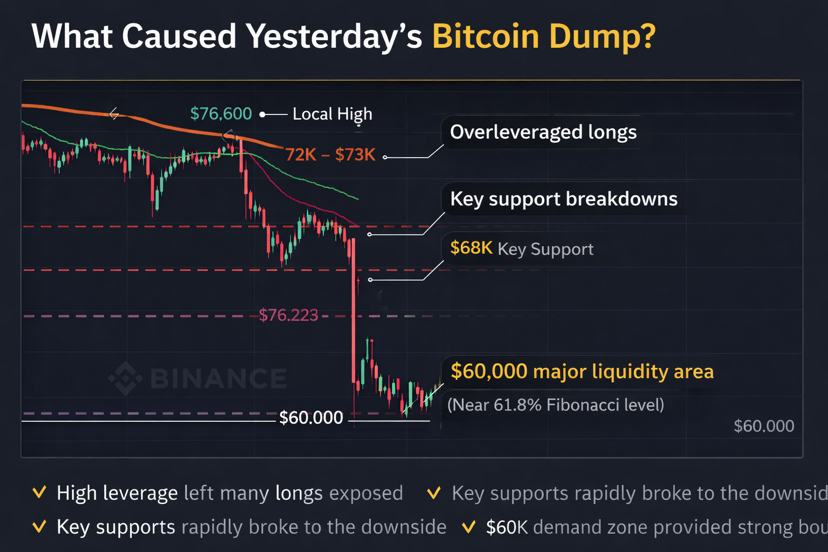

Yesterday, Bitcoin experienced a sharp drop from around $76,600 to nearly $60,000, wiping out billions in market value within hours. The move shocked many traders, especially those heavily positioned in long futures.

Let’s break down what really happened.

1. Liquidity Hunt & Over leveraged Longs

BTC had been trading near local highs, and funding rates were elevated. This means too many traders were positioned long with high leverage.

When price started dropping below key support, it triggered:

Stop-loss cascades

Liquidation of over leveraged long positions

Panic selling

This created a domino effect, accelerating the dump.

2. Key Support Breakdown

The first major weakness appeared after BTC lost the $72,000–$73,000 support zone.

Once that level broke, momentum shifted aggressively to the downside.

The real panic began when price sliced through $68,000, opening the path toward the major liquidity zone around $60,000.

That level acted as a strong demand area and stopped the bleeding.

3. Market Psychology

Markets move where liquidity exists.

At the top:

Retail traders were confident

Social media was bullish

Many expected continuation toward new highs

That’s usually when smart money takes profit.

The sharp dump was a classic example of a liquidity grab, clearing weak hands before the next structured move.

4. What Made $60,000 Important?

$60K was:

A psychological round number

A previous consolidation zone

A high-liquidity area

Buyers stepped in strongly there, causing a powerful bounce afterward.

Key Lesson from the Dump

Never overleverage near resistance

Always respect support breakdowns

Use proper risk management

The market punishes emotional entries

Yesterday’s move wasn’t random it was structured and liquidity-driven.

In crypto, volatility is normal. The real skill is surviving it.

Trade smart. Manage risk.