In technical analysis, support lines and resistance lines are tools that almost everyone uses, but most people use them incorrectly.

Whether it is $BTC or $ETH , or various altcoins, opening any candlestick chart will show traders repeatedly drawing lines and entering and exiting at key positions, trying to capture trends using the method of 'going long on support and short on resistance.'

But the reality is: the crypto market is precisely the market that is most likely to 'slap in the face' the support and resistance.

1. Support and resistance are 'unstable'

Compared to traditional financial markets, the crypto market has several inherent characteristics:

High leverage

Low liquidity (especially for altcoins)

24-hour continuous trading

Emotionally driven to a great extent

This means: support and resistance are more easily pierced and more likely to form false breakouts.

2. Support is a line, not a 'liquidity zone.'

In practice, precise support lines are almost meaningless.

A more effective approach is to observe:

Price range with significant previous transactions

Positions that reacted to multiple volume spikes

Areas of concentrated trades appearing during strong trend corrections

3. When it reaches support, it’s time to go long; when it reaches resistance, it’s time to go short.

In the crypto market, this mindset is particularly deadly.

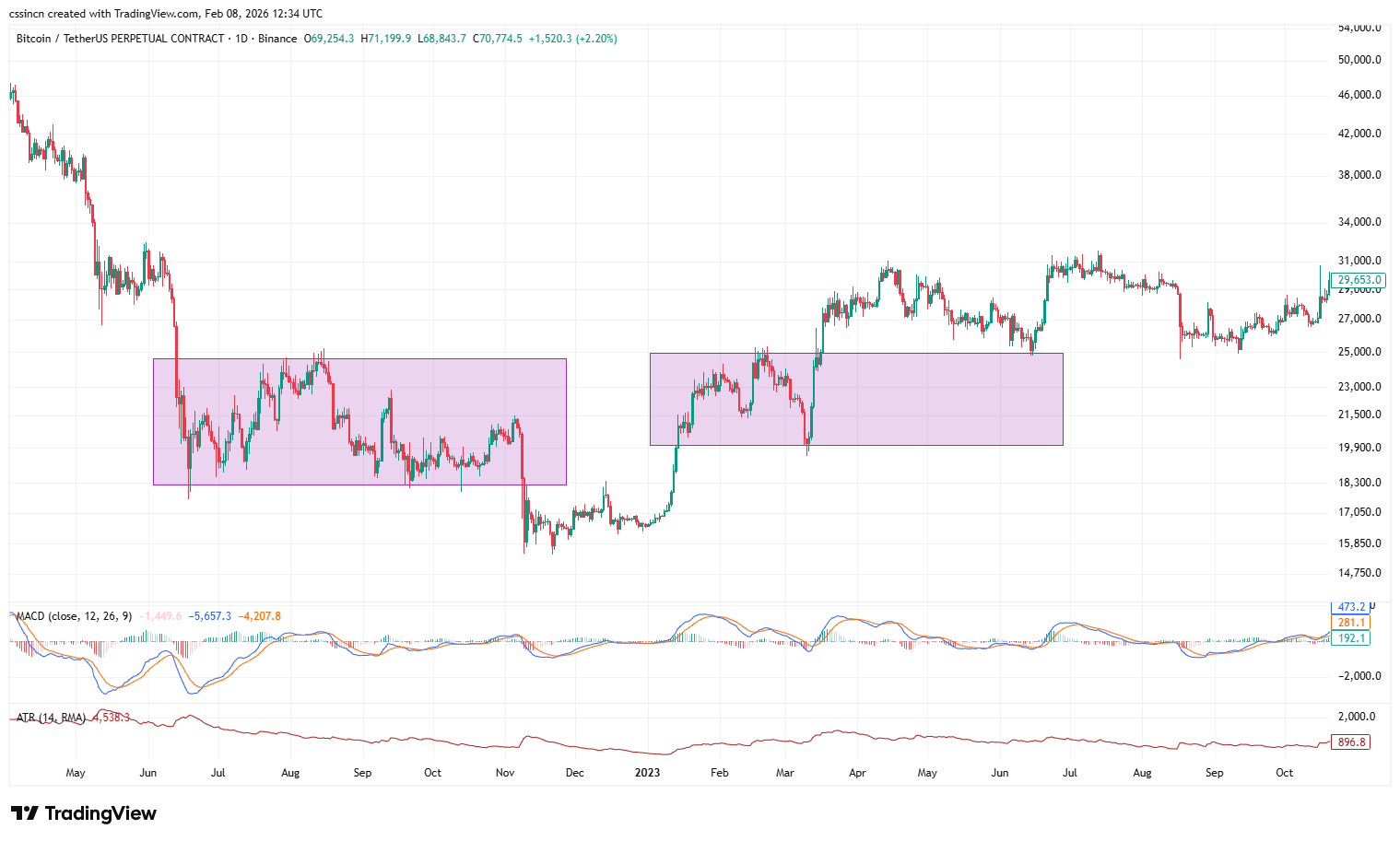

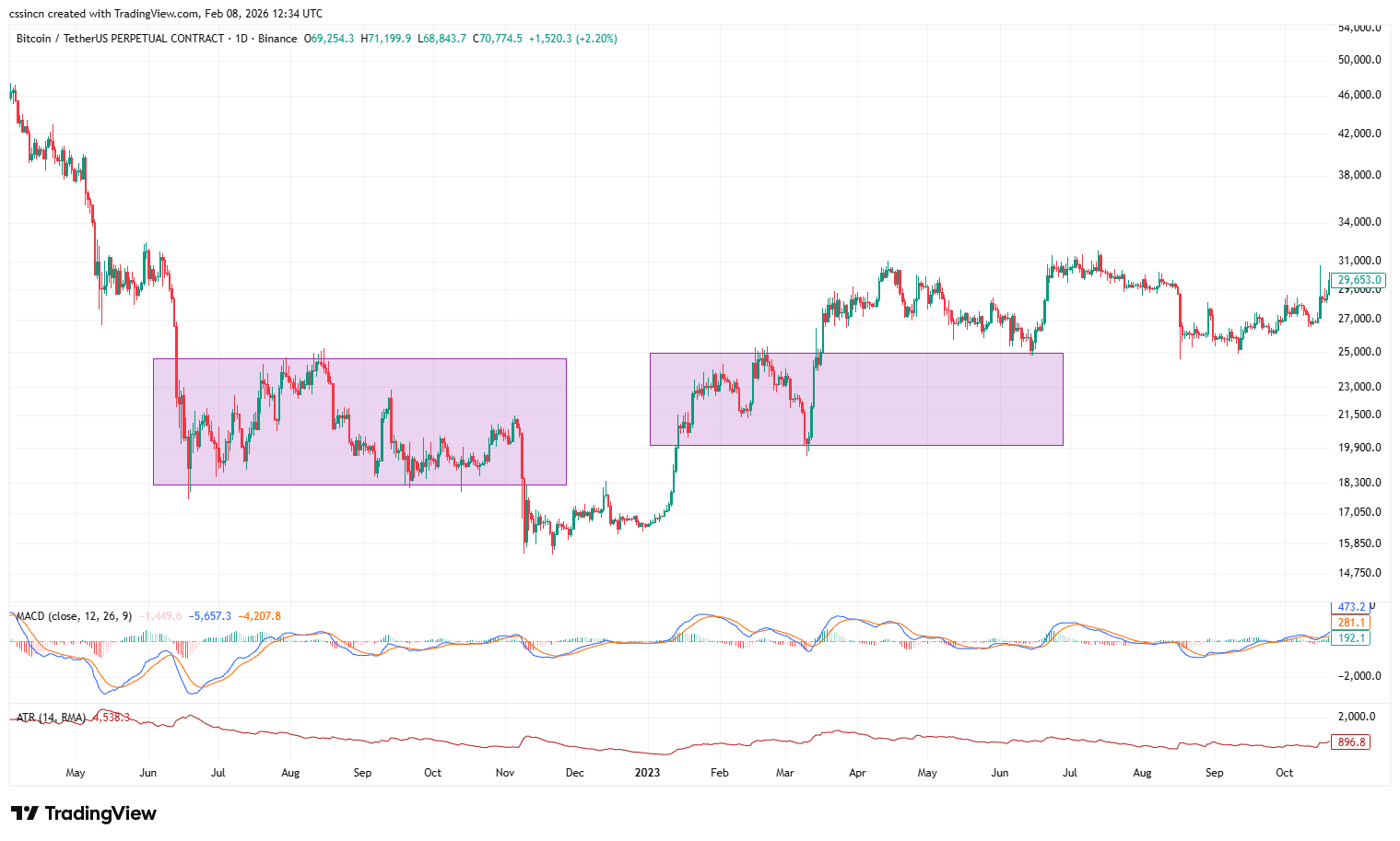

Many altcoins create 'seemingly reasonable support' during a downtrend:

Previous low

Daily level

Round number price levels

but the result is often: every 'support' is just the next downward continuation.

The reason is simple:

The trend has already turned down

Funds continue to flow out

Support is merely a temporary liquidity node.

In this context:

Support is more likely to be used for distribution

rather than reversal.

In the crypto market, the most dangerous place for support is often in a downtrend.

4. Support and resistance can independently form a trading system.

Many people use the strategy: 'Go long at support, place stop-loss a little below.'

But in practice, truly effective trading is often:

Support + Trend direction

Support + Structural confirmation

Support + Volume changes

A crypto trading scenario with a higher win rate is:

BTC breaks through previous highs (original resistance) with volume

Retraces to that area, but does not effectively drop back.

Volume decreases, volatility slows down

Again increases volume upwards

At this point, 'support' is not a prediction point,

but a risk reference point after trend confirmation.

5. The more you draw, the clearer it looks.

In real trading, filling in support and resistance is almost equivalent to giving up decision-making power.

Because you will find:

No matter how the price moves, it is 'reasonable.'

Every candlestick can be explained afterward, but it is very difficult to execute in the moment.

The mature approach instead is:

Only keep 1-3 key price levels

Highly correlated with the current cycle

Can clearly tell you: where you went wrong

6. In crypto trading, the true purpose of support and resistance

In practice, support and resistance are better used this way:

Used for placing stop-losses

Used to determine whether the market has failed

Used to filter whether trades are worth taking, rather than being used to 'predict that it will definitely rise or fall.'

A more professional crypto trading question is: 'If this area is effectively broken, can I still adhere to my original logic?'

Rather than: 'Is this support?'

Conclusion: In the crypto market, support and resistance are tools that are 'exploited.'

In a highly leveraged and emotionally charged crypto market:

Support and resistance not only exist as reality

but are often exploited by the main forces.

They are more like:

Liquidity concentration zone

Stop-loss concentration zone

Emotional turning point zone

When you treat support and resistance as 'entry reasons,' you are gambling;

When you treat them as 'risk boundaries,' you are trading.

Truly stable crypto traders,

are not the ones who draw the lines the most accurately,

but those who understand clearly where they went wrong and how much they lost before exiting.