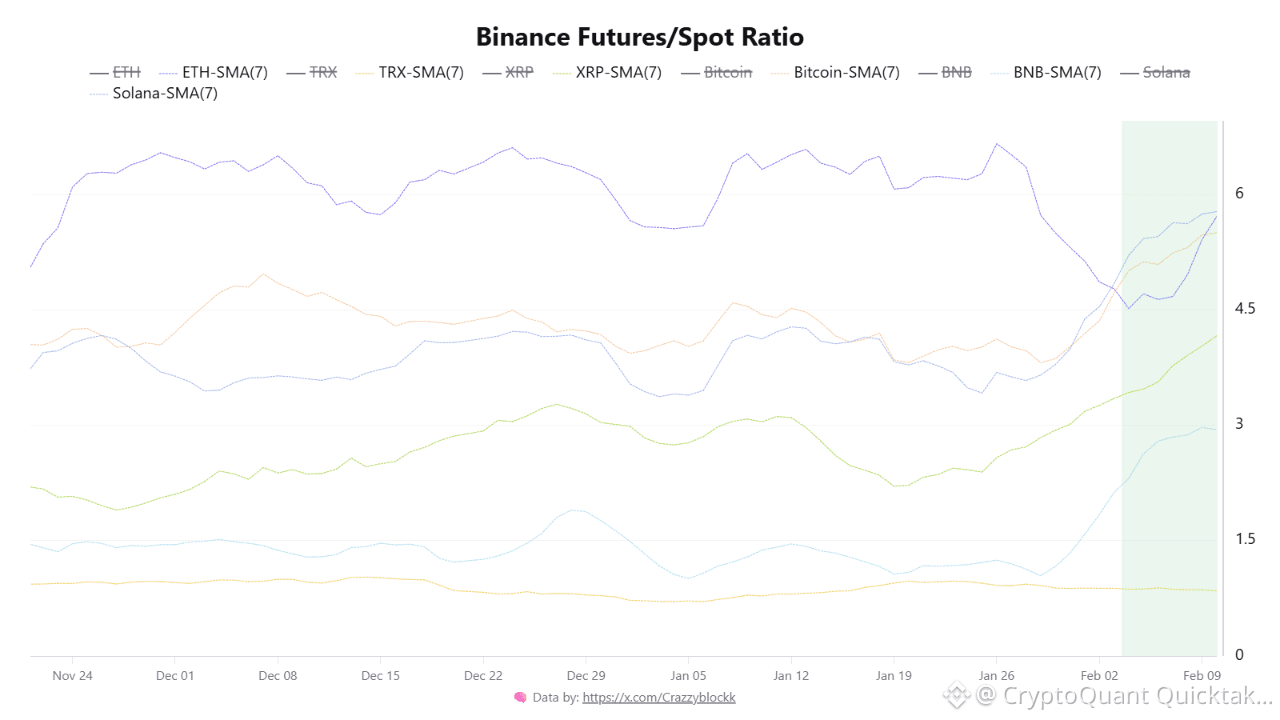

While Bitcoin’s price bled from $124K to $67K, the Binance Futures‑to‑Spot ratio quietly painted a different picture – especially for altcoins.

By late January, the ratio for ETH, XRP, and Solana had collapsed to multi‑month lows, reflecting fear and spot‑driven selling. But since February began, something shifted. ETH’s ratio climbed from 3.7 to 7.5, breaking decisively above its 7‑day moving average. XRP followed, surging from 2.6 to 4.6. Solana nearly doubled. Even Bitcoin’s ratio recovered, yet altcoins led the charge – their upside momentum in futures activity now outrunning BTC’s.

This isn’t random noise. A rising futures/spot ratio from depressed levels signals returning speculative appetite. Traders aren’t just hedging; they’re positioning. The fact that altcoins are showing stronger relative recovery in this metric suggests capital is rotating back into risk assets before price confirms it.

History echoes: similar bottoms in this ratio preceded the Q1 2024 and Q4 2025 rallies. Today’s setup isn’t euphoria – it’s quiet accumulation in derivatives markets. Short‑term pain is visible, but the futures tape is already discounting a turnaround.

Written by Crazzyblockk