SoftBank reported a quarterly profit of ¥248.6 billion, falling short of the expected ¥336.7 billion. Even though the number is still big, the miss raised eyebrows.

The group saw gains in some places but got dragged down in others. It wasn’t a clean win. The performance looked all over the place, despite what the headline profit might suggest.

For the nine-month period from April to December, net sales hit ¥5.72 trillion, up 7.9% from the ¥5.3 trillion posted a year ago. Income before tax jumped 228% to ¥4.17 trillion, while net income soared nearly 400%, landing at ¥3.17 trillion versus ¥636.2 billion the year before.

Gains on investments doubled from ¥2.17 trillion to ¥4.22 trillion, but the group’s investment business outside of Vision Funds collapsed, dropping 91.9% to just ¥163.4 billion. That segment alone used to bring in over ¥2 trillion.

Vision Funds returns after last year’s collapse

The SoftBank Vision Funds unit staged a massive turnaround, logging a ¥3.6 trillion gain, a major bounce from the ¥309.9 billion loss reported a year earlier.

The Vision Funds are where most of the OpenAI exposure sits. SoftBank has been piling billions into it throughout 2025, aiming to ride the AI wave.

Source: SoftBank

Source: SoftBank

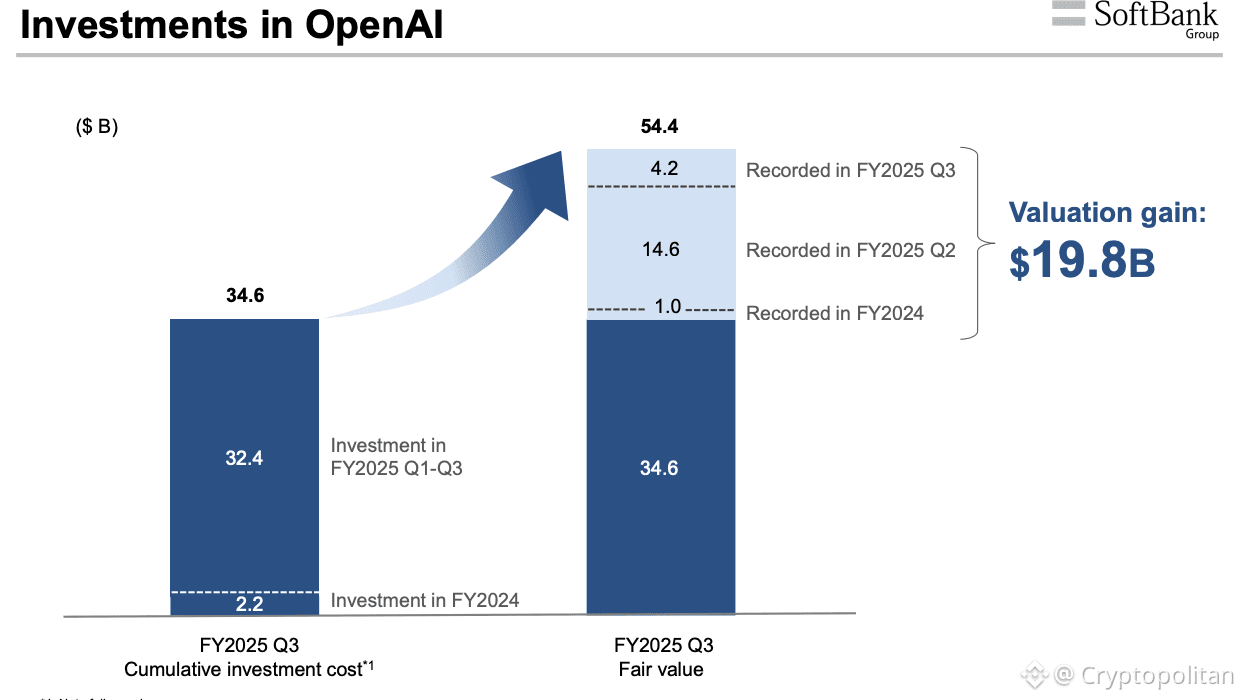

The group officially committed $40 billion to OpenAI in March 2025, though $30 billion of that was SoftBank’s own exposure. The money was funneled through SVF2, its second Vision Fund. In April 2025, the first $10 billion round closed, with $7.5 billion of it from SVF2.

Then, by December, a second $31 billion round wrapped up, with SVF2 throwing in another $22.5 billion. Altogether, SoftBank’s total stake hit $34.6 billion, giving it about 11% ownership in OpenAI.

The first chunk went into OpenAI Global LLC, while the second landed in OpenAI Group PBC, following a recapitalization completed in October.

The pre-money valuation was $260 billion, and co-investors chipped in another $11 billion, bringing the total syndication to $41 billion. SoftBank now holds its OpenAI shares directly through SVF2.

Asset sales and new bets show where the money is going

Behind the scenes, SoftBank’s been selling off other holdings to keep the OpenAI checks flowing.

Between June and December, it dumped $12.73 billion worth of T-Mobile shares. It also sold its full Nvidia stake in October for $5.83 billion, despite Nvidia’s role in AI chips. The company has also been borrowing against its Arm stake and other holdings to stay liquid.

It hasn’t stopped spending though. In December 2025, SoftBank said it would buy DigitalBridge, a data center investment firm based in Florida, for $4 billion, including debt. A couple of months earlier, in October, it agreed to acquire ABB’s robotics division for $5.4 billion. Both moves were aimed at building more exposure to AI-linked infrastructure.

SoftBank’s CFO Yoshimitsu Goto said this week that 60% of the company’s assets are now AI or ASI-related, referencing artificial superintelligence, which founder Masayoshi Son once claimed would be “10,000 times smarter than humans.” The focus on ASI is no longer just talk. It’s clearly where the company is betting everything.

Goto was pressed multiple times on OpenAI during the company’s earnings call. When asked why SoftBank keeps doubling down on the AI firm even after some rough patches, he replied:

“We assume OpenAI will be able to lead this industry and this era, and we are quite convinced. So that’s why we are making an investment in this company.”

The company believes OpenAI is just getting started with monetizing its tech. A person close to the matter said future revenue may come from enterprise deals, hardware, and ads, even though the company isn’t profitable yet.

SoftBank shares are up 9.5% in 2026 so far, after almost doubling in 2025. Investors got another reason to buy this week after Prime Minister Takaichi Sanae’s win over the weekend.

Takaichi-san’s push for bigger spending in AI and semiconductors gave markets a jolt. Still, the big question now is whether SoftBank can keep financing its AI push without sinking its balance sheet.

Claim your free seat in an exclusive crypto trading community - limited to 1,000 members.