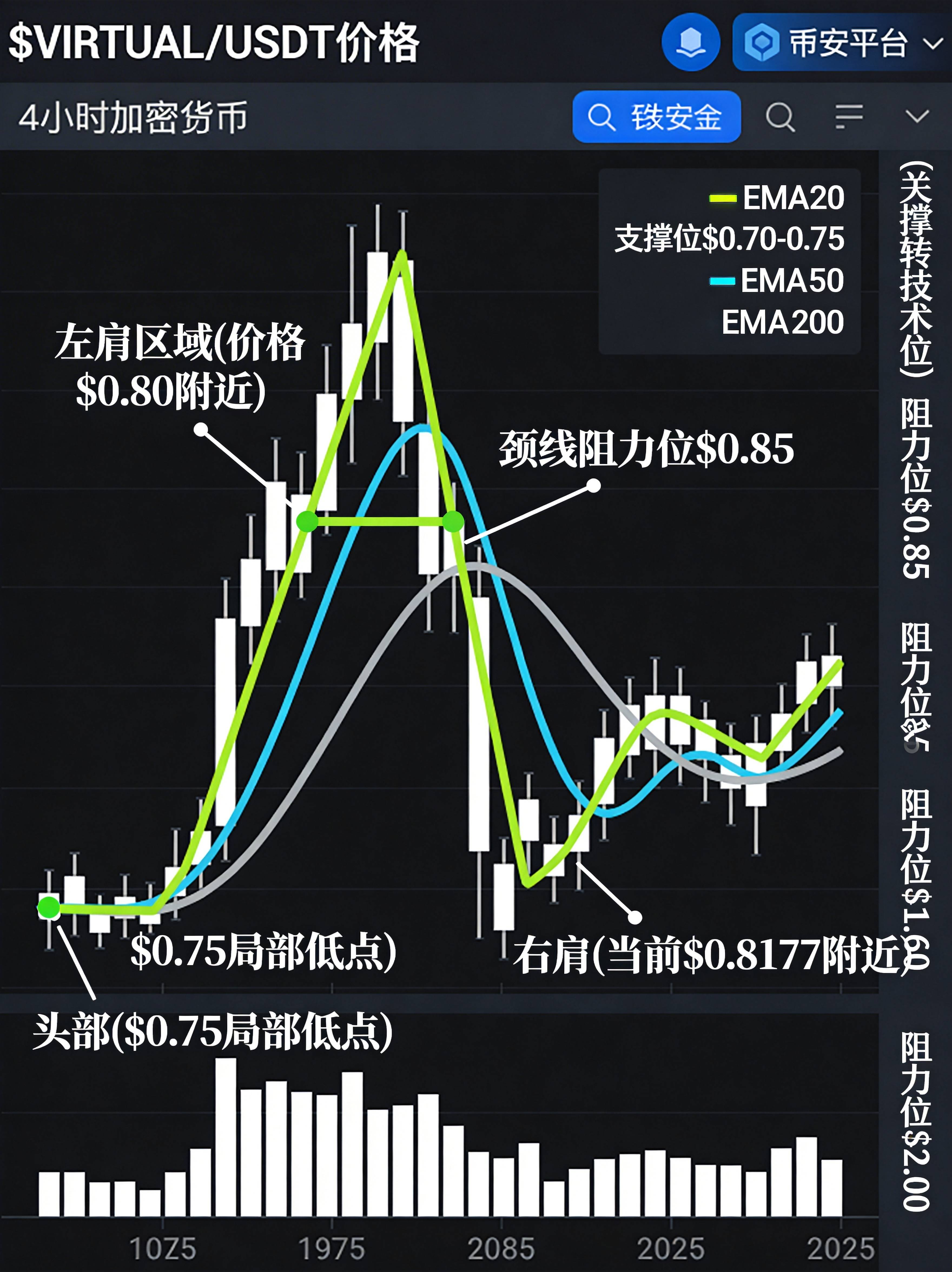

Price pattern: The inverted head and shoulders pattern is forming on the 4-hour chart, with the left shoulder at $0.80, head at $0.75, right shoulder at $0.8177, and neckline at $0.85. A breakout confirmation indicates a bullish outlook.

On-chain data and market sentiment

Holding addresses: Over 1 million, user base is extensive

Active growth: Active addresses +45%, ecosystem activity improved

Distribution optimization: Whale holdings 62% → 51%, more balanced

Valuation level: MVRV Z-score 0.321, undervalued

Social media: Twitter discussions are heated, sentiment is bullish but beware of RSI overbought correction

Operational strategy and risk management

Position control: ≤5% (high-risk niche coins)

Entry timing:

Aggressive: Buy in batches at support of $0.78

Conservative: Confirm correction after breaking $0.85 neckline. Stop loss: below $0.75 head low

Target: Short term $1.00, mid term $1.60

Risk warning

The overall market is still in panic, may lead to a decline

RSI overbought 83.93, high probability of short-term correction

Niche coins have poor liquidity and high volatility

AI + Blockchain project technical implementation has uncertainty

Conclusion

$VIRTUAL The technical outlook is bullish (MACD golden cross + head and shoulders pattern), but faces the risk of RSI overbought correction in the short term. Suggest position ≤5%, strict stop loss, watch for break of $0.85 neckline.

Follow Xiaohai to chat about the crypto circle for more in-depth technical analysis.