——To all the crypto believers who hold on to their faith amidst the volatility

1. A Millennium Dialogue Between Gold and Code: From Pharaohs to Blockchain

In 3000 BC, the ancient Egyptians recorded the abundance and scarcity of the Nile with gold bars;

In the 1st century AD, the Roman Senate issued the denarius silver coin anchored in gold;

In 2024, the roar of Bitcoin mining machines and the gold prices on the New York Commodity Exchange will resonate in sync.

Humanity has always been in search of an "immortal value carrier," and gold and chains are writing the same epic history of civilization in two completely different languages.

"Gold is a fragment of the sun, while code is the algorithm of God."

—— A certain anonymous DeFi protocol developer

II. Tear and Mend: When Traditional Value Meets the Digital Revolution

Cracks in the Old Order

Central bank printing presses operate 24 hours, with the dollar depreciating over 80% after the collapse of the Bretton Woods system in 1971

In Venezuela's hyperinflation, citizens use carts to carry banknotes to buy bread

30% of global gold reserves have been politically frozen

Dawn of a New Continent

Bitcoin's capped supply of 21 million vs. 200,000 tons of gold mined by humanity (enough to cover 3 standard football fields)

Ethereum smart contracts enable on-chain division of gold assets (starting from 0.001 grams)

Paxos issued PAXG tokens, each corresponding to LBMA certified gold bars

The essence of this value migration is the dimensionality reduction impact of "absolute scarcity" on "relative credit."

III. On-chain Alchemy: When Gold Gains Cyber Life

1. The shackles of the physical world are dissolving

Traditional gold trading: Cross-border transfers take 3 days + 0.5% fee

On-chain gold: P2P real-time settlement, gas fees as low as $0.01

Case: During the Turkish lira crash in 2023, local users exchanged lira for KAU gold tokens on the Kinesis platform, with daily trading volume surging by 400%

2. Programmable Wealth Freedom

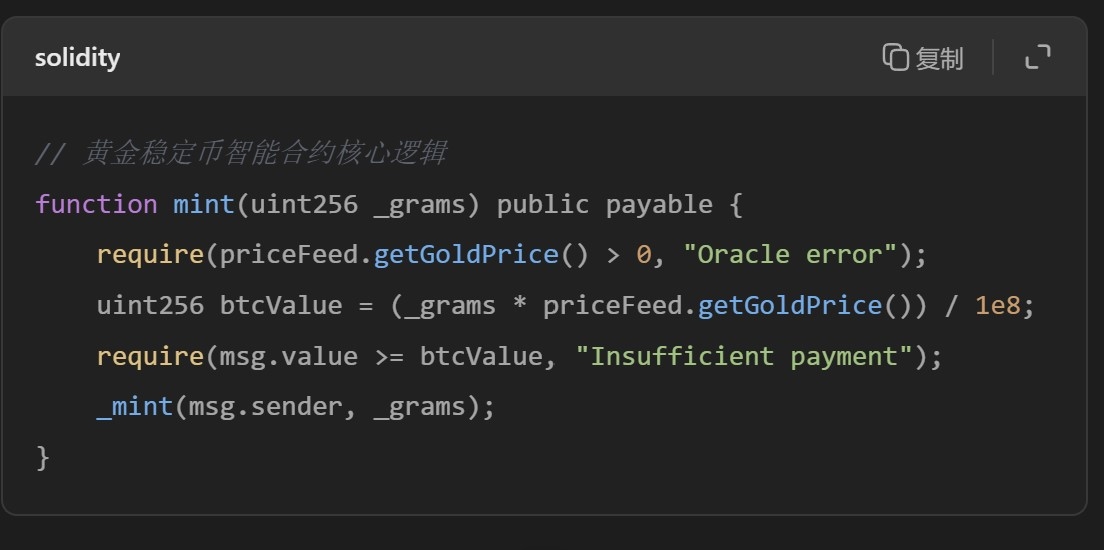

(Note: This code is for conceptual demonstration, not for use in actual production environments)

When Gold Becomes DeFi Building Blocks:

Gold collateral lending: MakerDAO supports wBTC+PAXG dual asset collateral

Yield farm: Yearn Finance launches gold index fund yGOLD

Anti-censorship insurance: Nexus Mutual provides smart contract insurance for on-chain gold

IV. A Song of Ice and Fire: Seeking Certainty Amidst Volatility

Data does not lie

Conclusion: On-chain gold is creating "Risk Hedging 2.0"

When BTC and US stocks rise together, PAXG usually remains flat

When BTC plummets, PAXG averages a counter-cyclical rise of 3.2% (backtesting data from 2020-2023)

V. New Alchemist's Declaration

"We are not here to replace gold, but to equip pieces of the sun with antimatter engines."

—— A certain RWA protocol founder

Three Major Scenarios of the Future

Sovereign wealth funds are entering: Singapore's Temasek tests gold tokenization settlement system

Metaverse hard currency: Decentraland land auction supports ETH+PAXG mixed payment

Quantum-resistant vault: QANplatform stores gold private keys in quantum-resistant computers

VI. To all holders: Lighting a lamp in the fog of value

When the Fed's printing press roars at midnight,

When the K-line chart of exchanges draws an ECG,

Please remember:

The headline of The Times inscribed by Satoshi Nakamoto in the genesis block

The weight of gold recorded by the Sumerians on clay tablets

And at this moment, the string representing on-chain gold in your wallet

They collectively tell a truth:

"True value never fears volatility; it only becomes more brilliant in the furnace of time."

Interaction at the end of the article

👉 Do you think on-chain gold will replace physical gold?

👉 If you were given $1 million, what proportion would you allocate to gold tokens?

Data sources: World Gold Council, CoinGecko, Messari, author's backtesting model

Risk Warning: This article does not constitute investment advice; on-chain gold carries smart contract risks and regulatory uncertainties