Most crypto discussions around stablecoins revolve around a single question:

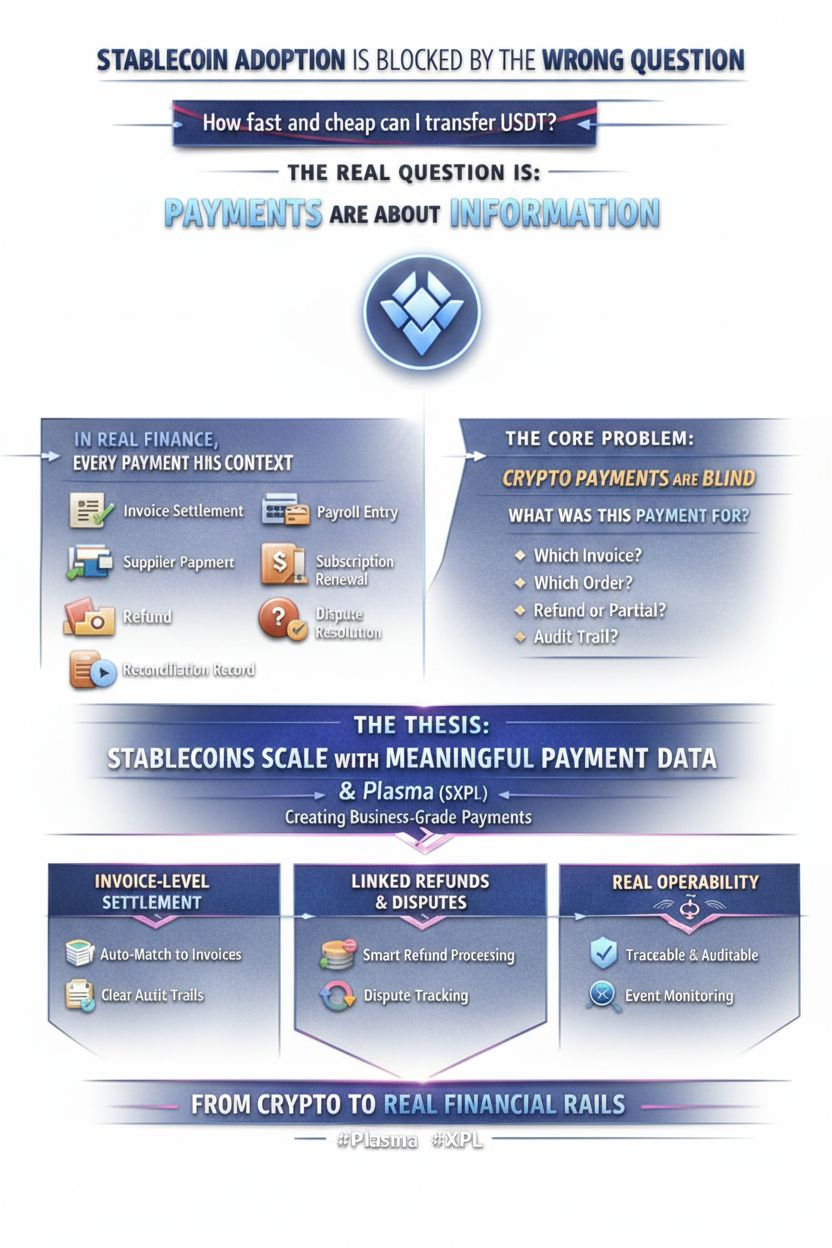

How fast and how cheaply can I transfer USDT?

Plasma ($XPL) already sits comfortably within that narrative—

zero-fee transfers, a coin-first architecture, and a clear move toward real-world payment rails.

But real adoption depends on something far more fundamental, and it receives almost no attention:

Payments are not just about value. Payments are about information.

In Real Finance, There Is No Such Thing as “Just a Payment”

In traditional financial systems, every payment has context.

It is always something:

an invoice settlement

a payroll entry

a supplier payment

a subscription renewal

a refund

a dispute resolution

a reconciliation record

Banks and payment networks dominate business money not because they are fast, but because they carry structured, end-to-end payment data that finance teams can reconcile, audit, and trust.

The Core Problem: Crypto Payments Are Blind

In crypto, a transfer typically records only one fact:

A sent money to B.

But businesses don’t ask if money moved.

They ask:

What invoice did this settle?

Which order was paid?

Was this a partial payment or a refund?

Which contract or tax record does this belong to?

A marketplace with 10,000 sellers doesn’t need 10,000 transfers.

It needs 10,000 transfers mapped cleanly to orders, fees, refunds, and adjustments.

Without structured meaning, humans must manually trace payments—and humans do not scale.

The Thesis: Stablecoins Scale When Payments Are No Longer Blind

The future of stablecoins is not just faster settlement.

It is payments that carry meaning.

This is where Plasma has the opportunity to compete decisively.

If Plasma treats payment data as a first-class primitive—rather than an afterthought—it can turn stablecoin transfers into modern, business-grade payments that companies can actually run on.

Why Payment Standards Exist: The Data Layer

Traditional payment systems became “boring” for a reason—and that boring part is the point.

Messaging standards were created so payments could carry structured, machine-readable information end-to-end. This enables:

automatic invoice matching

reconciliation without human intervention

auditability and traceability

fewer operational exceptions

Finance teams are not afraid of fees.

They are afraid of exceptions—because exceptions create spreadsheets, tickets, delays, and manual labor.

Institutional Adoption Requires More Than “It Works”

Plasma is positioning itself as infrastructure for institutions and payment companies.

That raises a different set of questions:

Can I reconcile it?

Can I audit it?

Can I trace it end-to-end?

Can I explain it to compliance?

Can it scale without edge-case chaos?

A payment rail that cannot answer these questions will never be trusted at scale.

Invoice-Level Stablecoin Settlement Changes Everything

Global trade runs on invoices.

Companies do not pay because they want to send money.

They pay because an invoice must be cleared.

Invoices include identifiers, dates, line items, partial payments, and adjustments.

Now imagine stablecoin payments that are invoice-native by design—not sloppy memo fields, but structured, system-readable data.

businesses auto-match payments to invoices

suppliers instantly know what was paid

support teams trace payments to checkouts

auditors verify flows against obligations

This is not hype.

This is stablecoins reaching operational adulthood.

Refunds, Disputes, and Operability

Refunds are not just reverse payments.

They are linked events tied to original purchases, policies, and timelines.

A properly designed stablecoin rail treats refunds as first-class payments, not exceptions—making commerce safer without recreating chargeback chaos.

The same applies to operability.

Serious payment systems are observable:

trace IDs

event logs

anomaly detection

incident response

If Plasma combines structured payment data with real operability, it becomes something rare in crypto:

a settlement network that operations teams can actually run.

Why This Matters to Everyday Users Too

This is not just a B2B story.

Better payment data means:

clear receipts

transparent refunds

fewer “where is my money?” moments

fewer support tickets

less fear

This is the secret of fintech UX.

Users never see reconciliation systems—but they feel the smoothness those systems create.

Stablecoins become real money when they carry real payment data.

Value is only half the story.

Meaning is the other half.

If Plasma makes structured payment data a first-class citizen, it stops being just a chain.

It becomes the bridge between crypto settlement and real business operations.

You don’t just get faster money.

You get money businesses can actually run on.

That is how stablecoins move from crypto rails to real financial rails.