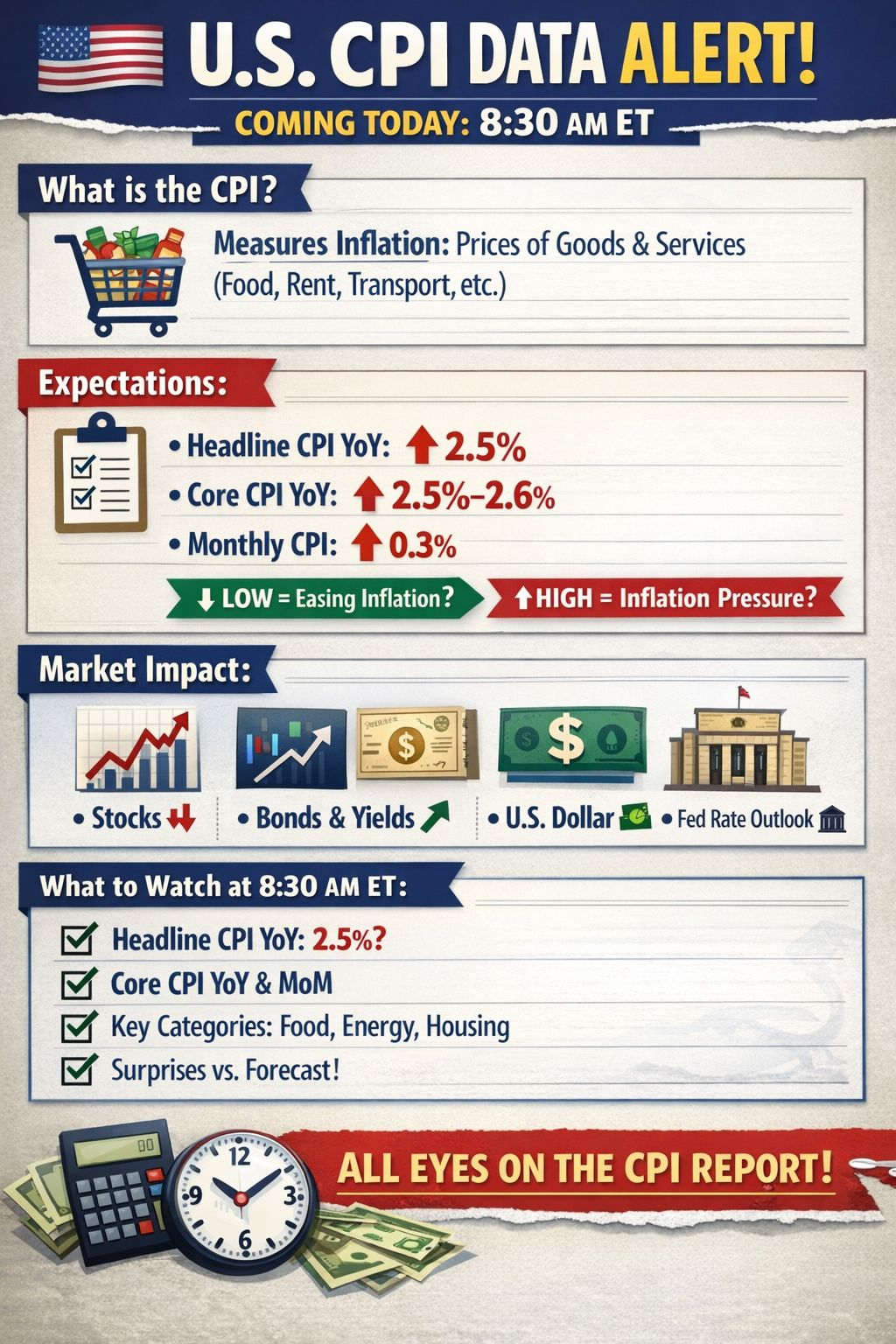

Here’s a full, detailed reminder + explanation ahead of the 🇺🇸 U.S. Consumer Price Index (CPI) release today:

Binance

Capitol Skyline

CPI Day at 8:30am ET Why Today’s 2.5% Inflation Print Could Move Every Market You Care About

Gold Prices Rise Before US Inflation Data – Markets Await CPI Release

Yesterday

Yesterday

📊 1) 📅 Release Timing

U.S. CPI for January 2026 is being released today at 8:30 a.m. Eastern Time (ET) — that’s 5:30 p.m. Pakistan Standard Time (PKT) today. �

marketpulse.com

📈 2) 📌 What the CPI Is

The Consumer Price Index (CPI) is the U.S. government’s main monthly inflation gauge. It measures the average change in prices consumers pay for a basket of goods & services — everything from food and rent to transportation and medical care. �

bls.gov +1

📊 The CPI report includes:

Headline CPI — overall inflation.

Core CPI — excludes food & energy (less volatile).

Month-over-month (MoM) and Year-over-year (YoY) readings. �

bls.gov

The Bureau of Labor Statistics (BLS) compiles this data from thousands of prices across the U.S. each month. �

bls.gov

📊 3) 📉 Consensus Expectations

Before today’s release, economists and market consensus were roughly expecting:

✔️ Headline CPI YoY: ~2.5%

✔️ Headline CPI MoM: ~0.3%

✔️ Core CPI YoY: ~2.5%–2.6%

✔️ Core CPI MoM: ~0.3%

These expectations are widely quoted ahead of the print. �

Why that matters:

Lower than expected = suggests inflation is cooling → may boost risk assets and strengthen expectations for future Fed rate cuts.

Higher than expected = indicates inflation pressure remains → could support the U.S. dollar, raise bond yields and potentially delay market expectations for easier Fed policy. �

Binance

💡 4) 🧠 Financial Market Relevance

The CPI is one of the most market-moving economic releases each month, impacting:

📊 Equities (stocks) — direction may shift with inflation surprises.

📈 Bonds & yields — inflation drives yield expectations.

💵 USD exchange rates — inflation outlook affects currency strength.

🏦 Federal Reserve policy expectations — plays a key role in rate decisions. �

Binance +1

Ahead of today’s release, markets have shown positioning moves — for example, gold prices rising as traders hedge ahead of inflation data. �

Capitol Skyline

🧾 5) 📌 Summary Checklist Before 8:30 am ET

What traders and analysts will watch:

✔️ Headline CPI YoY (expected ~2.5%)

✔️ Core CPI YoY & MoM (expected ~2.5% & ~0.3%)

✔️ MoM inflation in key categories (housing, energy, food)

✔️ How the data compares to expectations — the “surprise” moves markets

If you want, I can break down each CPI component (food, energy, shelter, etc.) and how they typically influence the headline vs. core inflation — just let me know!