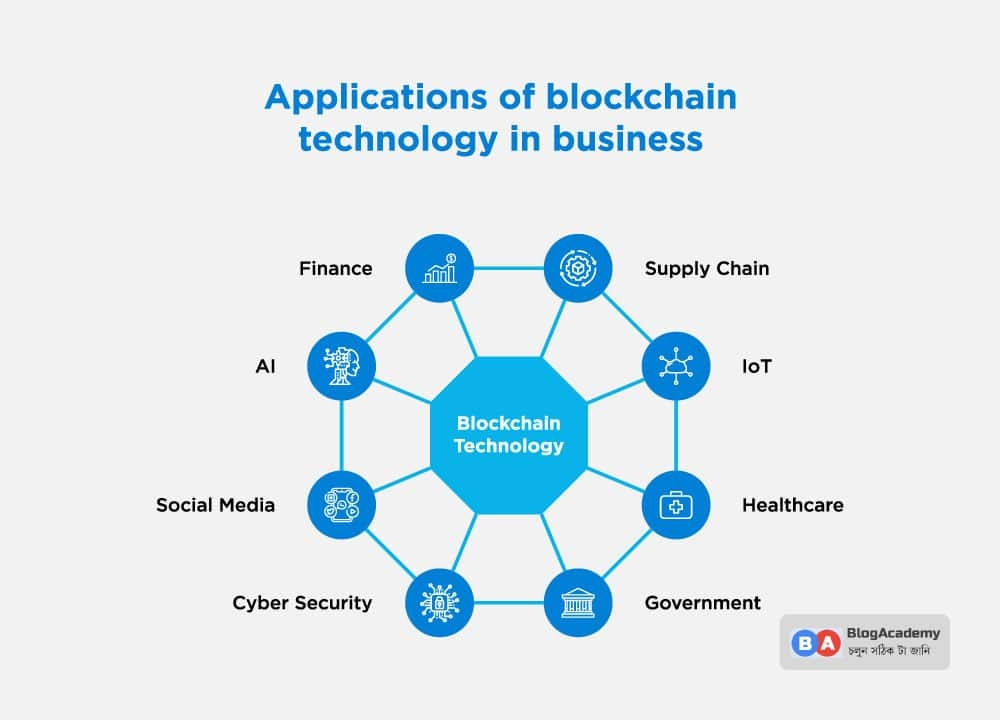

Blockchain technology has evolved far beyond its original purpose of enabling peer-to-peer digital money. Today, it is reshaping the global financial landscape, redefining how value is stored, transferred, and managed. At the center of this transformation are Layer 1 blockchains—the foundational networks that provide the infrastructure for decentralized applications, smart contracts, and entire financial ecosystems.

As financial markets seek greater transparency, efficiency, and inclusivity, Layer 1 blockchains are emerging as critical enablers of this new digital economy. Projects like @undefined and innovative tokens such as VANRY demonstrate how next-generation Layer 1 networks are pushing boundaries, unlocking new use cases, and bringing blockchain adoption closer to the mainstream.

In this article, we explore the transformative role of Layer 1 blockchains, their advantages, real-world applications, challenges, and long-term impact on global financial markets.

Understanding Layer 1 Blockchains

A Layer 1 blockchain refers to the base protocol itself—such as Bitcoin, Ethereum, Solana, Avalanche, or emerging networks like Vanar Chain. These networks process transactions, maintain consensus, and secure data directly on their own blockchain.

Unlike Layer 2 solutions, which operate on top of existing chains, Layer 1 blockchains aim to improve scalability, performance, and functionality at the core level. This makes them essential for building robust decentralized ecosystems.

Key characteristics of Layer 1 blockchains include:

Native consensus mechanisms

On-chain security and validation

Support for smart contracts

Independent transaction processing

As blockchain adoption grows, Layer 1 networks are becoming the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), tokenized assets, and Web3 infrastructure.

Why Layer 1 Blockchains Matter for Financial Markets

Traditional financial systems face long-standing challenges such as slow settlement times, high fees, limited transparency, and restricted access. Layer 1 blockchains address many of these inefficiencies by introducing decentralized, programmable, and borderless financial infrastructure.

1. Faster and Cheaper Transactions

Layer 1 networks can settle transactions within seconds or minutes, compared to days in traditional banking systems. Lower transaction costs make microtransactions, global payments, and real-time settlements economically viable.

This capability transforms:

Cross-border payments

Remittances

Merchant settlements

Peer-to-peer transfers

For emerging economies and underserved populations, this access to affordable financial services is revolutionary.

2. Trustless and Transparent Systems

Public blockchains operate on open ledgers, meaning anyone can verify transactions. This transparency reduces the risk of fraud, corruption, and manipulation—major concerns in centralized financial systems.

Smart contracts further automate processes such as:

Loan issuance

Interest distribution

Insurance payouts

Trade settlement

By removing intermediaries, Layer 1 blockchains increase efficiency and reduce operational risk.

Enhancing Scalability, Security, and Decentralization

One of the greatest technological challenges in blockchain is balancing scalability, security, and decentralization—the so-called “blockchain trilemma.” Modern Layer 1 blockchains are experimenting with innovative solutions to address this issue.

Scalability Innovations

New Layer 1 networks utilize techniques such as:

Sharding

Parallel transaction processing

Advanced virtual machines

Optimized consensus algorithms

These improvements allow thousands of transactions per second without sacrificing decentralization.

Security by Design

Layer 1 blockchains rely on cryptographic validation, distributed consensus, and economic incentives to maintain security. Attacking a well-established Layer 1 network requires enormous computational resources, making large-scale exploits extremely difficult.

Vanar Chain, for example, focuses on combining performance with enterprise-grade security, supporting applications that require reliability and speed.

Powering Decentralized Finance (DeFi)

DeFi is one of the most impactful use cases of Layer 1 blockchains. Instead of relying on banks or brokers, users can access financial services directly through smart contracts.

DeFi applications built on Layer 1 blockchains include:

Decentralized exchanges (DEXs)

Lending and borrowing platforms

Yield farming and staking protocols

Synthetic asset platforms

These services operate 24/7, are globally accessible, and require no permission to use.

Layer 1 networks provide the foundation that ensures DeFi platforms remain censorship-resistant and trustless. As adoption grows, DeFi is gradually becoming a parallel financial system.

Tokenization of Real-World Assets

Layer 1 blockchains enable the tokenization of physical and traditional financial assets such as:

Real estate

Commodities

Stocks and bonds

Intellectual property

Tokenization allows assets to be divided into smaller units, increasing liquidity and accessibility. Investors can own fractional shares of assets that were previously unavailable or illiquid.

This development has profound implications:

Democratized investing

Reduced barriers to entry

Faster settlement times

Global market access

Vanar Chain and projects within its ecosystem aim to support advanced asset tokenization, helping bridge traditional finance with blockchain-based markets.

Driving Global Financial Inclusion

Approximately 1.4 billion people worldwide remain unbanked. Layer 1 blockchains offer an alternative financial infrastructure that only requires internet access and a digital wallet.

Benefits include:

Access to savings and payments

Ability to earn yield

Protection against hyperinflation

Participation in global markets

For underserved regions, blockchain-based financial services can become a lifeline, enabling entrepreneurship and economic mobility.

Transforming Cross-Border Transactions and Remittances

Traditional cross-border payments involve multiple intermediaries, resulting in high fees and long delays. Layer 1 blockchains drastically reduce these friction points.

Blockchain-based remittances:

Settle in minutes

Cost a fraction of traditional services

Operate 24/7

Are transparent and traceable

As migration and globalization increase, efficient remittance solutions will play a crucial role in supporting families and local economies.

Challenges Facing Layer 1 Blockchains

Despite their promise, Layer 1 blockchains face several challenges:

Scalability Limits

Even advanced networks must continuously improve throughput to support mass adoption.

Regulatory Uncertainty

Governments worldwide are still developing frameworks for blockchain and crypto assets. Unclear regulations can slow institutional adoption.

User Experience

Complex wallet management, private keys, and transaction fees remain obstacles for mainstream users.

Interoperability

Different blockchains often operate in isolation, making asset transfers and communication difficult.

Potential Solutions

The blockchain industry is actively addressing these challenges:

Cross-chain bridges and interoperability protocols

Layer 2 scaling solutions

Improved wallet interfaces

Regulatory engagement and compliance tools

Layer 1 networks that embrace adaptability and innovation are best positioned to succeed.

Institutional Adoption and Long-Term Impact

Institutional investors are increasingly recognizing the value of Layer 1 blockchains as foundational digital infrastructure.

Major trends include:

Crypto ETFs and ETPs

Tokenized funds

Blockchain-based settlement systems

Corporate treasury allocations

As trust in blockchain technology grows, Layer 1 networks will likely become as essential to finance as cloud computing is to modern IT.

Projects like @undefined and ecosystems built around VANRY are part of this broader shift toward scalable, secure, and enterprise-ready blockchain solutions.

The Road Ahead

Layer 1 blockchains are not merely speculative technologies—they are building the rails of tomorrow’s financial system. From decentralized finance and asset tokenization to global payments and financial inclusion, these networks are reshaping how value moves across the world.

As innovation accelerates, the most successful Layer 1 blockchains will be those that combine:

High performance

Strong security

Developer-friendly tools

Real-world utility

Vanar Chain stands as an example of how next-generation Layer 1 networks are positioning themselves at the forefront of this transformation.

The future of finance is decentralized, transparent, and globally accessible—and Layer 1 blockchains are leading the way.

Follow @Vanar | Token: $VANRY | #vanar