$XRP Markets rarely send invitations before they move. They tighten, they hesitate, and then they lurch. Global investors are currently sensing escalating tensions. Geopolitical risk has returned to center stage, and traders across equities, commodities, and crypto markets are watching the Middle East with growing unease.

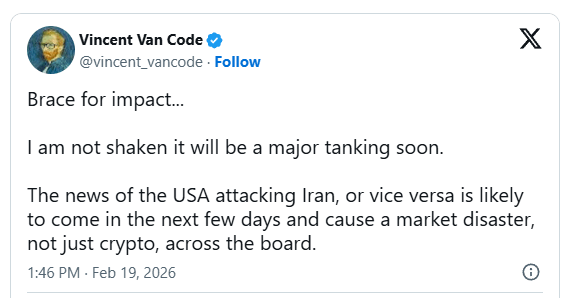

In that climate, software developer and crypto commentator Vincent Van Code issued a blunt warning to XRP holders, urging them to brace for what he believes could be a significant downturn. His remarks reflect a broader fear circulating in financial circles: escalating tensions between the United States and Iran could trigger a cross-market shock event.

✨Rising Geopolitical Pressure and Market Sensitivity

Markets react quickly to geopolitical instability because conflict disrupts supply chains, energy flows, investor confidence, and global trade expectations. Even the credible threat of military confrontation can spark sharp repricing across asset classes.

Oil typically rises first as traders price in potential supply disruptions. Gold often follows as investors seek perceived safety. Equities and high-risk assets, including cryptocurrencies, tend to decline as capital rotates into defensive positions. This pattern has repeated itself across multiple historical flashpoints, and traders now fear another cycle could unfold.

✨Crypto’s Exposure to Risk-Off Waves

Despite narratives that position crypto as a hedge, Digital assets tend to act like high-risk investments during global stress. When liquidity dries up and fear takes over, investors typically cut back on volatile assets first.

XRP, like the broader crypto market, remains highly sensitive to macro shocks. Large-scale geopolitical events can trigger rapid selloffs, cascading liquidations, and sharp spikes in volatility. Even strong long-term fundamentals rarely shield assets from short-term macro panic.

Van Code’s warning reflects this reality. He does not frame the concern as isolated to crypto; instead, he suggests a broader market impact that could spill across traditional finance and digital assets alike.

✨Why Timing Matters Now

The current environment amplifies vulnerability. Global markets already contend with elevated interest rates, fragile investor confidence, and tight liquidity conditions. When geopolitical risk overlays those pressures, markets can react disproportionately.

Traders are now closely watching news, as confirmed military escalation could trigger automated sell-offs. In modern markets, reactions occur within seconds, not days.

✨Preparing for Volatility

Investors cannot control geopolitical outcomes, but they can control positioning and risk management. Market history shows that sudden drawdowns often follow periods of complacency. The increased tension itself is likely to boost volatility, no matter what happens next.

Van Code’s message resonates because it captures a broader market truth: uncertainty drives repricing. If tensions de-escalate, markets may stabilize. If conflict breaks out, risk assets may plummet quickly.

For XRP holders and global investors alike, the coming days demand discipline, clarity, and emotional control. Markets move fast when fear takes hold.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.