Introduction

Intraday trading is one of the most widely used strategies in modern financial markets. It applies to stocks, currencies, commodities, and, with particular strength, to cryptocurrencies, where volatility is constant and markets operate 24/7.

But a key question arises:

Is day trading with cryptocurrencies really profitable and suitable for everyone?

There is no universal answer. However, understanding how it works, what skills it requires, and what risks it involves is essential before deciding whether this strategy fits your profile.

What is intraday trading?

Intraday trading involves opening and closing trades within the same day, without leaving positions open overnight. The goal is to capture short-term price movements, taking advantage of daily market volatility.

The term comes from the traditional stock market, where sessions have defined hours. In crypto, although the market never closes, the principle remains: zero overnight exposure.

How do intraday traders make money?

Successful day traders often share three key pillars:

Technical analysis (TA)

They use price action, volume, chart patterns, and indicators like RSI, MACD, or moving averages to identify entries and exits.

Strict risk management

Without risk control, day trading is unsustainable. Well-defined stops and appropriate position size are mandatory.

Liquidity and fast execution

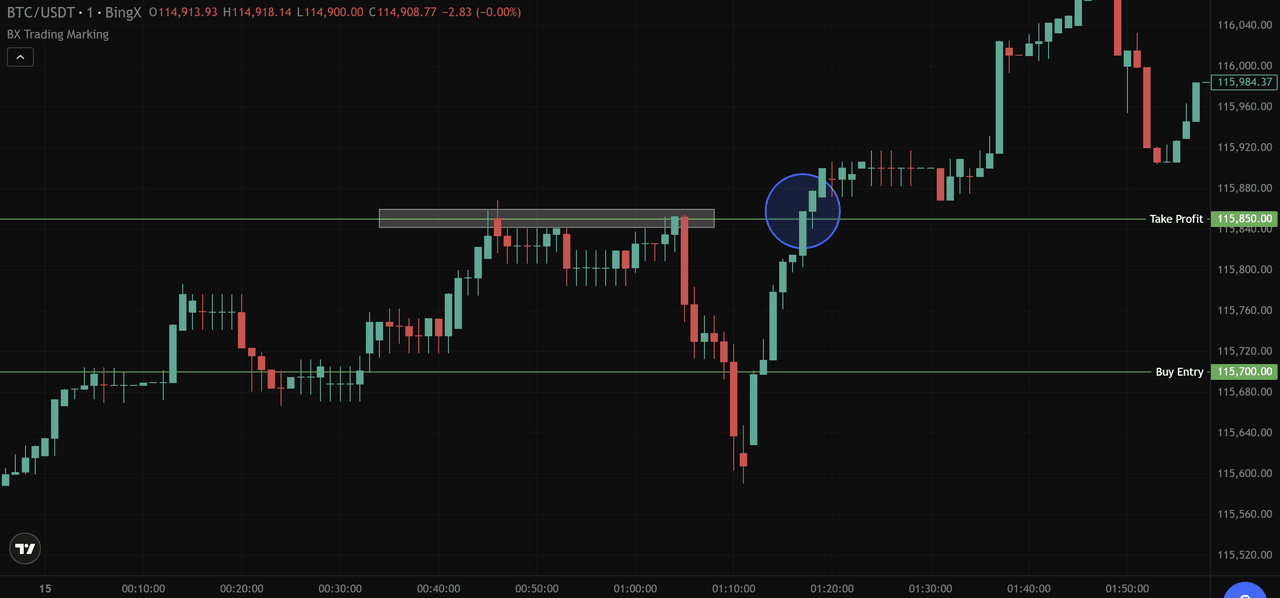

Day trading requires liquid markets to enter and exit without significant slippage. That's why most trade high liquidity pairs like BTC/USDT or ETH/USDT.

Some traders also apply news trading, taking advantage of volume spikes generated by relevant announcements, although this requires experience and quick reflexes.

-----

Common intraday trading strategies

1. Scalping (speculation)

Scalping aims to gain small but frequent profits, taking advantage of micro-movements in price over very short timeframes.

Characteristics:

High frequency of trades

Common use of leverage

Dependence on the order book, volume, and liquidity

It’s an advanced and demanding strategy, where a few mistakes can severely impact the account.

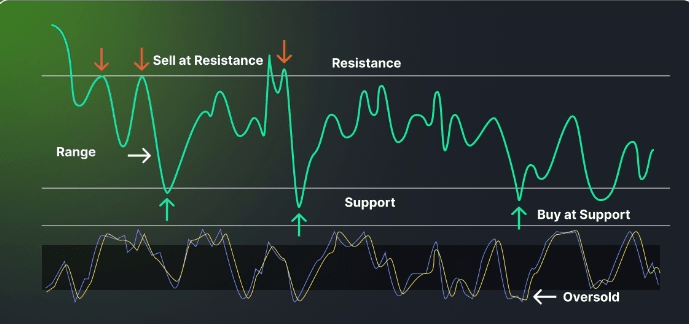

2. Range trading

Range trading is based on identifying clear support and resistance zones and trading the bounces within that range.

Example:

Buy near support

Sell near resistance

It's a more structured strategy suitable for beginner traders, as long as it is accompanied by stops against possible breakouts.

3. High-frequency trading (HFT)

High-Frequency Trading (HFT) uses algorithms that execute trades in milliseconds. It is common in quantitative firms and institutional funds.

Key points:

Requires programming, mathematics, and advanced backtesting

Costly infrastructure

Not realistic for retail traders

If someone sells an 'infallible HFT bot', it's wise to seriously doubt.

-----

How to start intraday trading in cryptocurrencies?

Before trading with real money, it is advisable:

Learn basic trading and market concepts

Practice with paper trading or demo accounts

Test strategies without risk

Define clear risk rules

A. Platforms like Binance offer:

Wide liquidity

Spot, margin, and futures markets

Real-time data

Advanced tools for active traders

-----

Can you live off intraday trading?

Day trading can be profitable, but it's neither easy nor quick.

Aspects to consider:

High emotional and psychological load

Need for constant concentration

Real risk of losses

Prolonged learning curve

It's not just a financial strategy, it's a demanding lifestyle. If it doesn't fit your personality or stress tolerance, there are alternatives like swing trading or long-term investing.

Conclusion

Intraday trading is a popular and powerful strategy, especially in cryptocurrencies, where volatility offers multiple daily opportunities. However, it's not for everyone.

Requires:

Discipline

Risk management

Technical knowledge

Emotional control

Understanding these basics before starting can make the difference between an educational experience and an unnecessary loss of capital.

If you liked this article, feel free to share it; it would be very helpful for me.