This Wasn’t a Random Crash It Was a Systematic Flush

Bitcoin just went through one of the most violent resets since 2022.

According to Wintermute’s February 9, 2026 market update:

BTC dropped from ~$80K to $60K

Rebounded back toward $70K

Fully erased all post-Trump election gains (since 11/2024)

Down ~50% from the $126K high

Largest drawdown in four years

This wasn’t panic. It was structure breaking under pressure.

$2.7 Billion Liquidations Why So Extreme?

The setup was textbook. For nearly two months, BTC moved sideways.

Volatility compressed. Traders got comfortable.

Low volatility creates overconfidence. Overconfidence creates leverage.

As price hovered near $80K, long positions built up aggressively. Funding remained elevated. Risk models relaxed.

Then $80K broke. That level wasn’t just support it was a trigger.

Stop losses fired.

Margin calls cascaded.

Longs were forced to market sell.

Price accelerated lower.

More liquidations followed.

Within days, $2.7B in leverage was wiped out.

This was not organic selling. It was mechanical unwinding.

The “Triple Hit” That Shocked Markets

Three macro catalysts landed almost simultaneously:

1️⃣ Kevin Warsh Nominated as Fed Chair

Market interprets him as hawkish.

Translation: Higher rates for longer.

Liquidity expectations tighten immediately.

2️⃣ Microsoft Earnings Disappoint (-10%)

AI narrative the strongest capital magnet of 2025 showed cracks. When AI weakens, risk appetite cracks with it.

3️⃣ Precious Metals Collapse

Silver fell ~40% in three days.

That’s not crypto-specific stress.

That’s broad risk-off behavior.

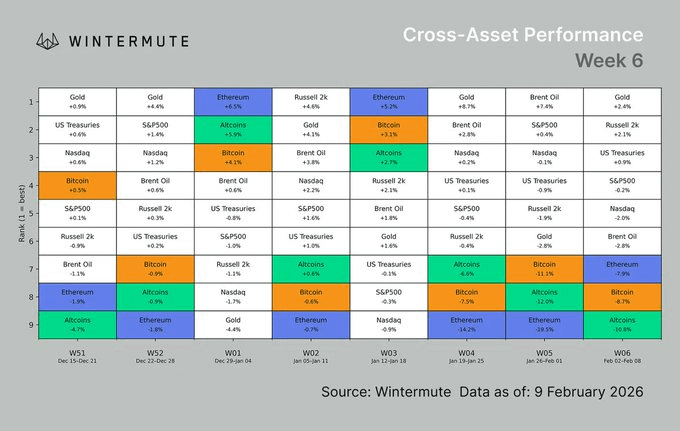

This wasn’t a crypto crash. It was a cross-asset liquidity contraction.

Who Was Selling?

The data points to U.S. flows.

Coinbase Premium stayed negative → U.S. spot selling dominant

OTC desks confirm heavy American distribution

Spot BTC ETFs saw $6.2B outflows since November

Longest ETF outflow streak ever

IBIT (BlackRock) is now both:

The largest BTC holder

And the largest forced seller when redemptions happen

ETF redemptions create a reflexive loop:

Redemptions → Fund sells spot → Price drops → More redemptions → More selling

A self-reinforcing unwind.

Why Is Crypto Weaker Than Other Markets?

Simple answer: capital rotation.

When markets rise → crypto underperforms.

When markets fall → crypto overcorrects.

Why?

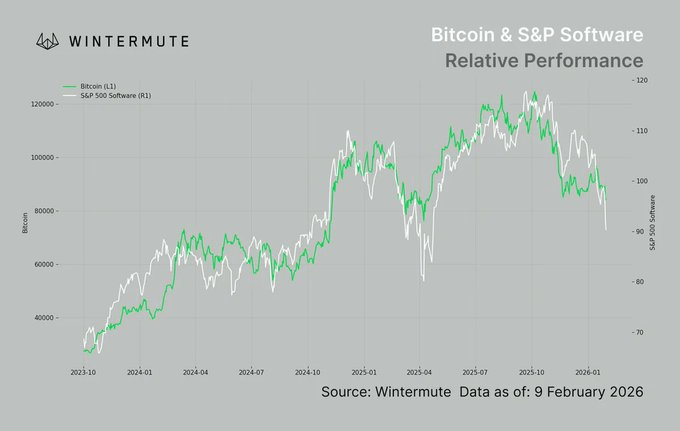

AI absorbed the majority of speculative capital.

Global liquidity chased AI narratives.

Crypto and non-AI software were left behind.

BTC has been trading more like a software equity beta proxy than “digital gold.”

For crypto to outperform again:

AI momentum must cool

Capital must rotate

Risk appetite must reset

Was This Capitulation?

There are clear signs of a flush:

Extreme volatility spike

$2.5B+ liquidations

Funding deeply negative

Aggressive short build-up

Weekend short squeeze

Strong buyers stepping in near $60K

But here’s the problem:

Spot volume remains thin.

Price action is still leverage-driven.

Real spot demand hasn’t convincingly returned.

This rebound is structural relief not confirmed accumulation.

The Silent Risk: Corporate Treasury Holders

Public companies holding BTC are sitting on ~ $25B in unrealized losses.

Many are now below cost basis. Premium/NAV compression increases pressure.

Implication:

They are no longer marginal buyers.

They’ve shifted from accumulation to passive holding.

One of the strongest demand engines of the last 18 months has stalled. That matters.

What Needs to Happen for a Sustainable Uptrend?

For BTC to regain structural strength:

✅ Coinbase Premium turns positive

✅ ETF flows return to net inflow

✅ Funding and basis normalize

✅ Spot volume leads price

❌ Leverage stops dominating price discovery

Right now, institutions via ETFs and derivatives are steering the market. Retail is not in control.

Short-Term Outlook

Expect:

High volatility

Violent range trading

Fake breakouts

No clean trend

Until real spot demand reappears, every rally risks being derivative-driven.

Final Thought

This wasn’t random. It was:

Liquidity contraction

Leverage unwind

ETF reflexivity

Capital rotation

Macro pressure

Bitcoin didn’t collapse.

It deleveraged.

And in every cycle, deleveraging precedes the next structural move.

The question isn’t whether BTC recovers.

Will real money return or was $126K the exhaustion high of this cycle?