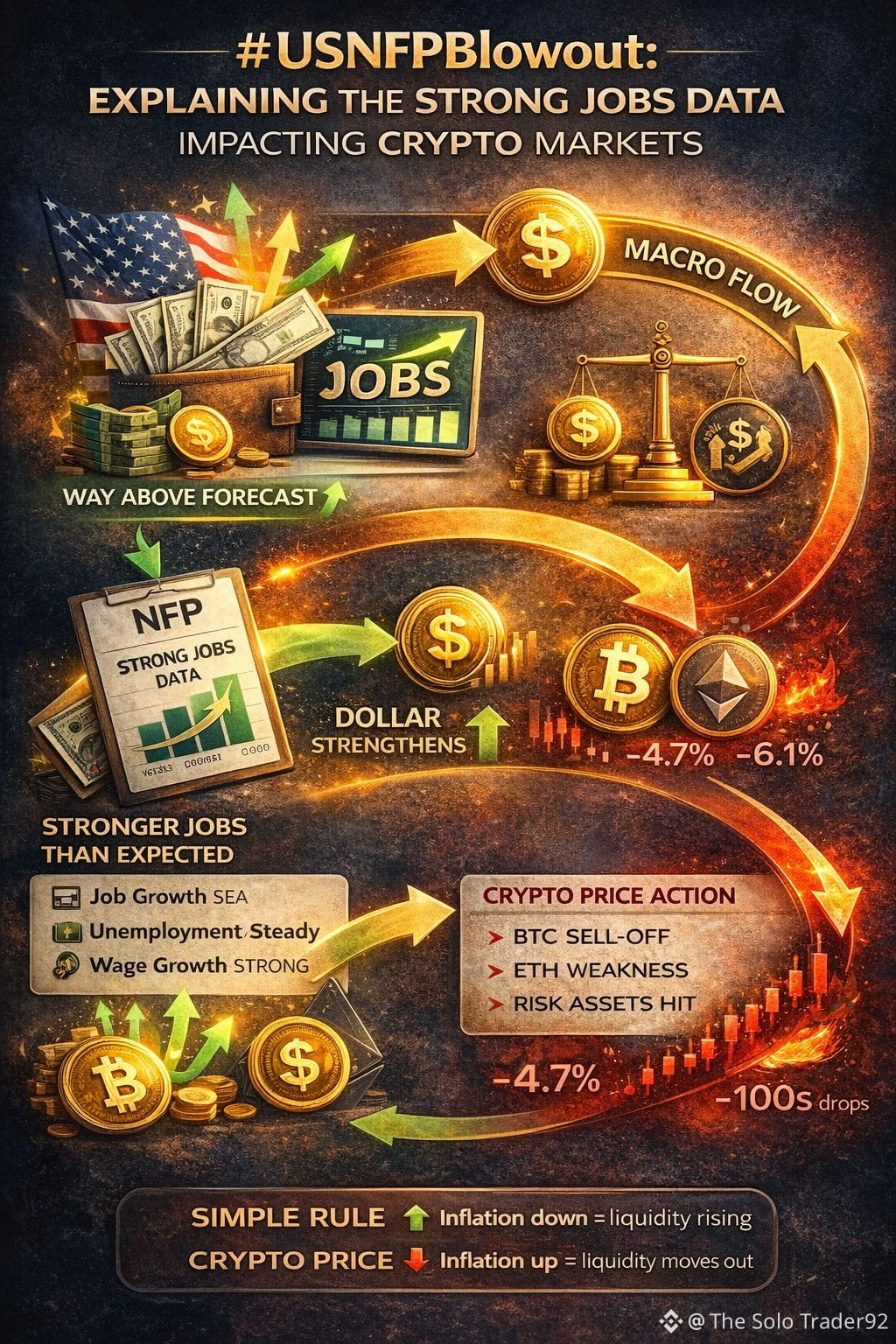

Today’s U.S. Non‑Farm Payroll (NFP) report came in significantly stronger than expected, surprising markets and triggering notable reactions across risk assets — including Bitcoin, Ethereum, and major alts.

Today’s U.S. Non‑Farm Payroll (NFP) report came in significantly stronger than expected, surprising markets and triggering notable reactions across risk assets — including Bitcoin, Ethereum, and major alts.

📌 What happened:

• U.S. added more jobs than forecast — actual >> expectations

• Unemployment remained relatively steady

• Wage growth stayed strong

When jobs beat expectations like this, traders digest the data fast — and it affects interest rate expectations, dollar strength, and risk sentiment.

🧠 Why This Matters for Crypto

1) Interest Rates & Fed Expectations

A strong jobs report usually means the economy is hotter than thought.

• This reduces chances of rate cuts

• Markets price in higher or sticky rates

• A stronger dollar often emerges

Crypto typically suffers in that environment because risk appetite weakens.

📉 Impact on Markets Right Now

BTC & ETH:

• Bitcoin sold off immediately post‑NFP as yields spiked and the dollar strengthened.

• Ethereum showed correlated weakness as traders rotated into safer assets first.

Macro Flow:

• Dollar Index up

• Bond yields jumped

• Risk assets reprice

This is the classic risk-off reaction, not random noise.

📌 Real Trader Signals

A) Immediate 30‑minute move: • Quick selloff

• Sharp reduction in open interest

• Retail shorts covered then reversal attempts

B) 1–4 Hour reaction: • Sideways chop as macro traders absorb data

• Whales rotate into stablecoin liquidity

C) Next session: • If CPI or Fed minutes softens → relief rallies possible

• If macro stays strong → risk asset breakdown risk increases

🧠 Practical Takeaways

✅ Strong jobs = stronger dollar

✅ Strong dollar often = risk assets weakness

✅ Selloffs on macro days are liquidity hunts

✅ Don’t chase the first move — wait for structure

NFP blowouts aren’t just numbers.

They set macro narratives that drive price psychology across markets.

👉 Follow me for real macro readouts you can trade from, not just headlines.

#USNFPBlowout #CryptoMacro #RiskSentiment #USNFP #USNFPCooldown