This week, Bitcoin briefly moved under $75,000 and Ethereum neared $2,100. Many altcoins dropped even more sharply. At first glance, it looked like the market was breaking apart.

But when we slow down and study the data, there are clear signs that the worst selling might already be happening — and that a local bottom may be forming.

Let’s walk through the biggest reasons — simple and clear.

1) Most Bitcoin Holders Are Already Losing Money

Right now, a large portion of Bitcoin holders are underwater — meaning they bought higher than current price.

Less than half of all Bitcoin in circulation is sitting in profit today.

This is very important because it tells us that most traders have already taken losses. A lot of selling pressure has already happened.

In the past, when so many holders are in loss, it often marks that the selling cycle is mostly done.

2) Margin Traders Have Been Forced Out

The futures and derivatives markets show that leverage has been washed out.

Funding rates — especially on Ethereum — have been negative for days. That means:

Traders are heavily short

Most people are betting price will fall

Fear is dominating emotion

When almost everyone expects a drop, markets often reverse direction and find a low.

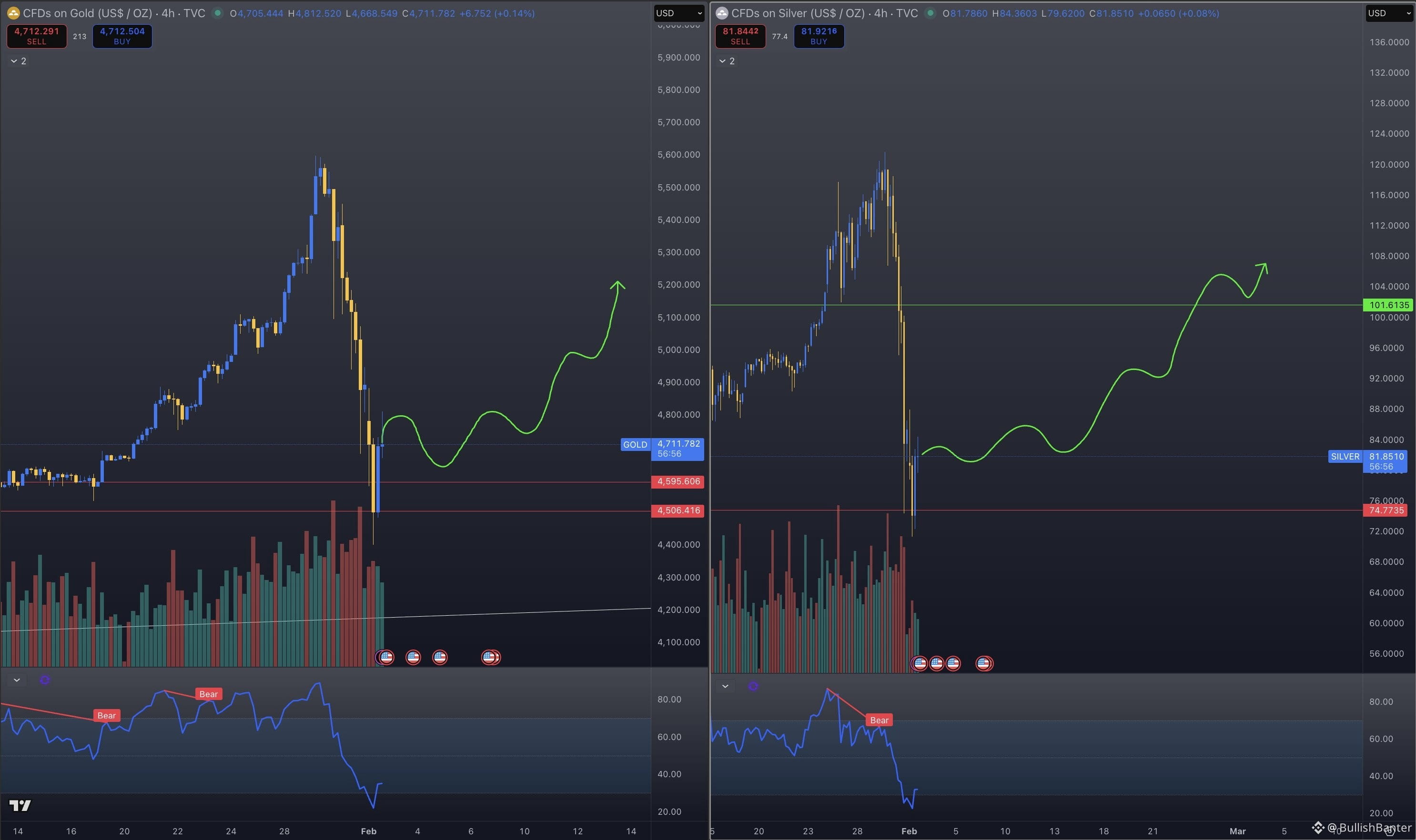

3) Big Institutions Are Quietly Accumulating

Although fear is loud in public, smart money is showing up quietly:

Bitcoin ETFs have received big inflows recently — hundreds of millions in fresh capital.

Large buying funds are adding Bitcoin to their holdings.

Big financial players rarely buy at panic prices unless they see value. This suggests real demand is stepping in at lower levels.

4) The Worst Headlines Have Lost Their Power

In the last few weeks, many scary stories were making rounds. But most of that fear has faded:

Wild rumors didn’t affect prices long

Major companies expected to struggle are still operating

Some large wallets are still accumulating coins

In fact, prominent groups are continuing to buy Ethereum and Bitcoin even after heavy dips.

This is a bullish sign — big players are not surrendering.

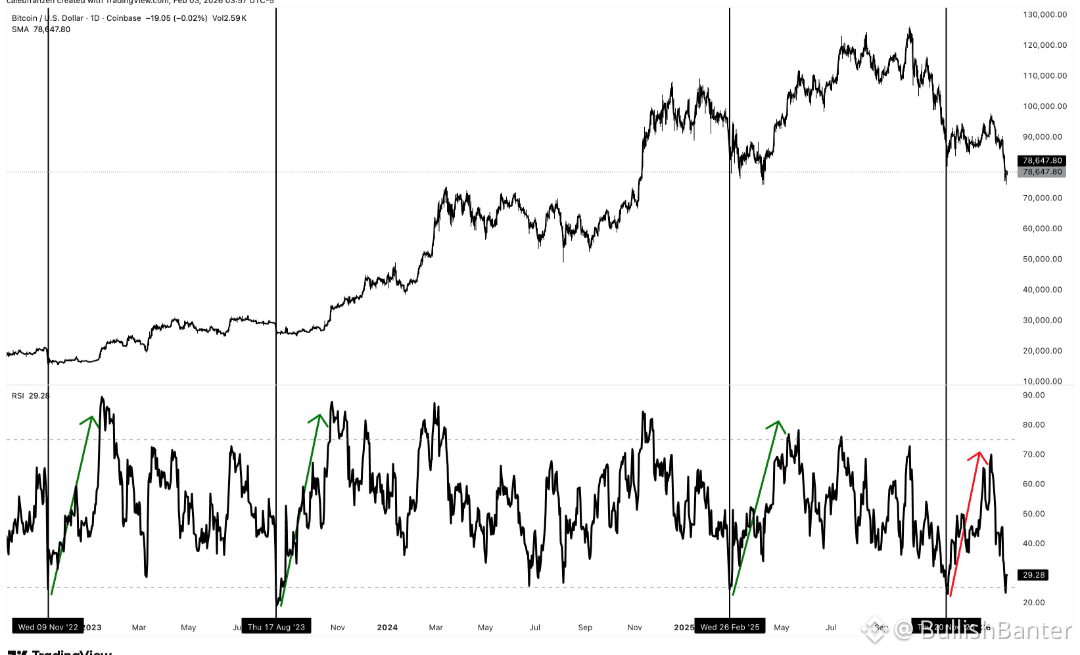

5) Technical Levels Could Spark a Bounce

There is an unfilled CME futures gap near the mid‑$80,000s on Bitcoin.

Historically, Bitcoin tends to revisit and fill these gaps with rallies before continuing other moves.

This means there is a natural price magnet above current levels — which could trigger short covering and relief rallies.

6) Panic Is Often Followed by Opportunity

When fear is loud and everyone expects lower prices, markets often do the opposite.

Right now:

Many holders are at a loss

Shorts are crowded

Funding is negative

Institutions are buying quietly

Large holders are accumulating

Selling pressure has eased

This mix usually shows up near bottoms, not tops.

7) Recent Positive Signals (New Developments)

Crypto exchange balances are decreasing — meaning investors may be moving coins off exchanges to hold long term.

Miner distress selling has cooled — miners are holding more Bitcoin than before.

Regulatory clarity in several countries has improved, reducing uncertainty.

DeFi activity has started to pick up again after weeks of decline.

All of these subtle but meaningful changes suggest buyers are quietly returning.

Conclusion — Simple Summary

Right now:

Many holders are at a loss

Leverage has been flushed

Fear is very strong

Institutions are buying quietly

Long‑term holders are accumulating

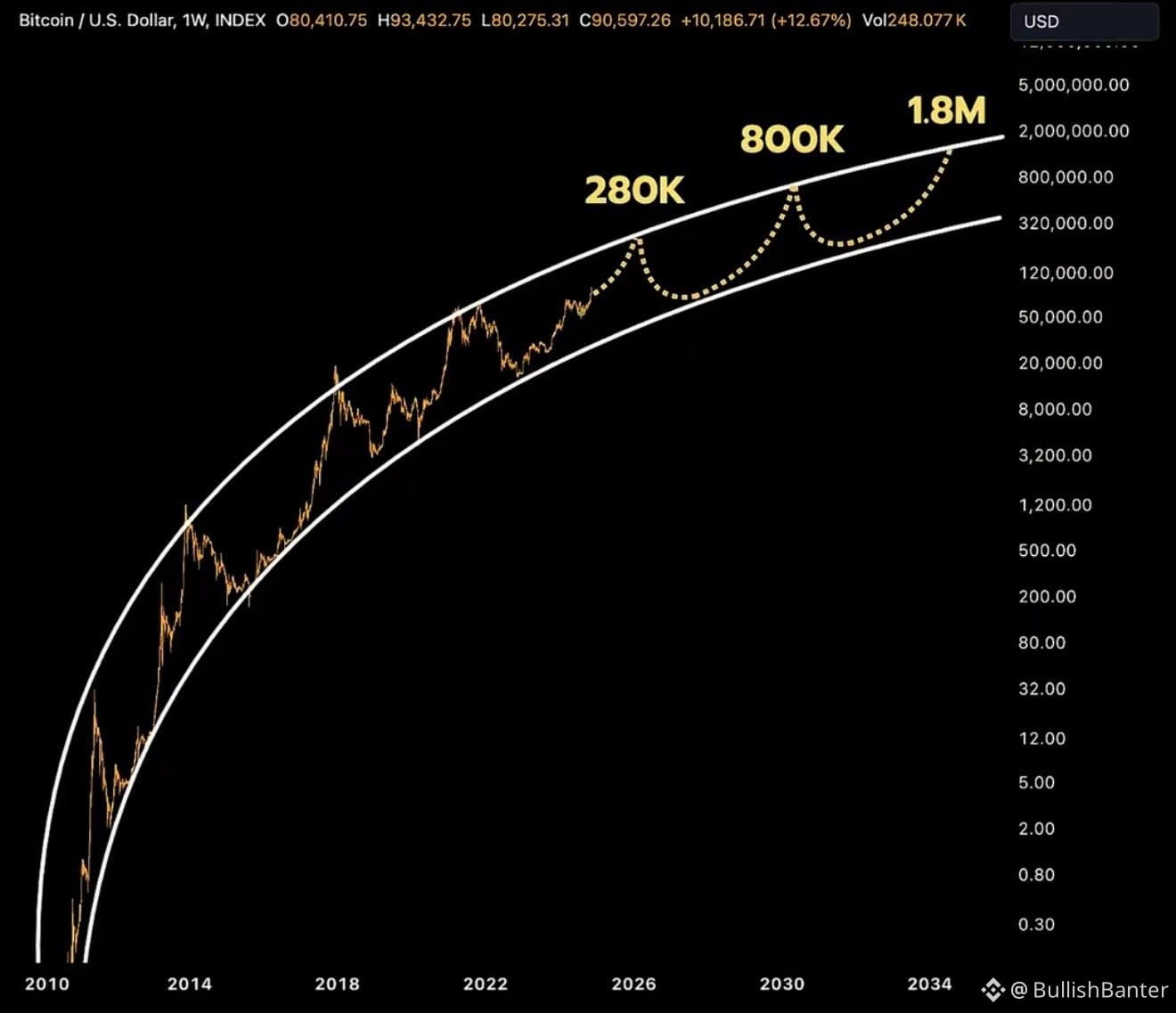

Technical signals point to potential upside

This mix doesn’t usually happen near market tops — it happens near strong local lows.

So while we can’t say the bottom is final, conditions look much more like a turning point than a breakdown.