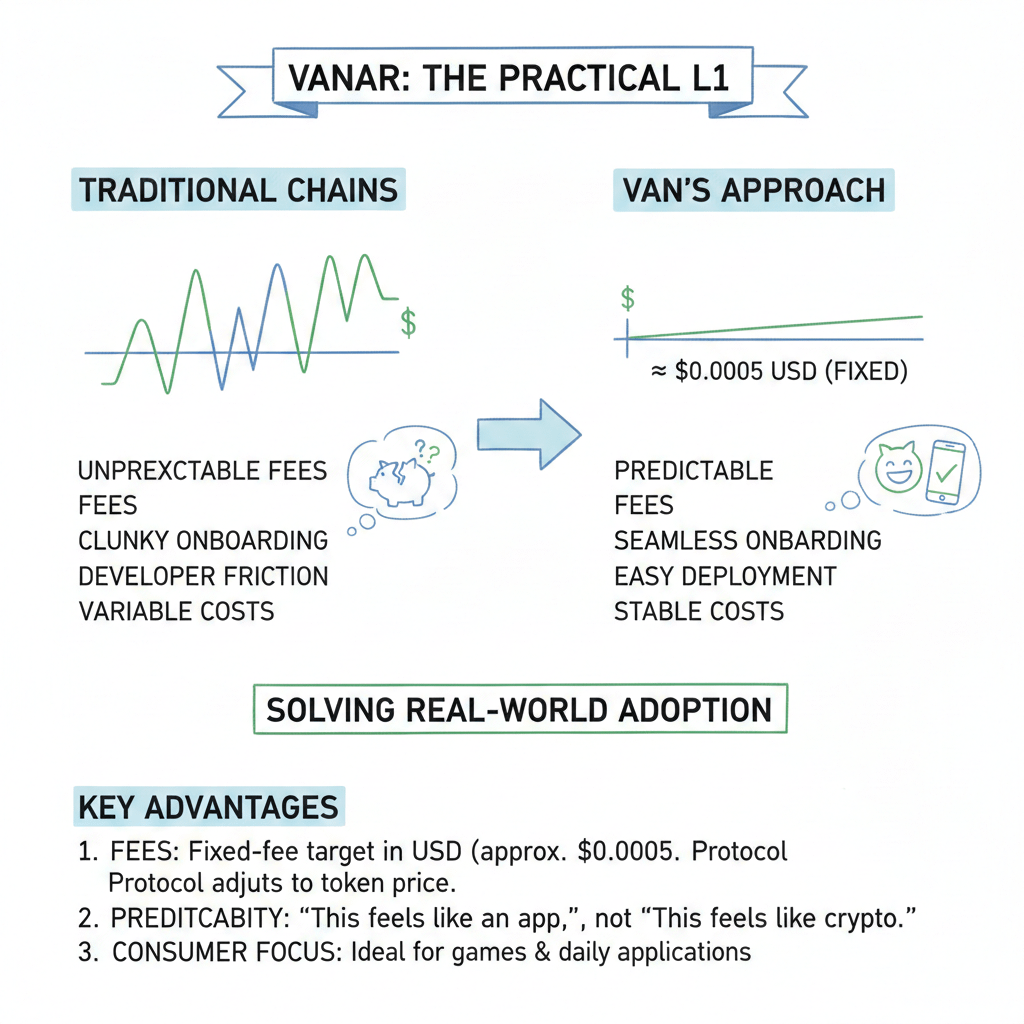

Vanar feels like it’s coming at the “L1 race” from a more practical angle than most chains. Instead of trying to win the internet with the loudest TPS number, it’s trying to solve the stuff that actually breaks adoption when you leave crypto Twitter and enter the real world: unstable costs, clunky onboarding, and developer friction when you want to ship a product that regular people can use every day.

The first advantage is how Vanar treats fees. A lot of fast chains are cheap, but cheap isn’t the same thing as predictable. If you’re building a consumer product—especially games—your users don’t care about gas theory. They just want the app to work and the cost to feel normal. Vanar’s model is built around a fixed-fee target in fiat terms (around $0.0005), and the protocol adjusts fee parameters based on token price updates. That’s a different mindset from networks where fees are “usually low,” but can still surprise you depending on usage conditions. In a consumer setting, predictability is the whole game because it’s the difference between “this feels like an app” and “this feels like crypto.”

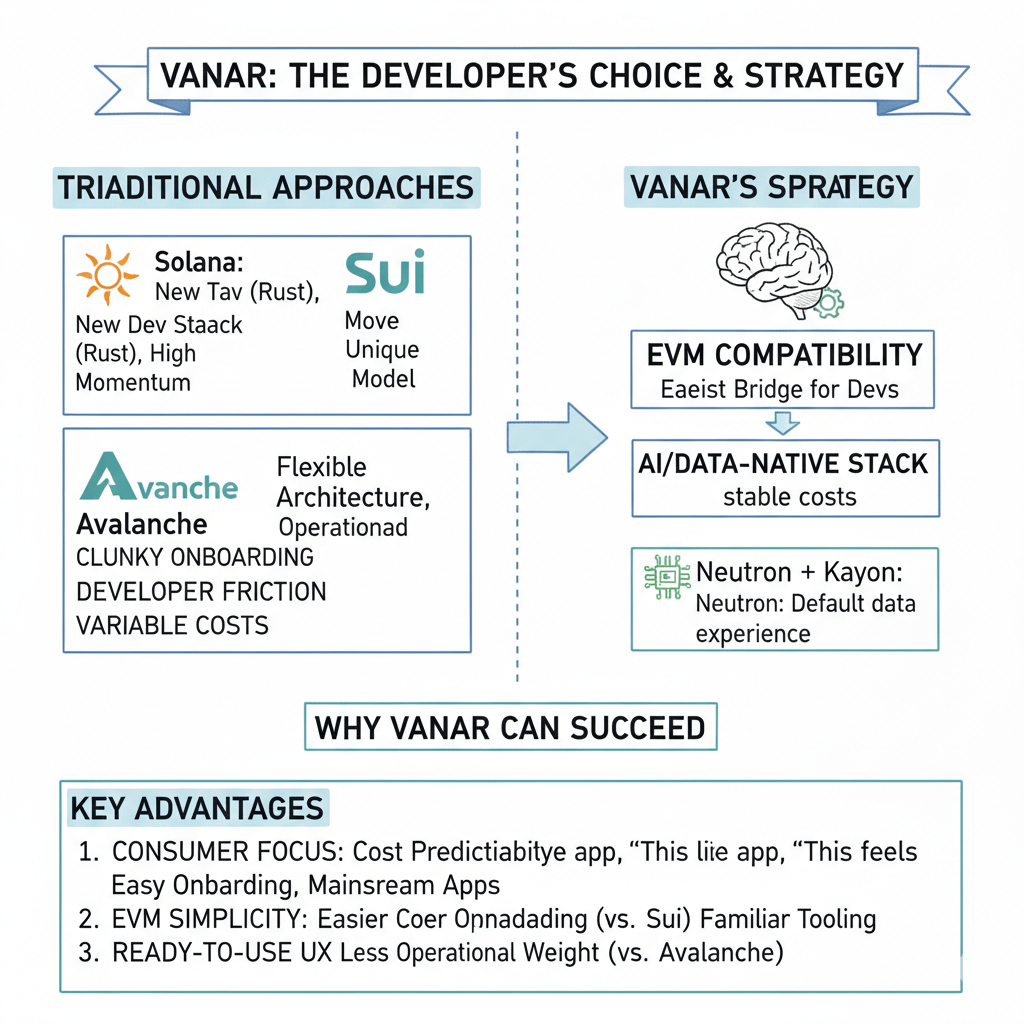

When you compare this to Solana, you can see the trade-off clearly. Solana is proven at scale and it’s known for being extremely cheap, but the fee logic is still chain-native and usage-driven. That works great in crypto-native environments where users expect variance, but Vanar is trying to turn the fee experience into something boring and stable on purpose. If you’re a studio or a brand that wants clean budgeting, that kind of design can matter more than raw performance bragging rights.

Sui is another strong competitor in the “modern high-performance chain” category. It’s fast and it’s built around a different architecture that can be extremely efficient, especially with parallel execution ideas. But Sui also introduces a different mental model for developers and users with how objects and storage work. It’s powerful, but it can add complexity. Vanar’s approach is less “new programming world” and more “make it easy for existing builders to ship,” especially since it keeps an EVM compatibility story that lets Ethereum-native teams move faster without re-learning everything from scratch.

Avalanche competes from a different direction. Its strength is flexibility—teams can build app-specific environments and tune things for their own use case. That’s huge for certain deployments, but it also pushes more operational complexity onto the project team. Vanar is basically betting that a lot of builders don’t want to operate a mini-internet; they just want a chain that’s ready for consumer usage with minimal overhead and a fee experience that stays consistent.

Then you get into adoption strategy, and this is where Vanar’s “why” becomes more obvious. Many chains grow by becoming DeFi hubs first and hoping consumer apps arrive later. Vanar’s narrative leans heavily into entertainment, gaming, and brand distribution from the start. The point isn’t just to say “we’re for gaming,” it’s to actually plug into places where users already exist. That’s why partnerships tied to mainstream gaming pipelines matter more than random protocol integrations. When Vanar highlights collaborations like Viva Games Studios and the goal of bridging Web2 audiences into Web3 with familiar sign-in experiences, it’s basically telling you their north star is not crypto-native power users. It’s everyday users who don’t want to feel they’ve entered a different universe just to play a game or use an app.

Token-wise, Vanar isn’t doing something wildly exotic, but the way the token connects to the network story is important. VANRY is used for gas, staking, validator incentives, and security. The supply and holder data is transparent on-chain via the ERC-20 contract view, and you can verify things like max supply and holder count. That onchain visibility matters because it’s one of the few “trust anchors” that’s objective in a market full of narratives. But the bigger point is that the token isn’t just “the thing you trade.” It’s part of the chain’s product promise—because the fee model depends on maintaining that stable-cost experience even as market conditions shift.

On the developer side, Vanar’s strongest move is keeping the barrier low. EVM compatibility is still the easiest bridge for the biggest pool of existing developers. Solana has a huge ecosystem and momentum, but it also leans into a different dev stack. Sui has Move and a unique model. Avalanche has options, but can lead to more architecture choices and operational demands. Vanar’s bet is: “don’t make builders fight the tooling before they build the product.” And then it tries to differentiate at a higher layer by talking about an AI/data-native stack with components like Neutron and Kayon—basically positioning itself as a chain where storing, structuring, and using real application data can become part of the default experience, not a messy external workaround.

So when you step back and ask, “why would Vanar beat rivals?” it’s not because it’s the fastest chain on a chart or because it has the most hype today. It’s because it’s trying to win the category where cost predictability, consumer onboarding, and mainstream distribution actually decide who survives. Solana is massive and proven, but Vanar is targeting a cleaner cost UX. Sui is technically sharp, but Vanar is keeping the onboarding and EVM path simpler. Avalanche is flexible, but Vanar is leaning toward a more ready-to-use consumer chain experience without requiring teams to take on extra operational weight.

If the market chooses one winner in this category, this is why I’m watching this one.