Bullish Technicals Align as HYPE Eyes $36 Breakout

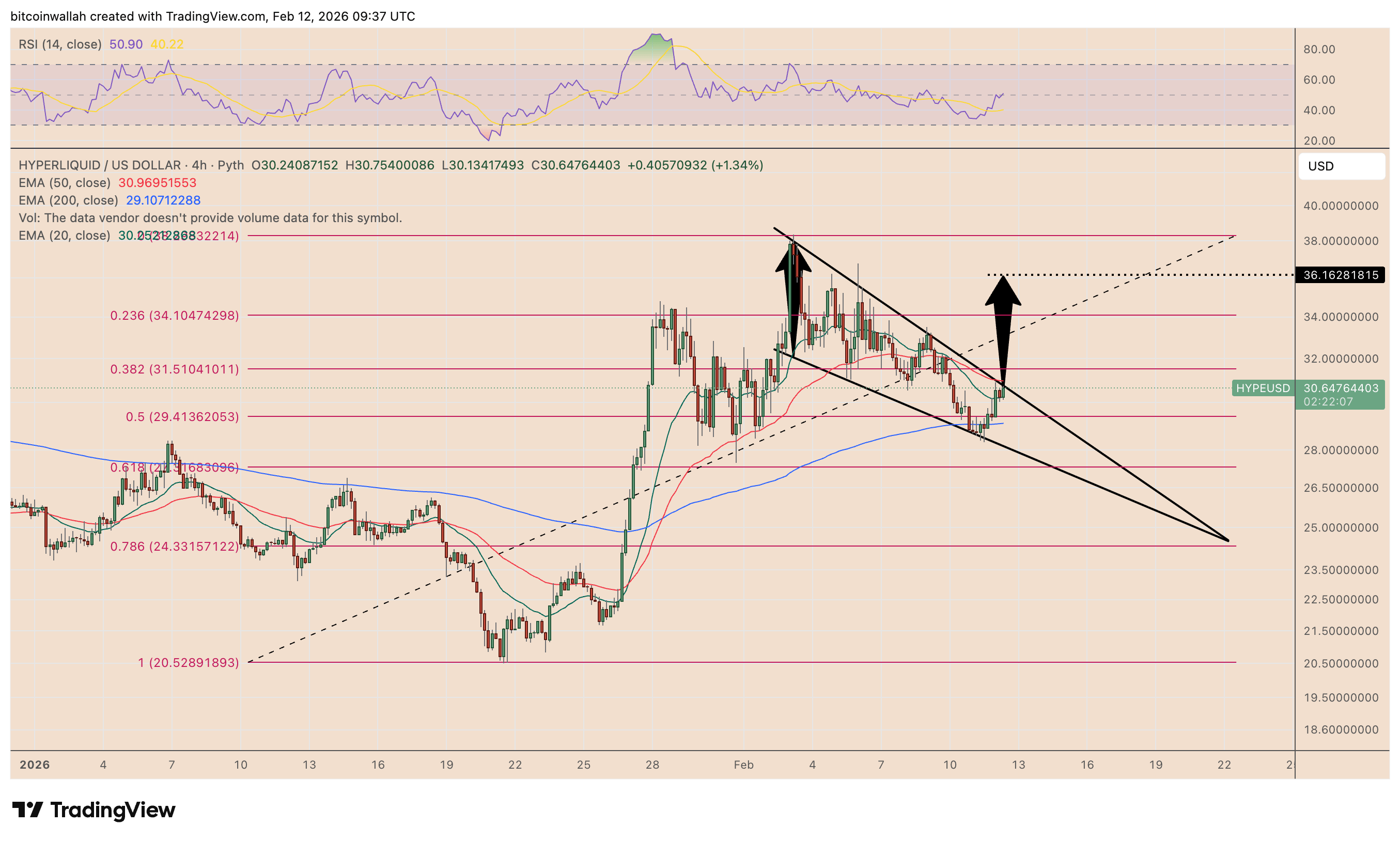

Hyperliquid’s HYPE token is flashing a textbook bullish signal on the four-hour chart, attempting to break free from a falling wedge pattern—a setup known for sparking sharp reversals to the upside.

Breakout in progress: HYPE is testing the upper trendline after a compressed consolidation phase.

Price target: A confirmed breakout could fuel an 18%–20% rally, with the wedge’s measured move pointing to $36—a level reinforced by prior resistance.

Momentum intact: The RSI has rebounded from neutral territory and remains below overbought levels, with no bearish divergence in sight.

Institutional Firepower: $130M Treasury Play Adds Fuel

The technical optimism is backed by real institutional weight. Hyperliquid Strategies Inc.—fresh off a $129.5 million acquisition of 5 million HYPE tokens—now holds roughly 17.6 million HYPE as of early February.

The Nasdaq-listed firm is doubling down on its role as a public-market proxy for the Hyperliquid ecosystem, signaling long-term conviction despite recent volatility.

The purchase comes on the heels of a $317.9 million net loss in late 2025, largely tied to unrealized HYPE price swings. Still, the company maintains $125 million in deployable capital and access to a $1 billion equity credit line.

A concurrent $10.5 million share buyback underscores disciplined capital allocation.

The Bottom Line

With a breakout brewing on the charts and institutional appetite growing, all eyes are on $36 as HYPE’s next major threshold—if buyers can hold the line.