I have been staring at the spreadsheets all morning.

The emotion in the market is loud, but the data is whispering something very different.

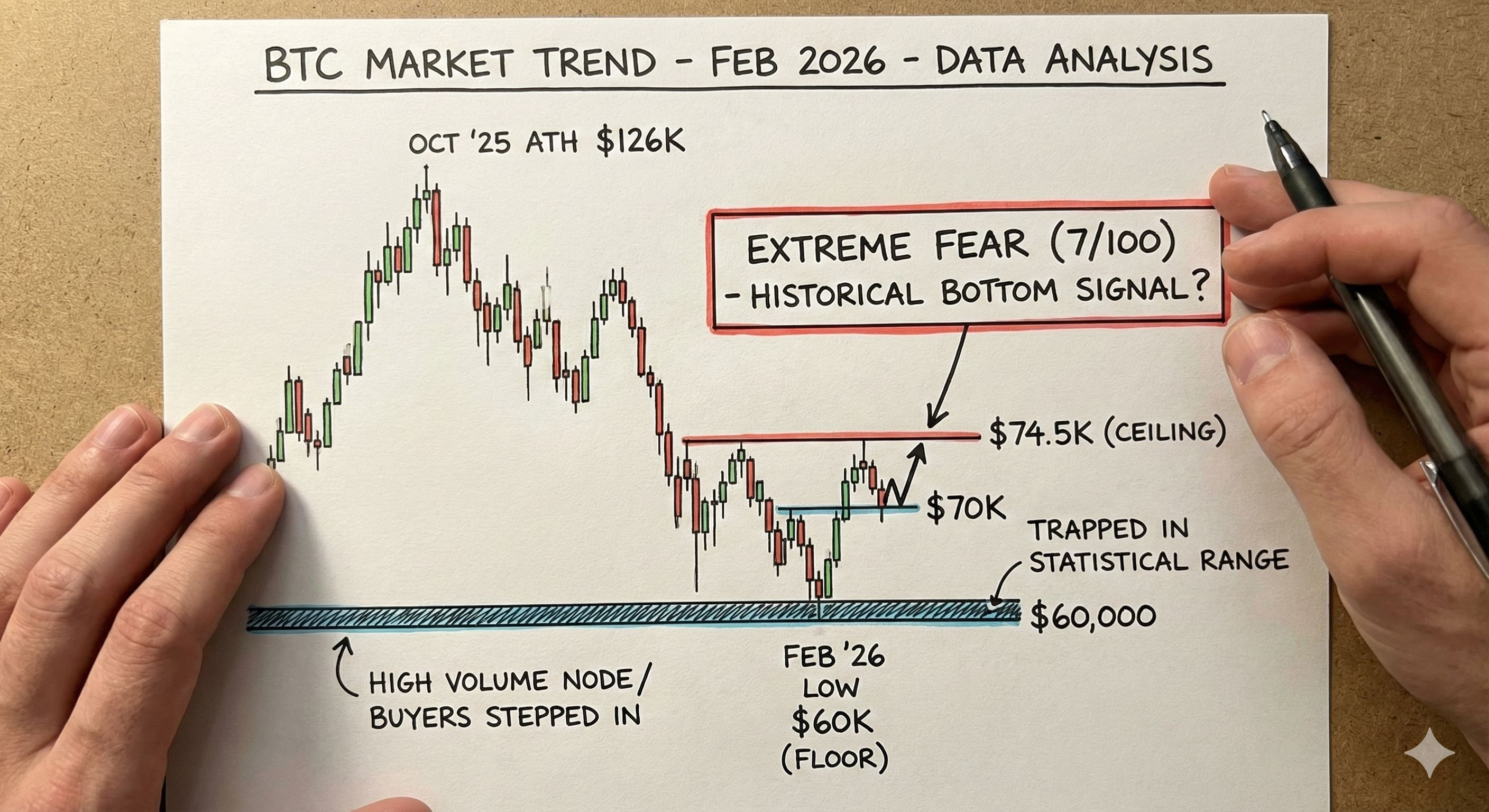

We are currently sitting in a heavy correction phase.

Since $BTC hits all-time high of $126,000 back in October, we have shed nearly 45% of the asset's value.

That is a painful number.

But statistically, this is where the math gets interesting.

¤ The 7/100 Signal

My volatility models are flashing red.

The Fear and Greed Index just hit 7/100. We call this "Extreme Fear." The last time the data showed sentiment this low, it wasn't a warning to sell. It was a statistical probability of a bottom.

The crowd is panic selling right when the historical data suggests the selling pressure is exhausted.

¤ The $60,000 Probability

Bitcoin tested the $60,000 level last week.

In technical analysis, it's called a "high volume node." It is a price area where a massive amount of Bitcoin previously changed hands. It acts like a concrete floor.

The data shows that buyers stepped in aggressively at this level.

As long as the daily close stays above $60,000, the bullish structure remains mathematically possible.

¤ The Invalid Point

However, I am looking at one specific number for the reversal.

$74,500.

Current liquidity heatmaps show a wall of sell orders sitting right there. Until the price breaks and closes above that number, the trend is technically bearish.

We are trapped in a statistical range between the floor at 60k and the ceiling at 74.5k.

The volume is declining. The bands are tightening.

A big move is mathematically guaranteed within 48 hours.

If the floor gives way...

I am keeping my eyes glued to the volume monitor for the next 4 hours.

If that $74,500 wall breaks, the math changes instantly.

I will drop the new targets the second we get a confirmed close.

Make sure you are following so you see it first. You do not want to be late to this move.