The drama in Washington is at its peak. Today, January 30, 2026, the budget comes to an end. If there is no legislative miracle in the next 4 hours and 45 minutes (before midnight EST), the U.S. government will enter official shutdown.

🔴 The Scenario: What's happening?

Unlike other years, the 2026 debate is stalled over funds allocated for border technology and the debt ceiling. While politicians fight, the crypto market observes.

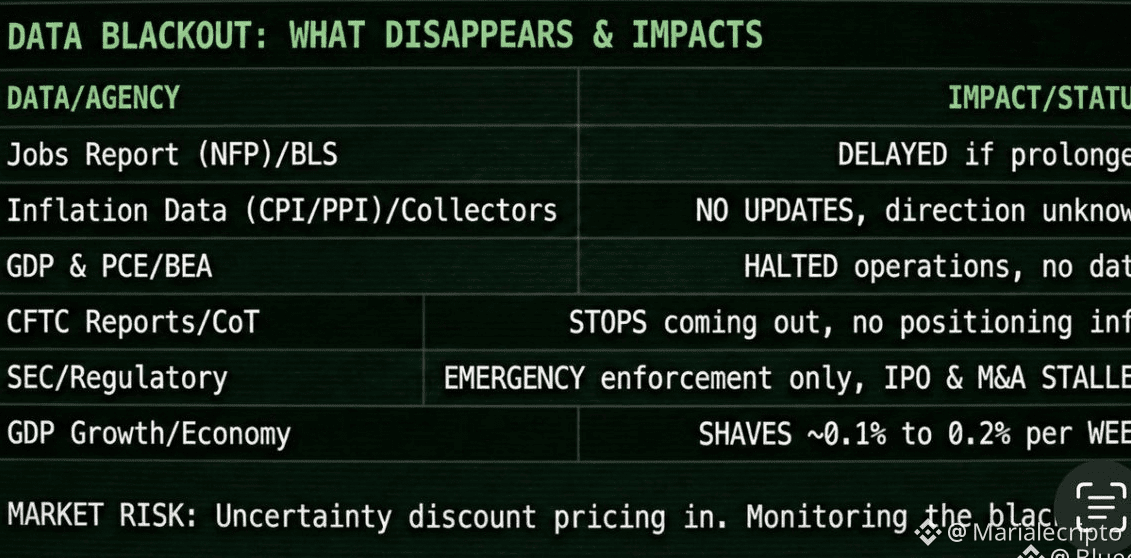

📉 The Impact: What to expect?

1. The Risk (Short Term):

Flight to Cash: The initial panic usually makes traders sell risk assets (like Altcoins) to seek refuge in the DXY (Dollar).

SEC on pause: Resolutions on new staking ETPs could be frozen until the government reopens.

2. The Opportunity (Long Term):

Weakness of Fiat: Whenever the U.S. government shows dysfunctionality, the narrative of Bitcoin as a "Hard Money" asset strengthens.

Liquidity Injection: Closures are usually resolved with agreements that involve printing or moving more money. Historically, Liquidity = Crypto Pump.

📊 Binance Sentiment Analysis

Currently, the market shows tense lateralization. Bitcoin remains in the range of $84,000, awaiting the outcome.

If there is a close: We could see a "flash crash" followed by an aggressive recovery.

If there is an agreement: An immediate relief in traditional markets that would drag BTC upwards.

💬 What’s your play?

The Fear and Greed Index is showing nervousness. Are you buying the fear or waiting in Stablecoins?

🚀 Bullish: Bitcoin is the refuge!

🐻 Bearish: The market will bleed before rising.

💎 HODL: I'm not moving, the political noise is temporary.

Leave us your opinion in the comments! 👇

#BinanceSquareFamily #USA #Shutdown2026 #BTC #macroeconomy #tradingStrategy