Overview — Buy Zones

In SMC, Buy Zone is not a cheap price area.

Buy Zone is where: The organization has previously placed large positions and has reasons to defend that position when price returns.

Standard SMC thought order:

- Identify market structure (Market Structure): HH – HL or LH – LL.

- Identify BOS / CHoCH (breaking structure).

- Find the price area that creates that structure break → that is the Buy Zone.

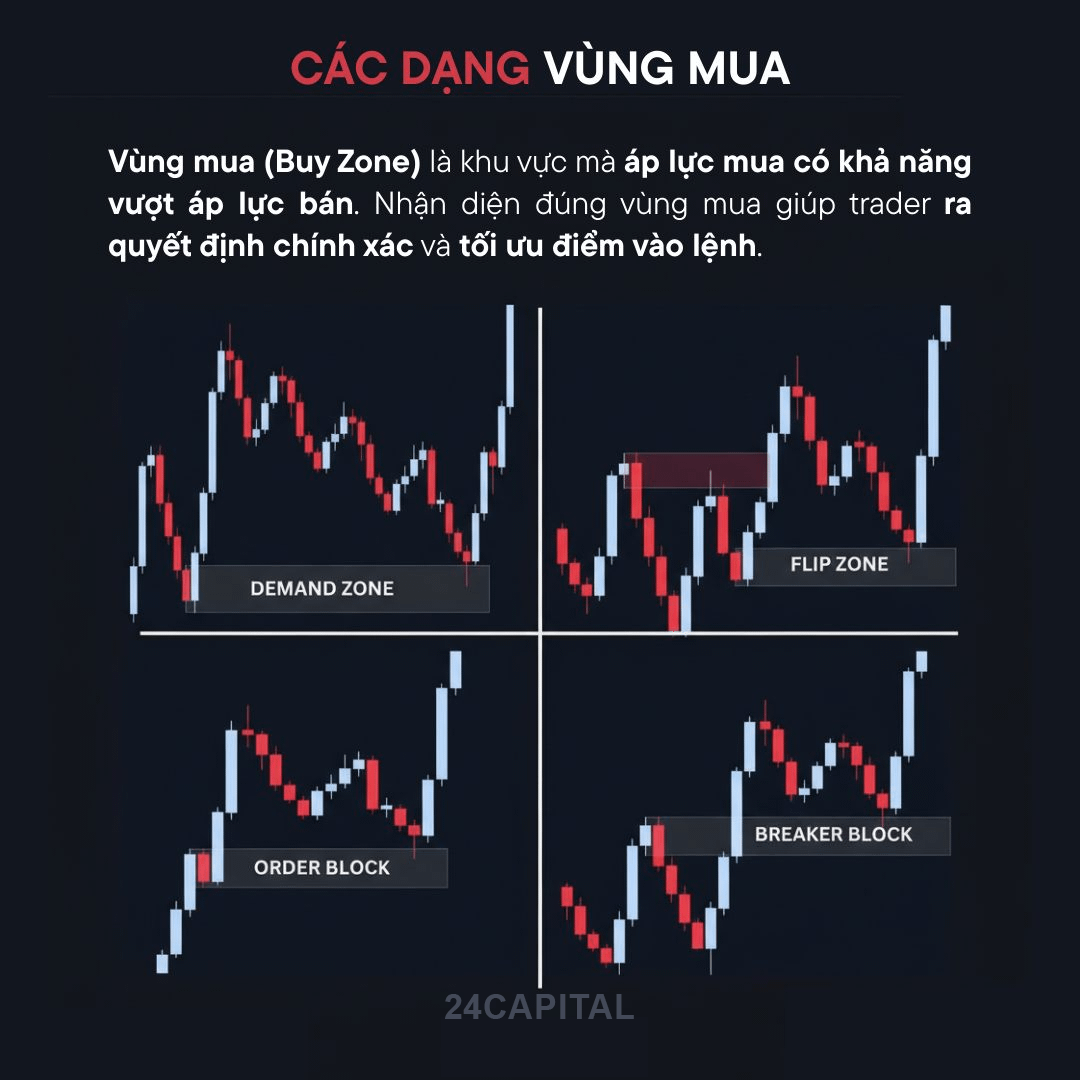

Four core types of Buy Zones:

- Demand Zone

- Order Block

- Breaker Block

- Flip Zone

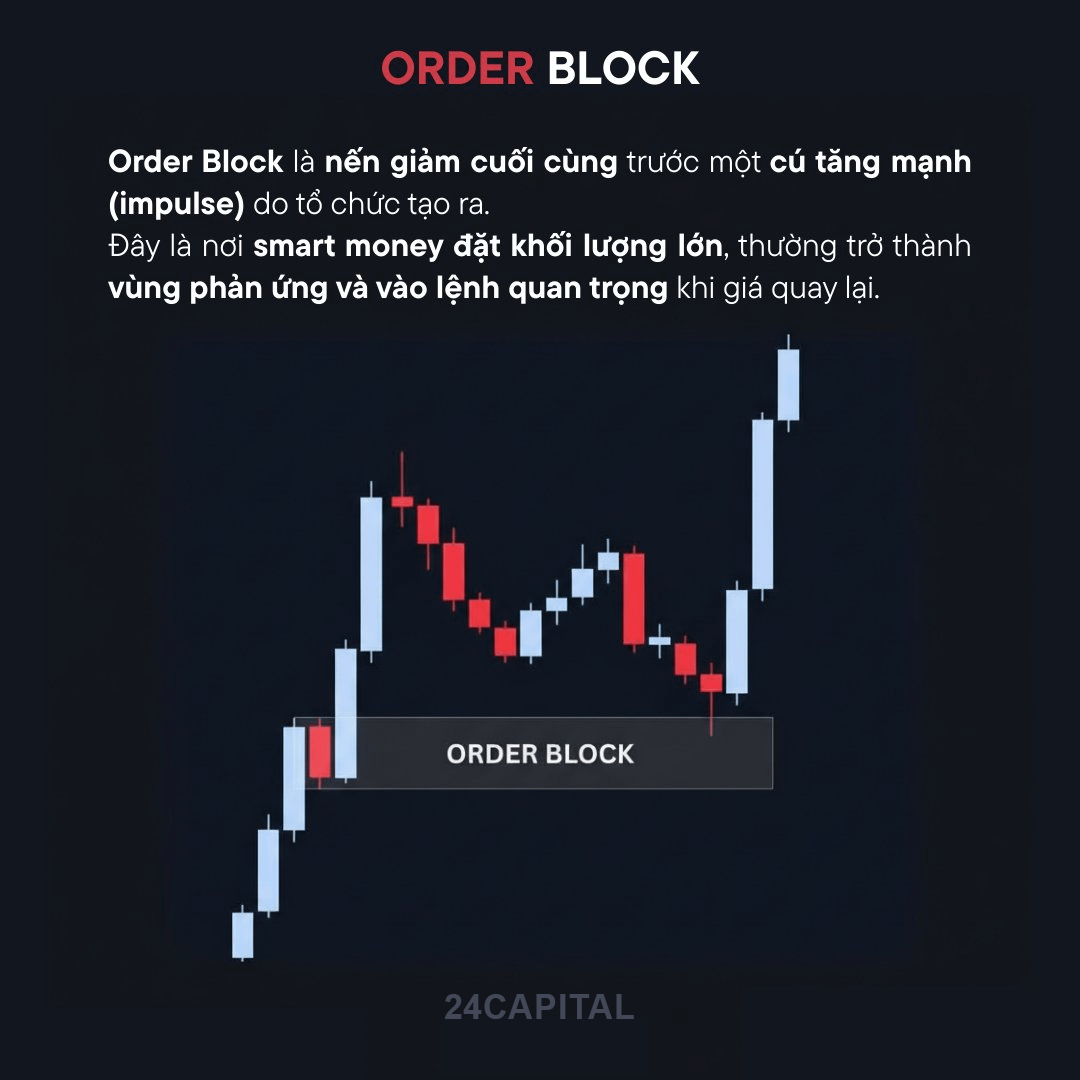

Order Block — Entry signal

Order Block is the last candle against the trend before the market creates an impulsive move breaking structure (BOS).

This indicates:

- Before breaking structure, the organization had accumulated positions at that candle.

- The impulse afterward is the result of large volume that was entered beforehand.

Conditions for a 'standard' OB

- After OB there must be a clear BOS.

- Impulse leaving OB must be strong and decisive.

- OB is at the starting point of displacement.

Entry logic

When price returns to OB: The organization tends to defend the price area that has entered.

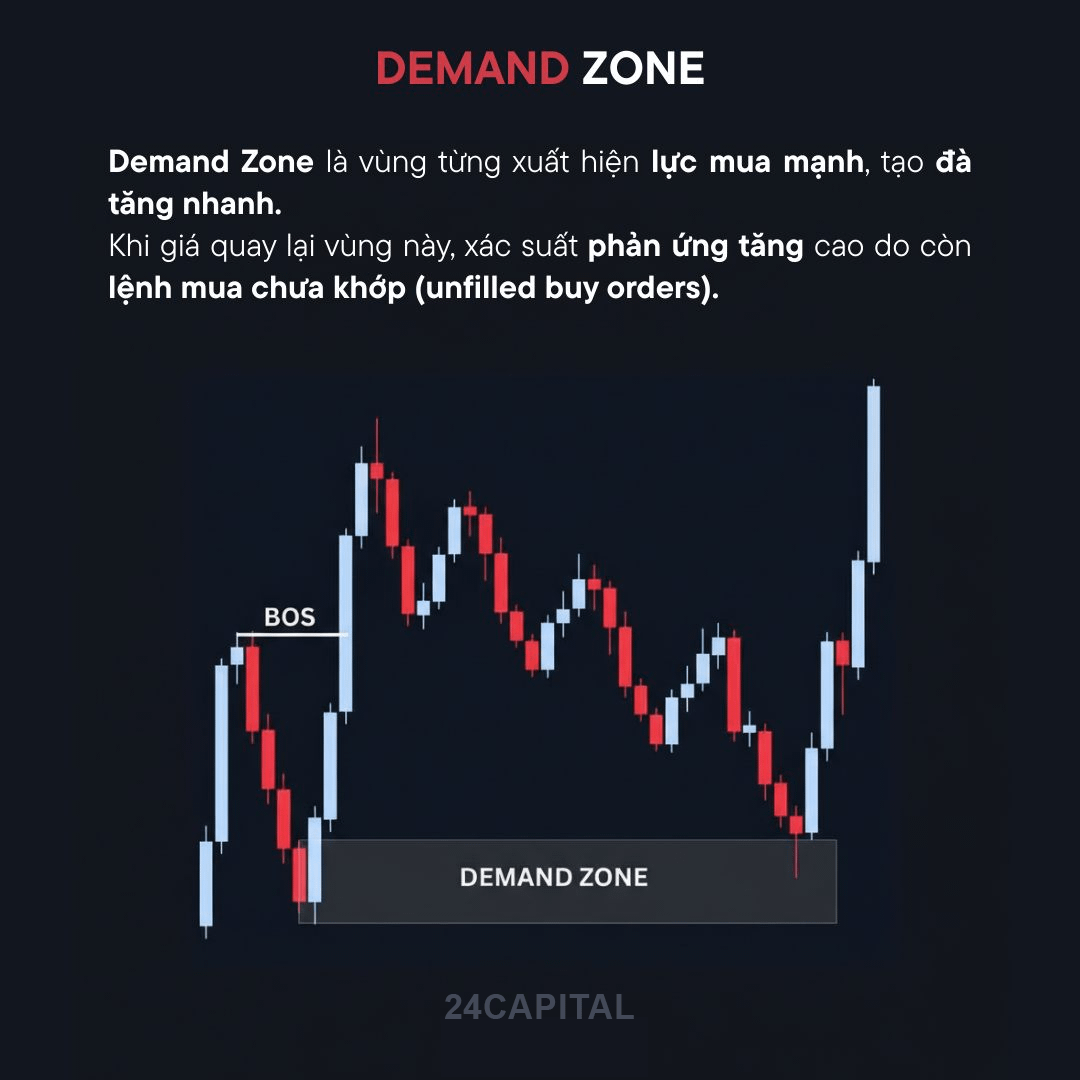

Demand Zone — Demand area from price imbalance (Imbalance)

Different from OB

Demand Zone focuses on: Price area that creates supply and demand imbalance (imbalance / displacement)

Not necessarily a specific candle like OB.

Identification characteristics

- Price leaves the area with strong displacement.

- May leave FVG (Fair Value Gap).

- There is usually a BOS beforehand.

Nature of cash flow

When price moves away too quickly:

A portion of the buy order has not been fully matched.

When price returns → the remaining order is activated.

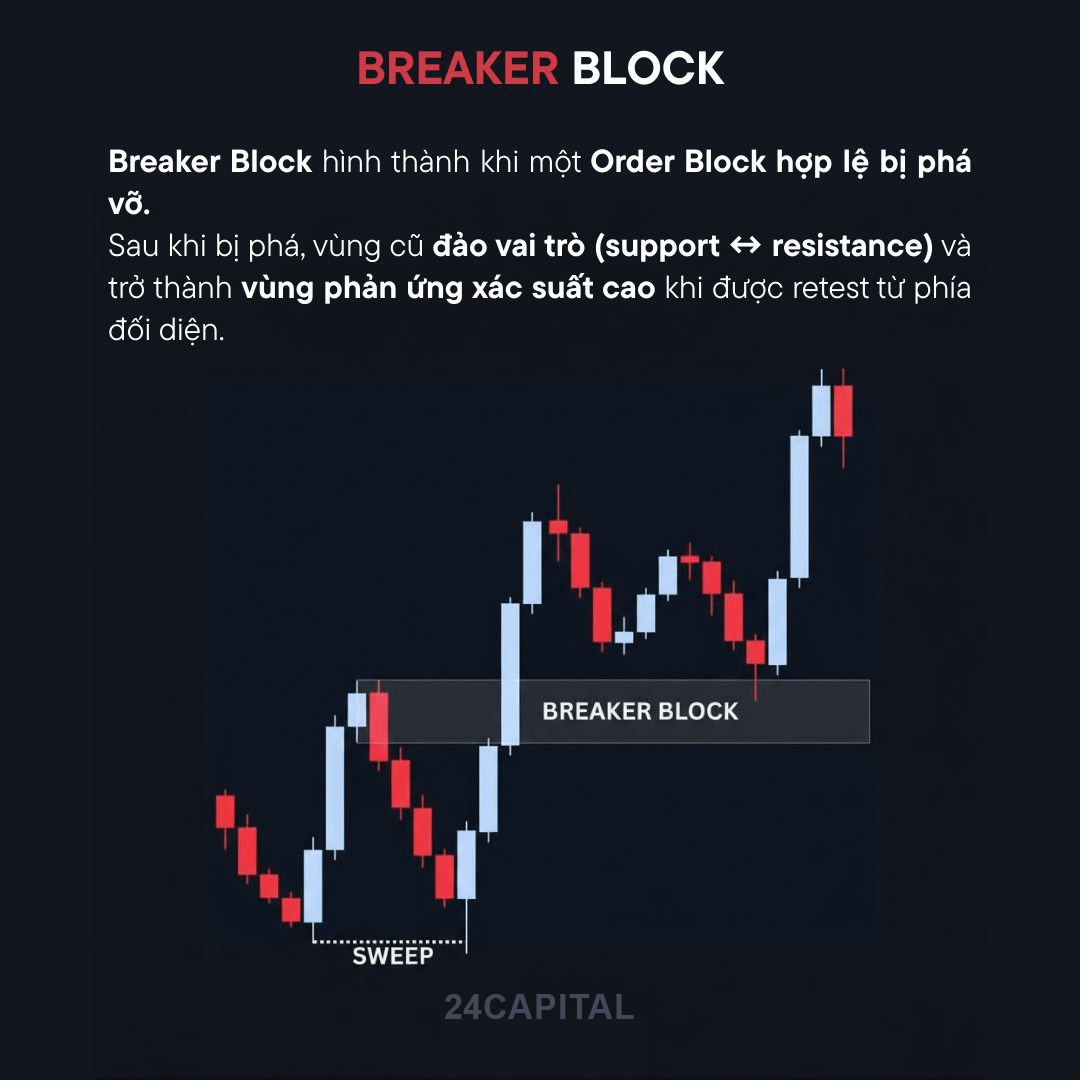

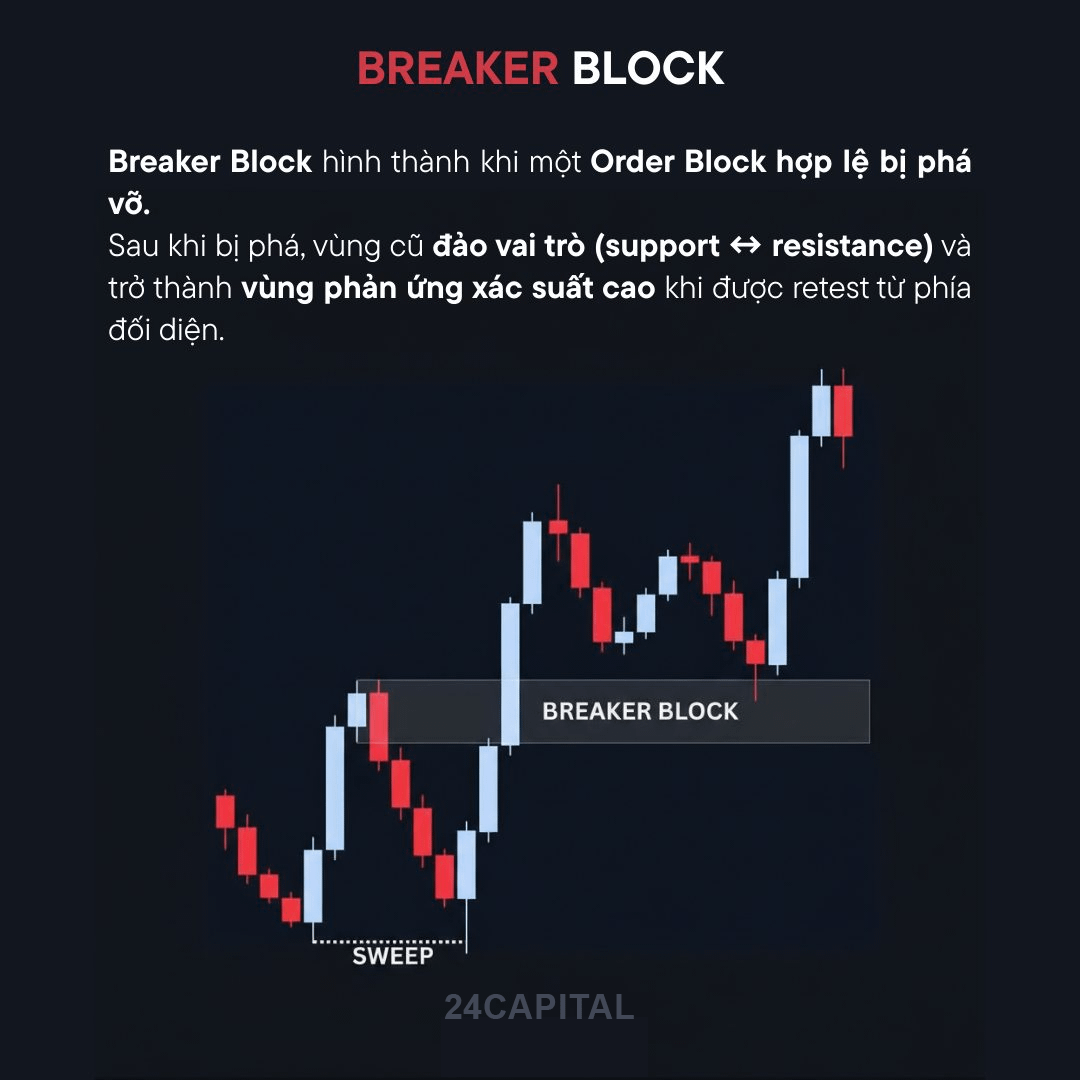

Breaker Block — When Order Block fails

Logic behind

Breaker forms when:

- Initial OB does not hold the price.

- Price sweeps liquidity through OB.

- Then returns to retest from the opposite side.

What does this say?

- The old OB has been used by the organization as a liquidity trap.

- That area now becomes a new entry point in the opposite direction.

Support >< Resistance flip according to liquidity logic.

Flip Zone — Sign of change in market control

Flip Zone always comes with:

- BOS or CHoCH

- Change from HH-HL → LH-LL or vice versa.

Meaning

The price area used to be:

- Support → now becomes resistance

- Resistance → now becomes support

This represents:

Control has switched sides (buyers vs sellers).

Application

Flip Zone is very strong for:

- Continuation trend orders

- Or confirmation points for reversal after CHoCH.