Review of yesterday: perfectly hit

Casual remarks return to the main topic:

Current price: 2270 USDT, ETH is in a key oscillation zone. Short-term (1H) and medium-term (4H) signals show significant divergence—1H strongly bearish, 4H slightly bullish, forming a typical 'short-term short, long-term long' structure. This is precisely the point of long and short competition that day traders love, with attractive win rates and risk-reward ratios!

1H chart: strong downward trend, short-term short window has opened

Core indicator signals:

ADX = 29.20 (>25, confirming strong trend, and direction is downward)

MACD = -16.01 (continuing death cross, momentum is bearish)

RSI = 49.65 (neutral, but failed to break 50, selling pressure dominant)

Price significantly below VWAP (2622.82), OBV continues to flow out (-1.48 million+)

Bollinger Band position: Price is below the mid-line (upper band 2345 / lower band 2150), potential to test the lower band

Probability assessment: Probability of reaching take profit (2170) is 57.26%, stop loss (2320) is 42.74%

Expected amplitude: Short-term decline of 2.19%, volatility matches the current market

Trading strategy (short sell recommendation):

Entry point: Around 2295.13 (conservative entry within 10-30 minutes of high volatility)

Take profit level: 2170.66 (main target)

Stop loss level: 2320.03 (strict control)

Position building: First position 20%, if it breaks EMA50 (2305) can add 10-30%

Reduce position: 2190.58 reduce by 30% (within 1-2 hours, or MACD golden cross exit early)

Position suggestion: Hold until take profit or OBV reversal signal, foresee mid-term target of 2220

Reward-risk ratio: 2.00:1

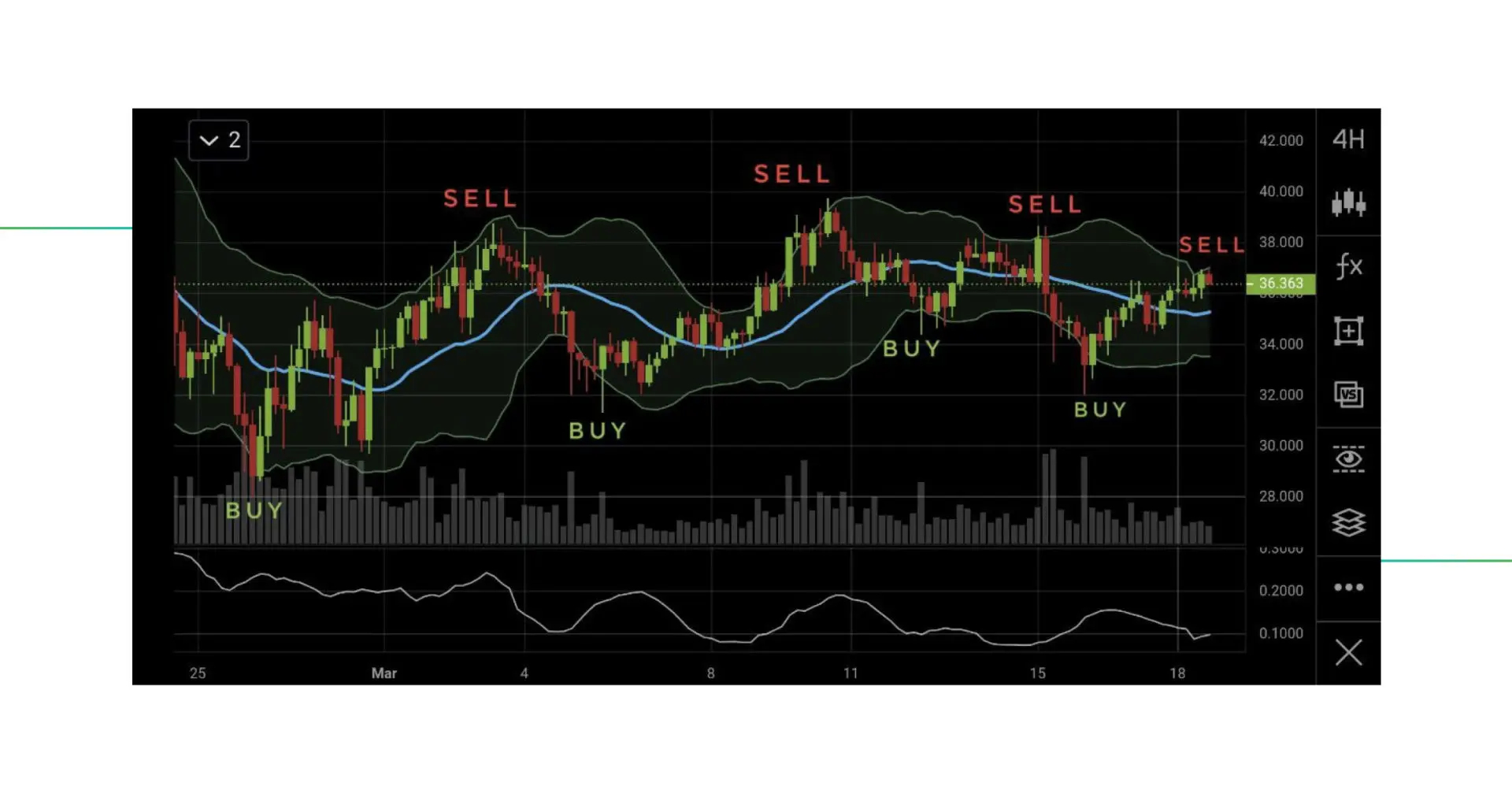

4H chart: Upward structure not broken, mid-line rebound probability higher

Core indicator signal: ADX still at 29.20 confirms trend strength, but MACD and OBV show signs of capital inflow, price consolidating near the mid-line

Probability assessment: Probability of reaching take profit (2370) is 66.19%, stop loss (2220) is 33.81%

Expected amplitude: Up 8.77%, more explosive potential

Trading strategy (mid-term long recommendation):

Entry point: Around 2245.56 (buy on pullback, within 10-30 minutes)

Take profit level: 2370.03 (main target)

Stop loss level: 2220.66

Position building: First position 20%, add position upon breaking EMA50 (2305)

Reduce position: 2350.11 reduce by 30% (1-2 hours, or MACD death cross)

Position suggestion: Hold until take profit, expected to reach the mid-term level of 2320 within 4 hours

Reward-risk ratio: 2.00:1

Overall suggestion summary

Aggressive type: Prioritize following 1H short sell, quickly capture 2.19% pullback profit, strictly adhere to stop loss

Conservative type: Wait for 1H bearish release, buy on dips in the 2245-2270 range for 4H long positions, aiming for greater upward space

Risk warning: Strictly control position <2%, combine stop loss + OBV reversal to exit, do not chase long without rebound signals

Current long-short divergence is the best operating window, reward-risk ratio reaches 2:1, worth paying close attention to!

What do you think about this operation? Is it a short sell to take profit or wait for a pullback to enter? Feel free to discuss in the comments! 🚀

#ETH #以太坊ETF批准预期 #日内交易 #美国伊朗对峙