Hello traders,

I’d like to share a practical trading approach designed to increase your coin (token) holdings over time, rather than focusing solely on short-term cash profits.

If you find value in structured, risk-aware trading ideas, consider following for timely market insights.

Wishing you a productive trading day.

Core Concept: Growing Holdings Instead of Just Cash

In crypto markets—where assets are traded in fractions—retaining coins generated from profits can be a powerful long-term strategy. Instead of always converting gains back into stablecoins, this method allows you to gradually increase your coin balance using market fluctuations.

To apply this strategy effectively:

Basic day trading experience is recommended

Familiarity with futures trading concepts (LONG & SHORT) makes execution easier

The Trading Logic (Simple but Disciplined)

The principle behind this strategy is straightforward:

When price moves in your favor, sell only the initial purchase amount, allowing the remaining coins (profits) to stay in your wallet.

If price is expected to correct, sell your existing holdings near local highs, then buy back at lower levels, increasing the total number of coins you hold.

The goal is not prediction perfection—but consistent improvement in position size over time.

Chart Framework & Entry Zones

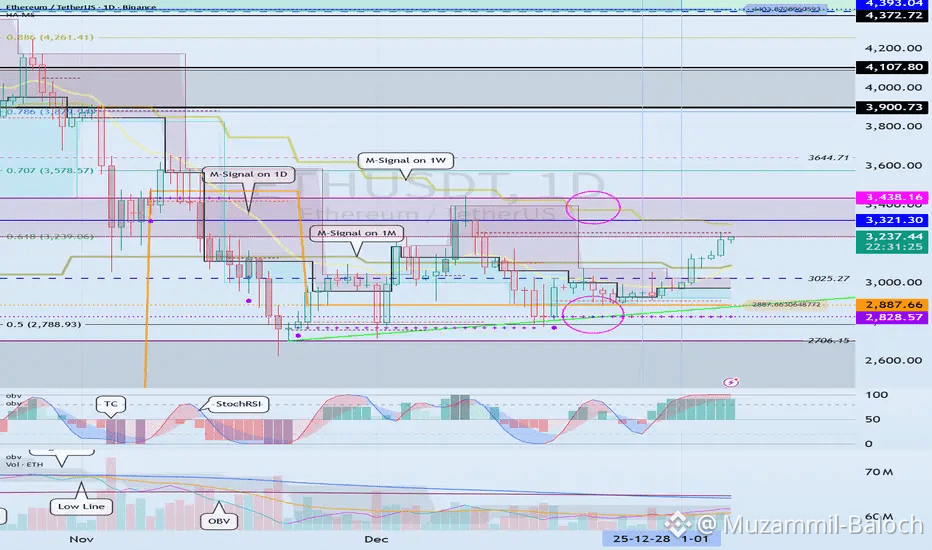

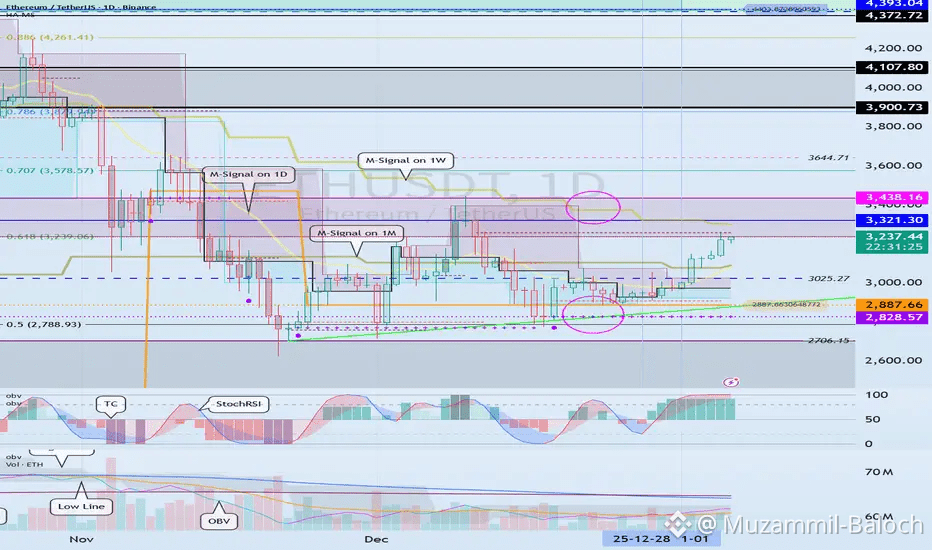

Using ETHUSDT as an example, the core structure is defined as follows:

Buy Zone: DOM(-60) to HA-Low

Sell Zone: HA-High to DOM(60)

This framework is effective for capturing repeated price swings. However, executing this strategy purely on a 1D timeframe can be challenging due to slower feedback and wider price movement.

For practical execution, lower timeframes (15m or 30m) are recommended.

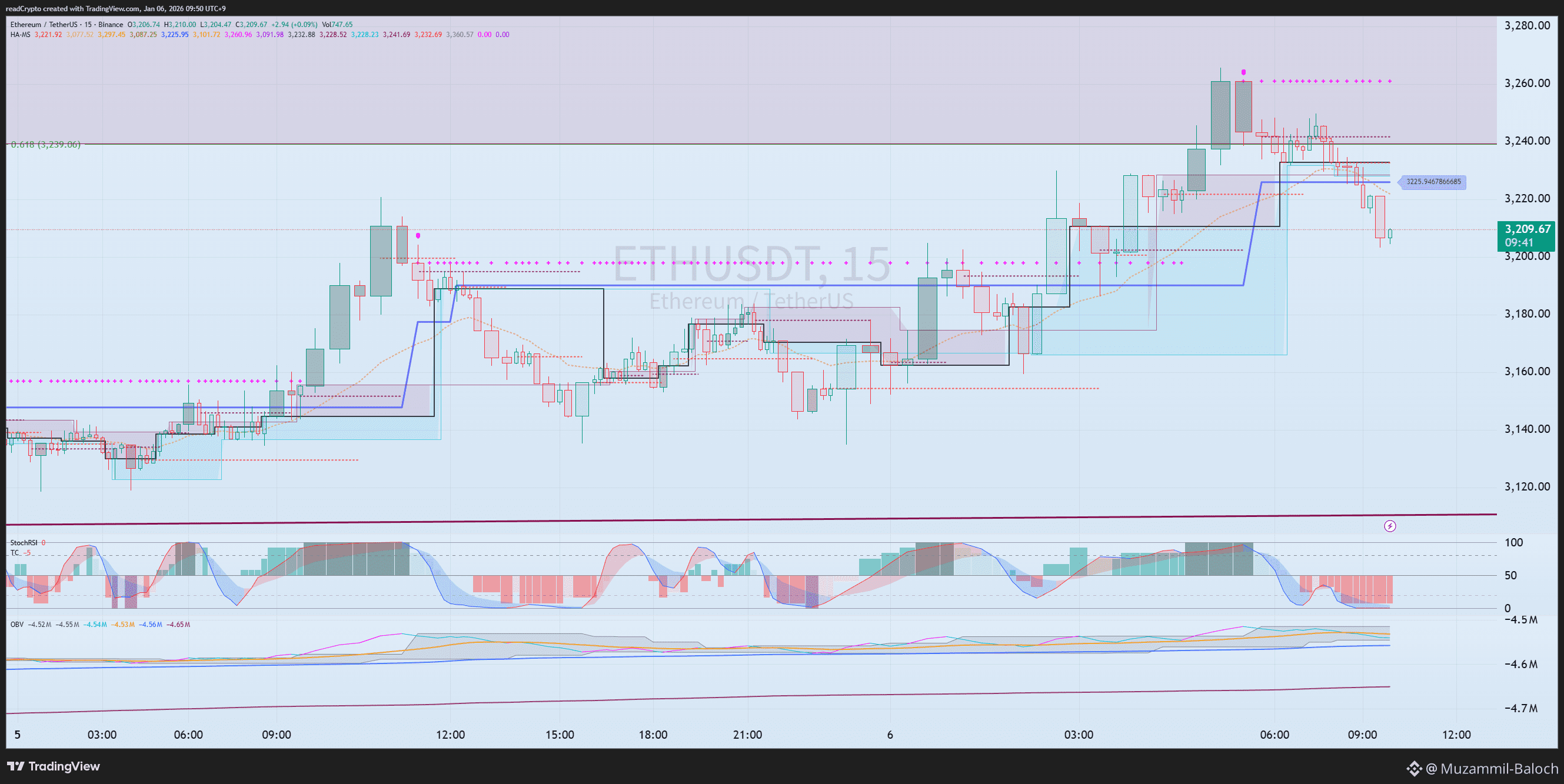

Lower Timeframe Execution (15m Chart)

On the 15-minute chart:

Buy when DOM(-60) aligns with HA-Low

Sell when HA-High approaches DOM(60) and begins to weaken

This allows traders to capitalize on intraday momentum while building coin balances incrementally.

At early stages, it’s important not to aim for aggressive growth. Gradual accumulation reduces emotional pressure and execution errors.

Indicator Confirmation (Trend Validation)

To improve trade quality, monitor the following indicators:

During Uptrends:

StochRSI trends upward but avoids deep overbought levels

TC remains above 0

OBV stays above the High Line

Weakness in these conditions often signals that upside momentum may struggle.

During Downtrends:

TC remains below 0

OBV stays below the Low Line

StochRSI confirms weakness (only valid when overall trend isn’t bullish)

Indicator alignment with price action is essential for timing entries and exits.

Why This Method Works Long-Term

Increasing your coin balance by even small amounts may not feel impactful at first. However, consistent accumulation through multiple trades creates a position with minimal or zero cost basis over time.

Compared to restarting trades with fresh capital, this approach:

Reduces psychological pressure

Lowers dependency on perfect re-entries

Allows trading using existing holdings

That said, converting profits entirely into cash can sometimes be appropriate—especially when volatility or uncertainty is high. Each approach has its place.

Risk Awareness & Final Notes

There will be moments when you sell expecting a pullback, only to see price continue higher. To reduce this risk:

Monitor higher timeframe indicators (1D)

Avoid selling into strong bullish momentum

It’s generally safer to increase holdings during corrective or declining phases rather than during aggressive uptrends.

Final Thought

This strategy isn’t about chasing large single trades—it’s about systematic growth through structure, patience, and discipline. Over time, this approach can significantly strengthen your portfolio while reducing reliance on additional capital.

Thank you for reading.

Wishing you clarity, consistency, and success in your trading journey.