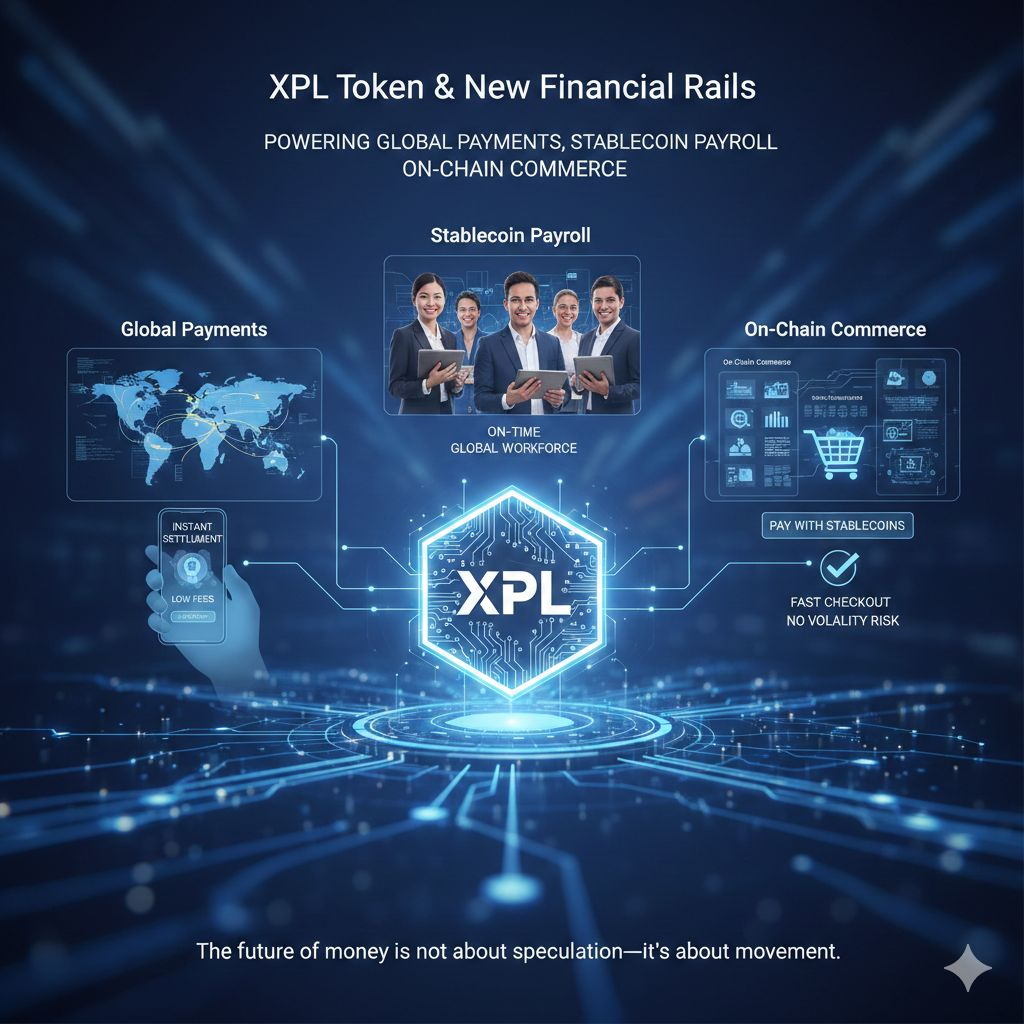

Powering Global Payments, Stablecoin Payroll, and On-Chain Commerce

The future of money is not about speculation—it’s about movement.

How fast value travels, how reliably it settles, and how seamlessly it integrates into everyday economic activity.

This is where XPL, the native token of the Plasma ecosystem, steps into focus.

Plasma isn’t trying to be everything. Instead, it is building the financial rails for what matters most in the next phase of crypto adoption: real-world payments powered by stablecoins.

1. Global Payments: Borderless Money That Actually Works

Traditional global payments are slow, expensive, and layered with intermediaries. Sending money across borders can take days, incur high fees, and expose users to FX risks and settlement uncertainty.

Plasma reimagines this system from the ground up.

How Plasma Changes Global Payments

Instant settlement: Transactions finalize immediately—no waiting, no ambiguity.

Stablecoin-native: Payments are made in stable value, not volatile assets.

Low-cost rails: Minimal fees compared to legacy banking or remittance networks.

24/7 availability: No banking hours, no geographic restrictions.

Role of XPL Token

XPL acts as the economic backbone of the network:

Facilitating transaction execution

Securing the settlement layer

Incentivizing validators and network participants

In short, XPL helps turn stablecoins into true digital cash, capable of replacing outdated cross-border systems.

2. Stablecoin Payroll: The Future of Global Work

The workforce is global, but payroll systems are not.

Remote teams, freelancers, and international companies face constant friction:

Delayed salaries

High transfer fees

Currency conversion losses

Compliance complexity

Plasma introduces a better alternative: stablecoin payroll with instant finality.

Why Stablecoin Payroll Matters

Employees get paid on time, every time

Salaries retain stable purchasing power

No dependency on local banking infrastructure

Ideal for freelancers, DAOs, startups, and global companies

Where XPL Fits In

XPL enables:

Reliable, scalable payroll settlement

Network security for high-volume payment flows

Future governance over protocol-level payroll tools

This isn’t just a crypto use case—it’s a labor market upgrade.

3. On-Chain Commerce: When Crypto Becomes Practical

For years, crypto payments have promised mainstream adoption—but complexity held them back.

Plasma simplifies on-chain commerce by focusing on what merchants actually need:

Fast checkout

Price stability

Settlement certainty

Minimal technical overhead

Plasma’s Commerce Advantage

Payments settle instantly in stablecoins

No volatility risk for merchants

Easy integration for Web2 and Web3 platforms

Scalable infrastructure for high transaction volume

XPL as the Commerce Enabler

XPL supports:

Transaction throughput optimization

Economic incentives for payment infrastructure

Long-term sustainability of merchant ecosystems

As commerce moves on-chain, Plasma aims to be the default settlement layer, not just another option.

Why This Matters for XPL Token

XPL is not designed to rely on hype cycles or speculative narratives.

Its value proposition is rooted in:

Usage

Volume

Infrastructure demand

As global payments, payroll, and commerce increasingly shift to stablecoins, the demand for efficient settlement layers grows—and so does the relevance of XPL.

This is how real value is built:

Not by chasing trends, but by powering systems people depend on every day.

Final Thoughts

Crypto’s next chapter won’t be defined by charts alone.

It will be defined by who moves money best.

Plasma is positioning itself at the center of that transition—and XPL is the key that keeps the system running.

In a world moving toward stable, instant, borderless value transfer, XPL isn’t just a token.

It’s part of the financial infrastructure of what comes next.