Many people think market makers make money by:

• Pump coin

• Dump coin

• Hay "chicken chasing"

Sounds reasonable… but not quite right.

Market makers don't need you to lose.

They just need you to trade a lot.

And that is the most sophisticated point.

1. The biggest sources of money: Spread and liquidity

A simple truth:

Market makers always place orders on both sides.

• Bid

• Ask

The small difference between these two levels is called the spread.

Sounds small, but:

When volume is hundreds of millions of USD each day

Then that spread is a huge cash flow.

The interesting thing is:

Market makers don’t need to guess the market direction correctly.

They just need the market to move enough.

2. Volatility is a perpetual gold mine

Traders often fear volatility.

Market makers need it.

Because:

• Volatility → more orders

• Many orders → more spread

• Many stoplosses → many liquidations

This is why the market often:

• Sideways for a long time

• Then sweeps both ends

Not by coincidence.

That's how liquidity is gathered into the hands of MM

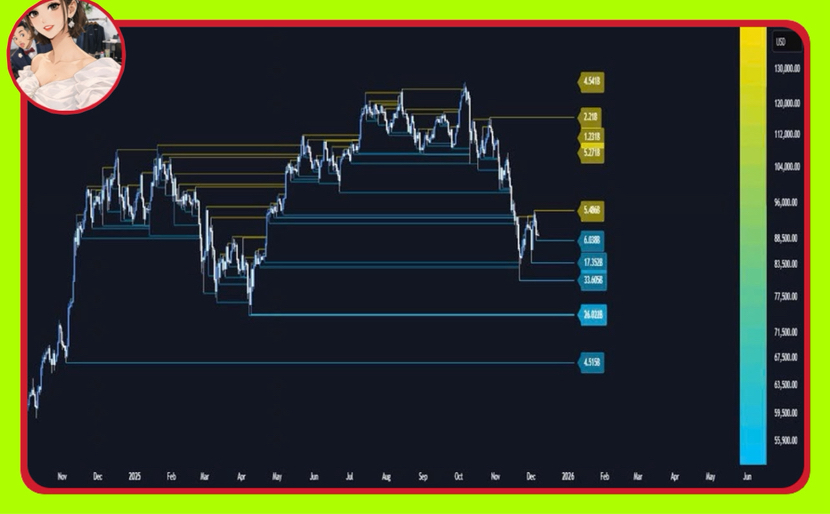

3. Stoploss is the map

A little insight that few people tell you:

Market makers do not “hunt stoploss” in an emotional sense.

They look at liquidity clusters.

Places with:

• Many people place stop

• Many leveraged positions

• Strong funding imbalance

Those are the areas where prices are almost certainly going to go.

Not because they want to.

Because the liquidity there is too attractive, like a beehive right in front of a bear just waking up from hibernation.

4. Futures are where the real money is

The spot market creates a narrative.

Futures market creates money.

Most of the system's profits come from:

• Funding

• Liquidation

• Futures spread

And the important thing is:

The more traders use high leverage

The more market makers can easily make money

Because a small move is enough to trigger a chain of liquidations.

5. What makes market makers almost unable to lose

Traders only have one position.

Market makers have a whole system.

They see:

• Order book

• Real volume

• Cash flow in and out

• Overall long short position

While traders only see… the chart.

It's like playing poker

Like a person who can see everyone's cards.

6. The biggest mistake of traders

Mistakes are not:

• Using leverage

• Or trade more

Mistake is thinking that:

“The market moves randomly.”

In reality:

The market moves according to liquidity

Not based on Twitter emotions.

The most important insight

Market makers don't need to beat you in one order.

They beat you in thousands of small orders.

And the irony is:

The more you try to recover

The more traders become good liquidity sources.

In summary:

The market is not a casino.

But it's also not a fair playground.

It's like an ocean:

Small fish compete to eat.

Big fish eat the flow.

And market makers…

Are the ones controlling that flow.