Since the beginning of this year, the volatility in financial markets has never ceased. After quickly retracing from a historic high, the S&P 500 index, Bitcoin repeatedly testing key resistance amid controversy, and gold quietly breaking through historical highs. Is there a common logical clue behind these seemingly isolated market movements? Professional investors are confronted not only with price fluctuations but also with the deeper mechanisms and narrative changes driving these fluctuations.

I. U.S. Stocks: The Game of Technical Patterns and Liquidity

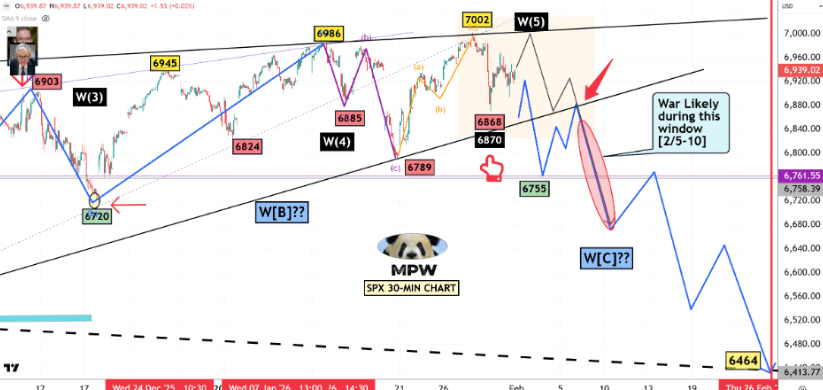

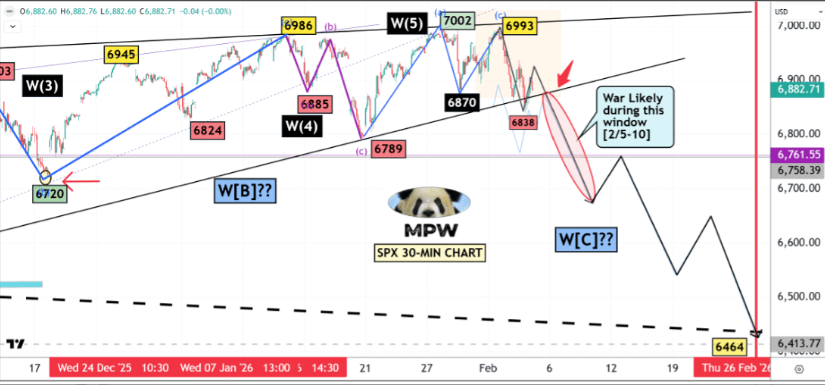

January 31, the S&P 500 index presented a typical 'distribution pattern' on the 30-minute chart - despite a gap down in the overnight session, the market resiliently rebounded close to the previous high, but the subsequent straight drop exceeded 110 points, exposing the fragility of the internal structure. This trend highly aligns with the 'black path' proposed in the (swing market research report): the index is advancing towards the 6464-point area in late February to digest the monthly level overbought RSI readings.

Key observation points:

The market attempts to 'shake off the shorts and induce latecomer longs,' which is a typical psychological game during the top formation period

When RSI divergence reaches a significant level, it usually indicates that subsequent volatility will intensify

The coincidence of time windows and astrological cycle events increases the narrative tension for market turning points

The combination of this technical analysis and market psychology reveals the dilemma faced by professional investors in the current environment: they must respect the information conveyed by the charts while being wary of the market exploiting these consensus expectations for reverse operations.

Two, cryptocurrency: when purchasing power is no longer a linear consumption

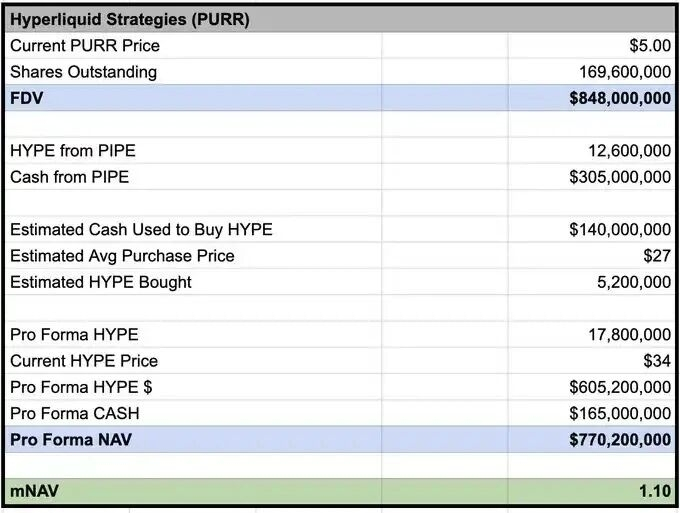

In the field of cryptocurrency, a more subtle mechanism revolution is taking place. Digital asset treasury companies (DAT), represented by PURR (formerly Hyperliquid Strategies), are redefining the traditional definition of 'purchasing power.'

Traditional cognition: Investors see PURR as a 'wallet with a balance,' and its ability to purchase HYPE depends on the remaining cash size.

Mechanism truth: through the ATM (At-The-Market) issuance mechanism disclosed in the S-1 filing, PURR can gradually issue new shares in the public market when mNAV (market value to net asset ratio) is at a premium, pricing based on VWAP (volume-weighted average price) rather than the latest transaction price.

What does this mean:

Purchasing power can dynamically expand with transaction volume: if daily trading volume remains at $42 million, PURR can theoretically add about $8 million of 'firepower' daily

Incentive mechanisms change: maintaining strong momentum for HYPE → increasing PURR transaction volume → expanding ATM issuance capacity → obtaining more funds to purchase HYPE

The possibility of forming a positive cycle: this is fundamentally different from the 'one-time consumption' model of traditional PIPE financing

Deeper insights:

Most DAT failures stem from structural defects: discounted OTC issuance, short unlocking periods, lack of endogenous returns from underlying assets, inflationary supply. The HYPE-PURR structure avoids these traps:

Protocol revenue transforms into demand for HYPE

Supply shows deflationary characteristics in use cases

No significant unlocking of positions creates selling pressure

This is no longer a simple 'pump-and-dump' game, but a kind of capital mechanism innovation. When traditional finance truly understands this 'barbell structure,' it may trigger more extreme valuation re-evaluations—referencing historical performances of MSTR (3.3× mNAV), Metaplanet (8.3×), and BMNR (5.6×).

Three, gold: the modern dilemma of millennial value storage

Gold reaches a historical high in 2025, driven by the interplay of two forces:

Structural drivers:

Financialization popularization: Gold ETFs (like GLD, IAU) make it easy for retail and institutional investors to hold gold exposure, eliminating the security and liquidity barriers of physical gold

De-dollarization accelerates: After the 2022 Russia-Ukraine conflict, the 'weaponization' of the dollar prompts central banks in various countries to diversify reserves, with gold becoming the natural choice

Reality check:

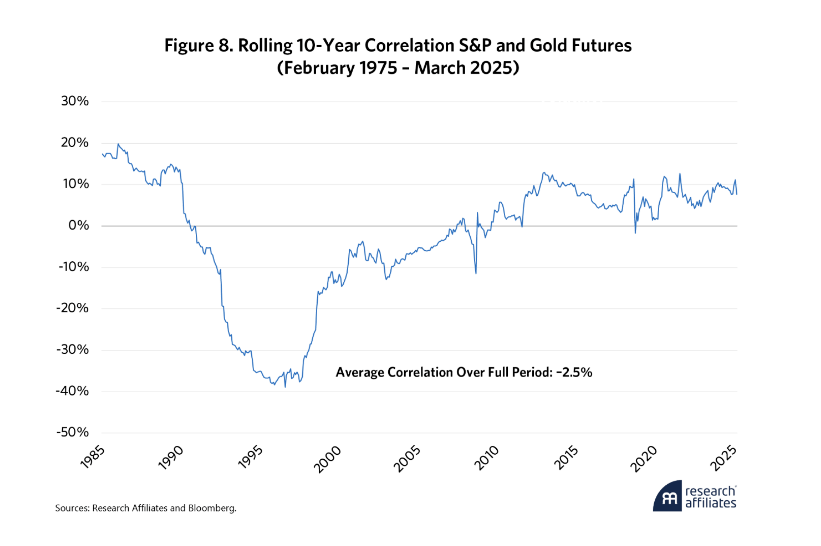

Inflation hedge? Not necessarily reliable: gold volatility (about 15%) is far higher than inflation volatility (less than 2%), using high-volatility assets to hedge low-volatility variables yields unstable results

Crisis protection? Performance varies: in the 11 major pullbacks of the S&P 500, gold rose 8 times and fell 3 times but with smaller declines than the index; during 4 recessions, gold had positive returns 3 times

"Gold dilemma": current real gold prices are at historical highs, while historical data shows that high price levels often correspond to lower returns over the next decade

Key contradiction:

Either this time is really different—de-dollarization is a permanent structural change, and gold enters a new mechanism; or mean reversion will eventually happen. Buffett's criticism of gold remains valid: gold 'is not very practical and will not reproduce,' but its low correlation (less than 10% with the S&P 500) still makes it an alternative in defensive asset baskets.

Four, cross-market perspective: narrative, mechanism, and capital flow

These three seemingly independent markets actually reflect common characteristics of contemporary financial markets:

1. The power of narrative far exceeds fundamentals

US stocks focus on RSI divergence and the self-fulfilling effects of technical patterns

Cryptocurrency builds capital narratives around the DAT mechanism

Gold trading's grand narrative of 'de-dollarization'

2. Capital mechanisms are reshaping the rules of the game

ATM issuance transforms purchasing power from 'fixed balance' to 'dynamic function'

ETFs and other financial tools have changed the liquidity and availability of assets

Derivatives and structured products have created new risk transfer pathways

3. The real challenge for professional investors

Novice investors look for 'trading signals,' while professional investors must understand:

The psychological battle behind the technical patterns of bulls and bears

How capital mechanisms change the price discovery process

Conflicts of driving factors across different time frames (short-term emotions vs. medium-term mechanisms vs. long-term structures)

Five, calm thinking: between the complexity of mechanisms and narrative fanaticism

Faced with these complex intertwined market phenomena, professional investors may need to return to a few basic principles:

1. Distinguishing 'story' from 'mechanism'

Good stories can drive short-term prices, but only sustainable mechanisms can maintain long-term value

When evaluating any asset, ask two questions: how much of this narrative is emotionally driven? What is the mechanism supporting this price?

2. Understanding the time preference of capital

DAT's ATM mechanism essentially discounts future capital potential for current use

Gold trades on the reputation of millennial value storage, but the holding period for investors may be several months

This time frame mismatch creates opportunities while burying risks

3. Finding certainty relationships in uncertainty

The low correlation between gold and the stock market is relatively certain

There is a mechanistic relationship between DAT's mNAV premium and issuance capacity

The self-fulfilling effect of technical patterns often strengthens at critical positions

4. Remain vigilant about 'this time is different'

Whether it's the 'permanent structural change' of gold, the 'entirely new capital mechanism' of cryptocurrency, or the 'this time the top is different' of US stocks, history repeatedly proves that the most dangerous five words are 'this time is different.'

Conclusion: Seeking the unchanging essence within changing mechanisms

Financial markets are always evolving: new trading tools, new capital structures, new narrative frameworks. But some core principles remain unchanged:

Prices ultimately reflect supply and demand, no matter how complex the mechanisms are

Risk and reward are always symmetrical, regardless of how elegantly packaged

Market psychology cycles continuously, no matter how advanced the technology is

The value of professional investors lies not in predicting the next price point, but in understanding:

What kind of narrative and mechanism does the current price reflect?

What vulnerabilities do these narratives and mechanisms have?

When these assumptions are falsified, how will capital reallocate?

In this sense, the technical patterns of US stocks, the DAT mechanisms of cryptocurrency, and the de-dollarization narrative of gold are all different expressions of the same issue: how capital seeks relatively certain placement methods amid uncertainty.

Ultimately, the market will reward those who can distinguish between 'short-term stories' and 'long-term structures,' understand 'mechanism innovation' and 'essential risks.' The current complex situation may be a touchstone for this distinguishing ability.

This article is based on publicly available information and research exchanges and does not constitute any investment advice. The market has risks, and decisions should be made independently. Professional investors should make judgments based on their own research, risk tolerance, and investment objectives.