whale movements remain one of the most powerful forces capable of shifting prices, especially when large volumes of Bitcoin are involved

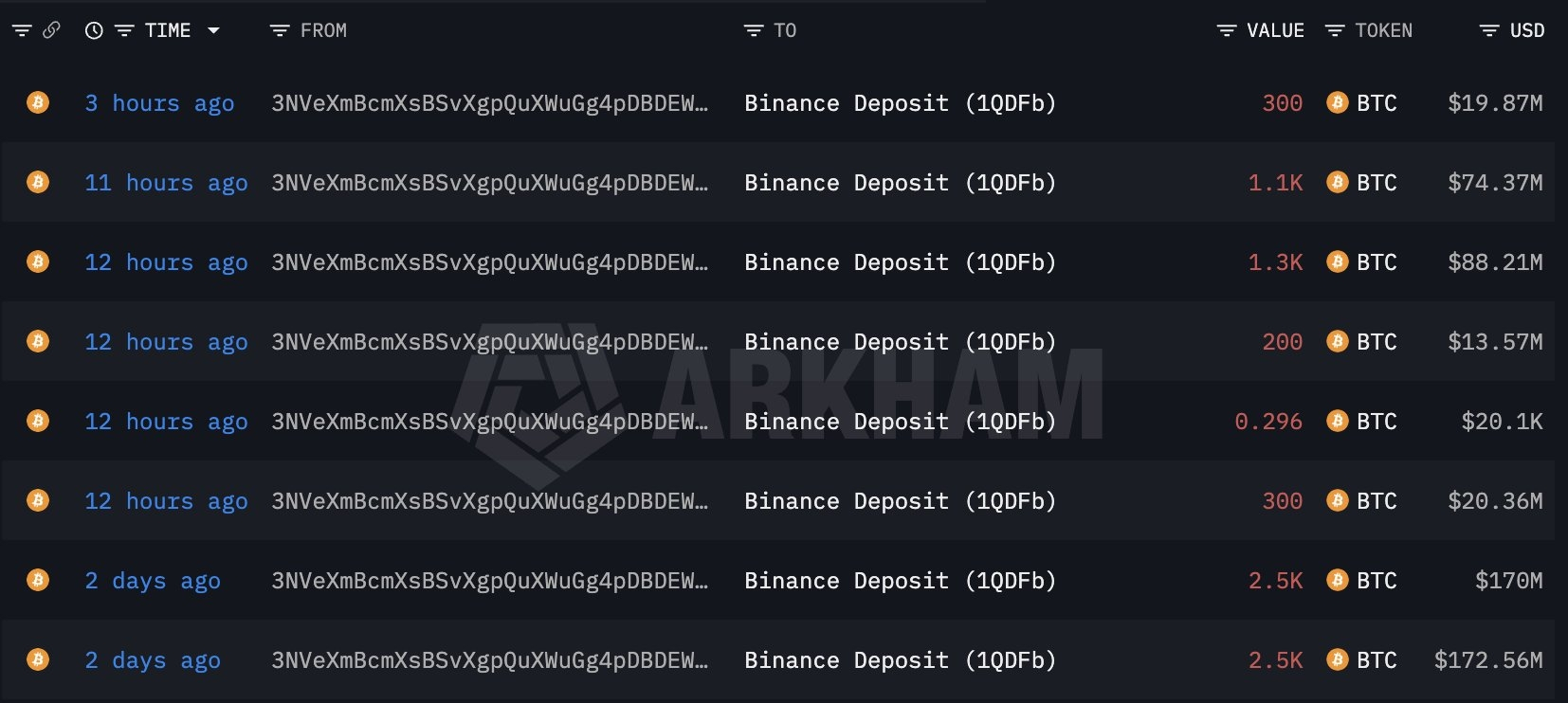

Over the past couple of days, we witnessed a striking example with a single whale (wallet starting with 3NVeXm) depositing a total of around 8,200 BTC — roughly equivalent to $559 million — into Binance.What stands out is the clear pattern: almost every time this whale makes a significant deposit, Bitcoin’s price drops shortly afterward. Two days ago, 2,500 BTC (≈ $170–172 million) was transferred to the exchange, followed by noticeable downward pressure

The same sequence repeated with subsequent transfers: 1,300 BTC, 1,100 BTC, several 300 BTC batches, and smaller amounts

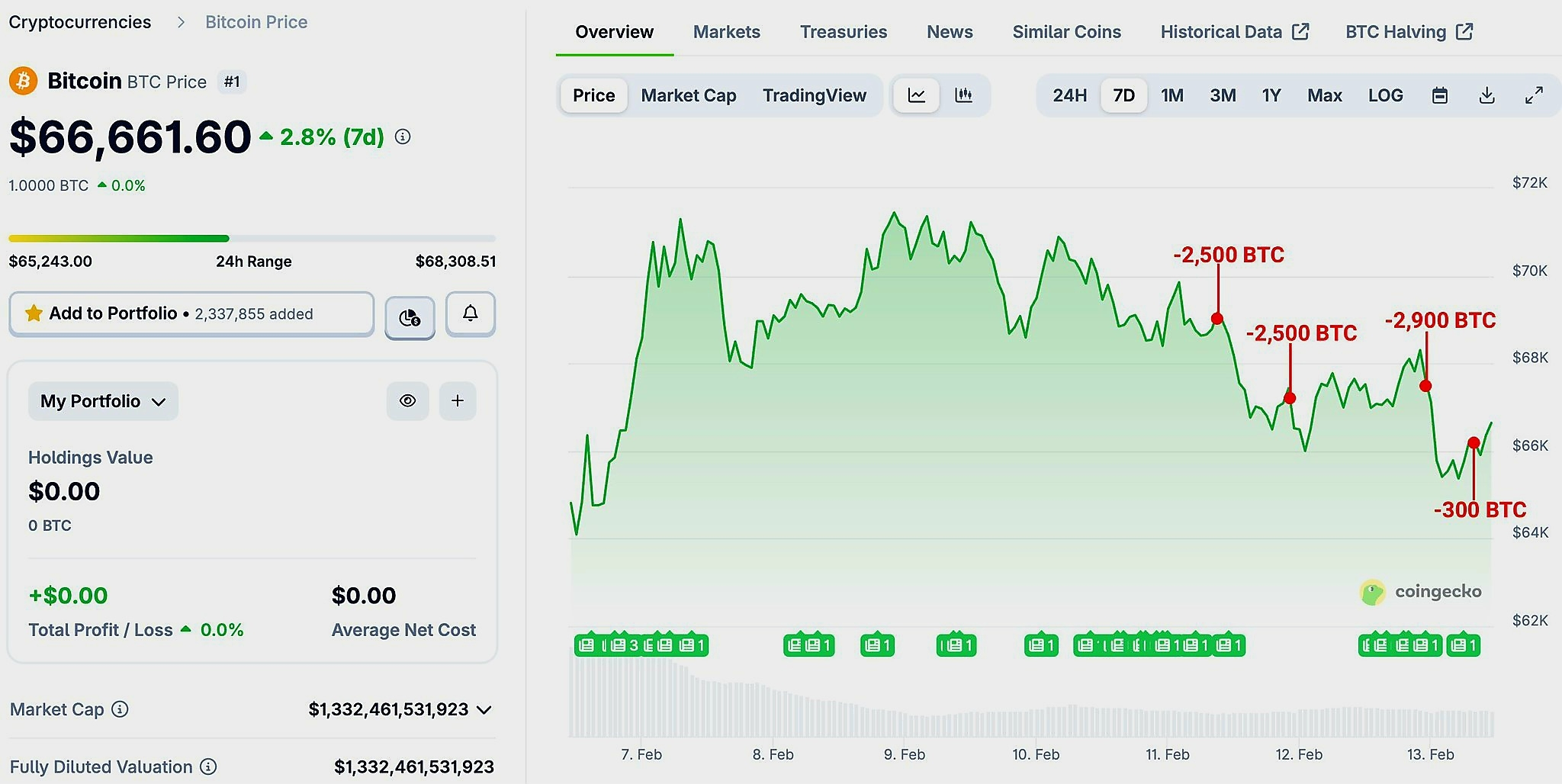

In each case, the market reacted with either an immediate or delayed sell-off.Right now, Bitcoin is trading around $66,661 (showing a modest +2.8% over the past 7 days), yet it remains well below the recent peaks near $70–72K. The chart clearly marks these pressure points: red annotations highlight drops following the -2,500 BTC, -2,900 BTC, and -300 BTC deposits

These large inflows to a centralized exchange are typically interpreted as preparation for selling or liquidation, suddenly increasing available supply and pushing prices lower

Just yesterday, an alert went out the moment another large deposit was detected — and within minutes Bitcoin fell more than 3%. This is not coincidence. Whales hold such enormous stacks that their actions directly influence liquidity

When they move coins to trading platforms like Binance, retail traders often panic-sell in anticipation of further declines (a reverse FOMO effect), amplifying the downward momentum

Whale activity simply cannot be ignored ,These are not random transfers; they are strong market signals

At present, this particular whale appears to be distributing holdings gradually — possibly taking profits, reducing exposure amid current volatility, or repositioning

As long as these sizable inflows continue without strong institutional or retail buying to absorb the supply, downward pressure is likely to persist.Bitcoin’s price ultimately follows the basic laws of supply and demand

When whales dominate the supply side through repeated large deposits to exchanges, the asset becomes highly vulnerable to sharp corrections

The takeaway is straightforward: always keep an eye on the whales

Every major inbound transfer to an exchange can mark the beginning of the next leg down