Plasma ($XPL) is steadily positioning itself as core infrastructure for global payments, and recent enterprise metrics are beginning to support that vision. The 286% growth of MassPay.io signals rising demand for blockchain-powered cross-border B2B settlements — a strong indicator of real-world utility rather than speculation.

📊 Market Perspective (Opinion)

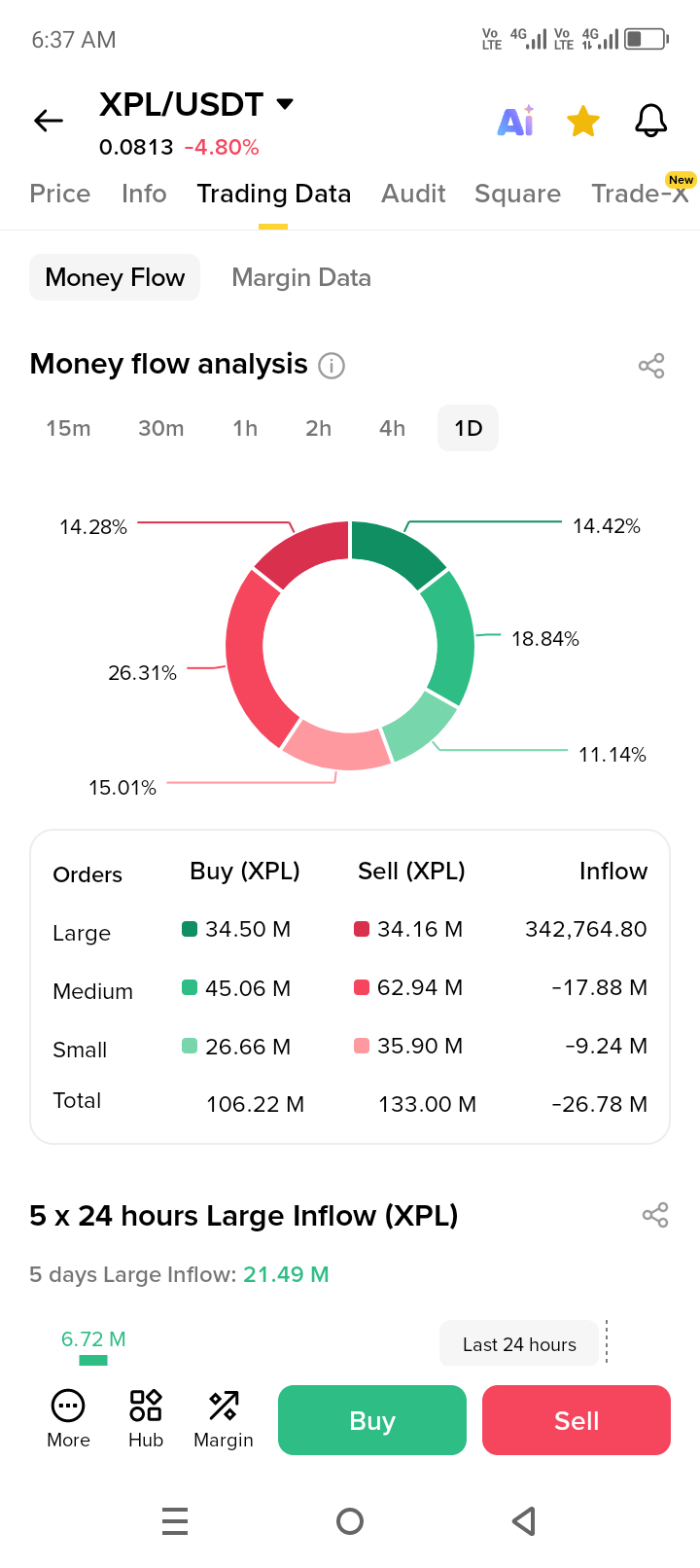

From a spot market viewpoint, projects backed by measurable adoption tend to attract medium- and long-term investors instead of short-term hype traders. This often results in relatively stronger price stability during market corrections.

🎯 Spot Trading Strategy

Entry Approach:

Consider accumulating near major support levels or after healthy pullbacks of 10–20%. Avoid chasing aggressive upward spikes.

Target Plan:

First target: Previous local resistance

Second target: Break above structural high

Extended target: If momentum and volume expand

Risk Management:

Place a stop-loss below key structural support or invalidation zones. Limit exposure per trade to 1–3% of total capital to maintain disciplined risk control.

🔎 Final View

In my opinion, $XPL represents an infrastructure-focused opportunity rather than a hype-driven asset. If enterprise growth continues, strategic spot accumulation during dips may offer a calculated long-term approach.#Plasma @Plasma $XPL