VANRY is the native utility token of Vanar Chain, a Layer 1 (L1) blockchain engineered specifically to bridge the gap between mainstream consumers and Web3 technology . Originally evolved from the Terra Virtua Kolect (TVK) ecosystem, Vanar has pivoted in 2026 to become the world’s first “AI-native” L1 blockchain, targeting the emerging “Intelligence Economy” . This article provides a full technical and economic breakdown.

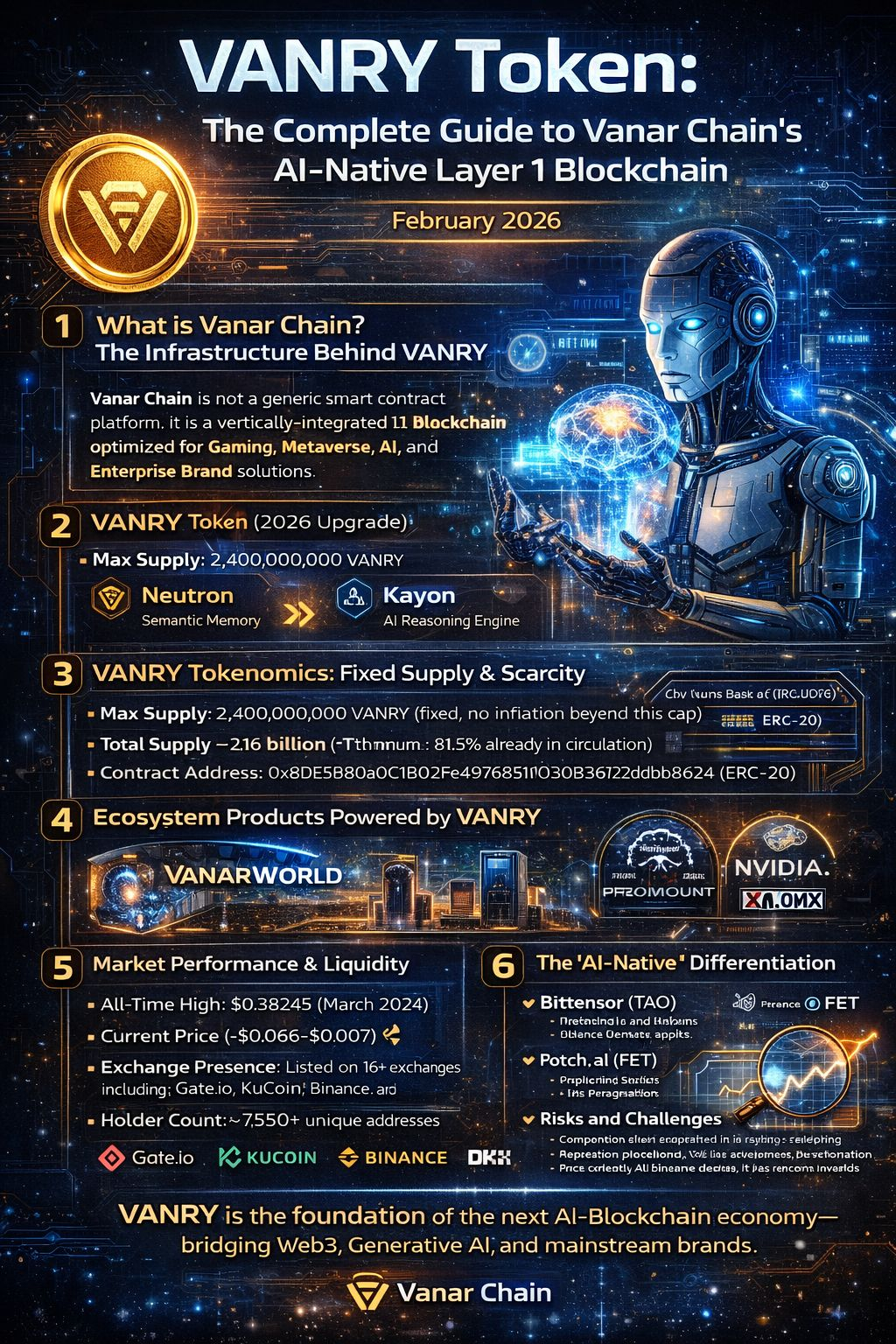

1. What is Vanar Chain? The Infrastructure Behind VANRY

Vanar Chain is not a generic smart contract platform; it is a vertically-integrated L1 blockchain optimized for Gaming, Metaverse, AI, and Enterprise Brand solutions . Unlike general-purpose chains, Vanar is designed to onboard the “next 3 billion users” by offering fixed, predictable costs and tools tailored for non-crypto-native brands .

The “Vanar Stack” (2026 Upgrade):

· Neutron (Semantic Memory): An AI-powered storage layer compressing data up to 500:1, storing files (contracts, deeds) as on-chain “Seeds” .

· Kayon (AI Reasoning Engine): Allows smart contracts to read and execute logic based on stored data (e.g., automatic payment upon invoice verification) .

· Consensus: Delegated Proof of Stake (dPoS) combined with Proof of Reputation (PoR) , ensuring sub-3-second block times and energy efficiency via Google Cloud carbon-neutral infrastructure .

2. VANRY Tokenomics: Fixed Supply & Scarcity

As of January 2026, VANRY operates under a deflationary-conscious model with a hard cap.

· Max Supply: 2,400,000,000 VANRY (fixed, no inflation beyond this cap) .

· Total Supply: ~2.16 billion.

· Circulating Supply: ~1.96 billion (approx. 81.5% already in circulation) .

· Contract Address (Ethereum): 0x8DE5B80a0C1B02Fe4976851D030B36122dbb8624 (ERC-20) .

Note: Historical data showing 1.3B circulating supply (2024) is outdated; the project has matured through its vesting schedule .

3. Core Utility: What is VANRY Used For?

VANRY is a “utility-plus” asset with expanding use cases beyond simple gas fees:

A. Network Fuel & Micro-Transactions

· Fixed gas fee of $0.0005 per transaction, enabling high-frequency gaming and AI queries .

B. AI Subscription & “Burn” Mechanism (New for 2026)

· Starting Q1 2026, access to Neutron/Kayon premium AI tools requires VANRY.

· Fees collected are subject to a buy-back-and-burn mechanism, creating deflationary pressure correlated with AI adoption .

C. Staking & Network Security

· Holders stake VANRY to become validators or delegators, earning block rewards while securing the dPoS/PoR network .

D. Governance

· Staked VANRY grants voting rights on protocol upgrades and treasury allocation by the Vanar Foundation .

E. Metaverse & NFT Commerce

· Primary currency for Vanar Marketplace: buying land, avatars, and event tickets in Vanar World (metaverse) .

· Powers VGN (Vanar Games Network) for in-game asset tokenization and play-to-earn rewards .

4. Ecosystem Products Powered by VANRY

Vanar is not a whitepaper project; it has live, revenue-generating products:

· Vanar World: A high-fidelity metaverse competing with The Sandbox, featuring partnerships with Paramount and Legendary Entertainment .

· Vanar ID: A decentralized Web3 identity system unifying assets and reputation across the ecosystem .

· Vanar ECO: Sustainability tracking for ESG-conscious brands .

· Vanar SDK: No-code/low-code builder tools for third-party developers .

5. Market Performance & Liquidity

· All-Time High: $0.38245 (March 2024) .

· Current Price (Feb 2026): ~$0.006–$0.007 (reflective of broad market corrections and L1 sector competition) .

· Exchange Presence: Listed on 16+ exchanges including Binance etc

· Holder Count: ~7,550+ unique addresses .

6. The “AI-Native” Differentiation

Why does VANRY matter in a crowded L1 market?

· Vs. Bittensor (TAO): TAO is a marketplace for AI models; Vanar is the hosting layer for consumer-facing AI dApps.

· Vs. Fetch.ai (FET): Fetch focuses on autonomous agents; Vanar provides the storage+reasoning infrastructure.

· Key Advantage: Full EVM compatibility – Ethereum developers can migrate existing dApps and instantly access AI tooling without learning new languages .

7. Risks and Challenges

While technologically advanced, $VANRY faces:

· Competition: From established L1s (Solana, Avalanche) and specialized AI chains.

· Regulatory Uncertainty: Variable compliance landscapes for AI and blockchain integration .

· Price Volatility: Despite utility, VANRY has experienced 93% drawdown from ATH, common in growth-stage L1s .

Conclusion

VANRY has successfully transitioned from a gaming/metaverse token to a foundational infrastructure asset for the AI-blockchain economy. Its fixed low fees, on-chain data storage, and upcoming AI subscription model provide structural demand drivers rarely seen in micro-cap L1s. For developers and long-term ecosystem participants, VANRY offers direct exposure to the convergence of Web3, Generative AI, and mainstream brand adoption. #vanar