Crypto ETFs were supposed to mark the definitive entry of institutional investors into the ecosystem. A few months later, the reality is more mixed. While the market tries to identify a bottom, a clear gap is widening between bitcoin and Ethereum. The latest figures show that ETH ETF holders find themselves in a significantly more exposed position than their counterparts invested in Bitcoin ETFs. An imbalance that raises questions about the relative strength of the two assets during this correction phase.

In brief

Ethereum ETF investors are in a more fragile position than those exposed to Bitcoin, according to the latest market data.

The estimated average entry price of ETH ETF holders, around 3,500 dollars, places them more at an unrealized loss than BTC ETF investors.

Assets under management have sharply declined from their peaks, with a more significant contraction on the Ethereum side.

Despite the correction, Bitcoin ETFs show relative position stability, with a limited share of liquidated assets.

Weakened positions for Ethereum ETFs

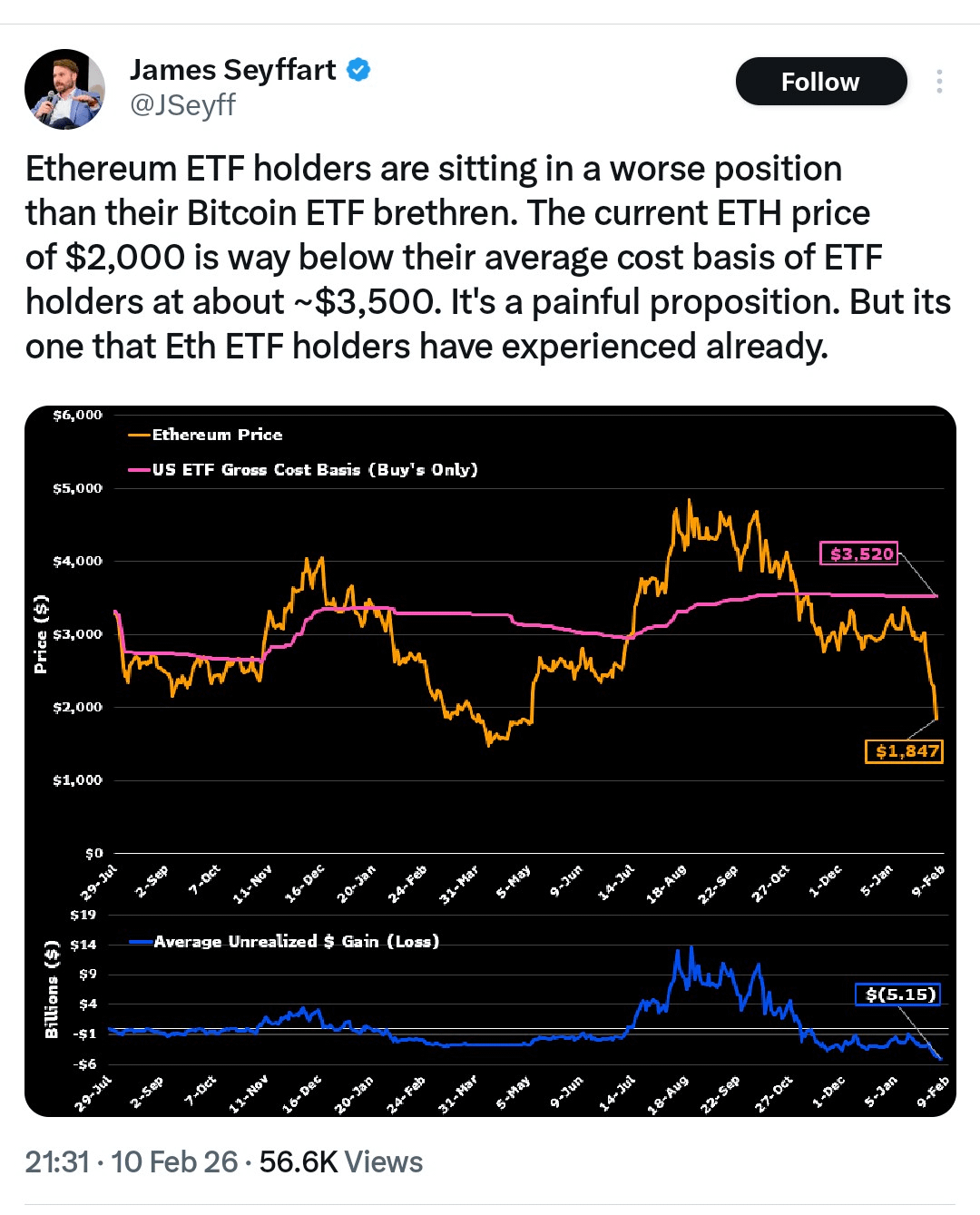

While sales are increasingly massive on crypto, the gap between the situation of Bitcoin ETF holders and Ethereum ETF holders is based on precise numerical data highlighted and commented on by Bloomberg ETF analyst James Seyffart.

He estimates that ETH ETF investors are “in a more difficult position” than their counterparts exposed to bitcoin. Several indicators illustrate this imbalance.

The estimated average entry price of Ethereum ETFs: about 3,500 dollars, a level above the asset’s current prices, placing much of the investors at an unrealized loss.

The average entry price of Bitcoin ETFs: 84,063 dollars, placing BTC holders in a relatively less degraded situation.

Assets under management of Bitcoin ETFs: 85.76 billion dollars, compared to a peak of 170 billion dollars in October 2025.

Assets under management of Ethereum ETFs: 11.27 billion dollars, compared to a peak of 30.5 billion dollars.

These figures reflect a marked decline in assets under management for both products, with a particularly severe contraction for Ethereum. The difference in entry price plays a central role in the current risk exposure. Thus, ETH investors are further from their break-even point than BTC ETF holders.

Sustainable flows and a tense market dynamic

Beyond the simple level of entry price, flow dynamics provide additional insight. Despite the correction, only about 6 % of assets of Bitcoin ETFs have been liquidated, suggesting relative resilience of the holders. This stability contrasts with the situation of Ethereum, where negative flows persist and no clear reversal signal appears at this stage.

The macroeconomic context increases this pressure. Indeed, the higher volatility in tech markets and the overall economic uncertainty weigh on risky assets. In this context, Ethereum seems to suffer a sharper sensitivity than bitcoin. Several billion dollars of unrealized losses for ETH ETF holders reinforce the idea of a more vulnerable positioning.

The gap between Bitcoin and Ethereum ETFs reflects a difference in resilience in a still unstable market. Upcoming institutional flows will be decisive. If Bitcoin maintains a solid foundation, the evolution of the ETH price will determine Ethereum’s ability to reduce this lag and restore investor confidence.